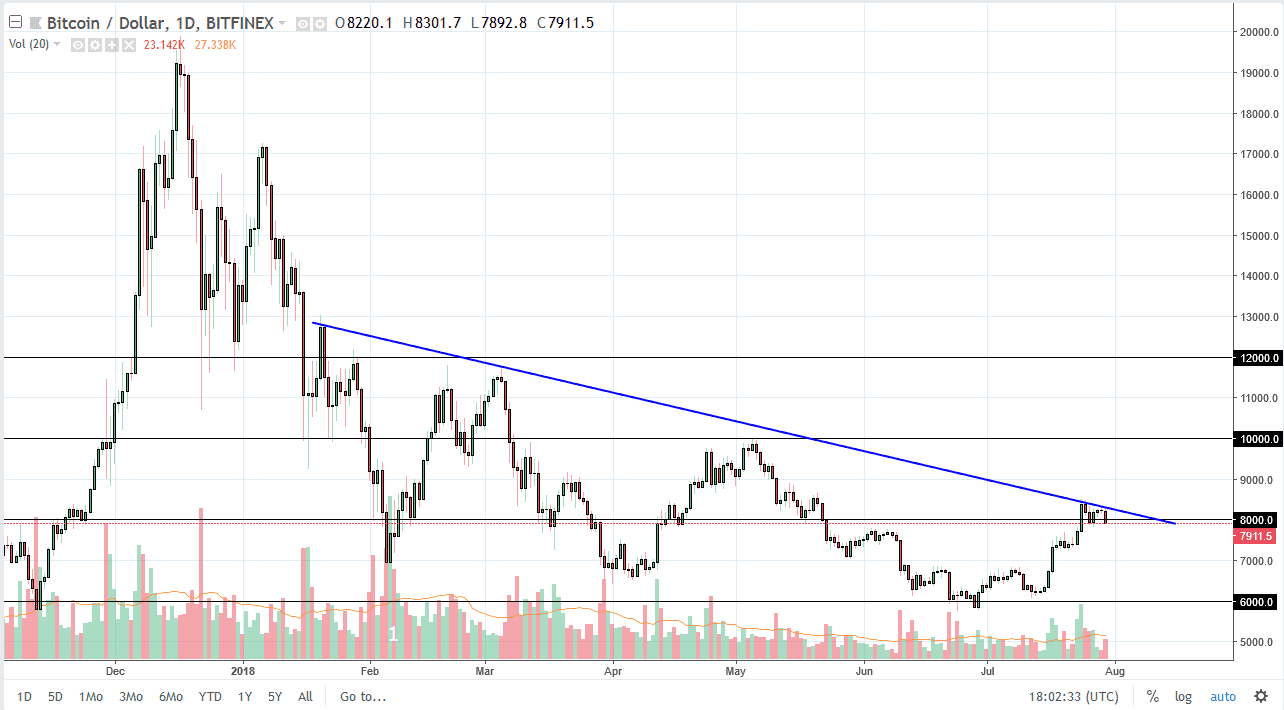

BTC/USD

Bitcoin markets drifted a little bit lower during the trading session on Monday, breaking below the $8000 level. The move was especially strong in the afternoon during New York trading, and was very sudden. We were down roughly 4% as I record this video, and it looks as if we are going to make a beeline towards the $7500 level again. If we do, and the market breaks below that level, then I think the downtrend continues. Otherwise, if we find buyers near $7500, it could be an attempt to turn things around and break down through the last vestiges of a downtrend line. That would be an extraordinarily bullish sign for bitcoin, perhaps sending it to $10,000 over the next several weeks. I believe the next few days are going to be crucial for the future bitcoin.

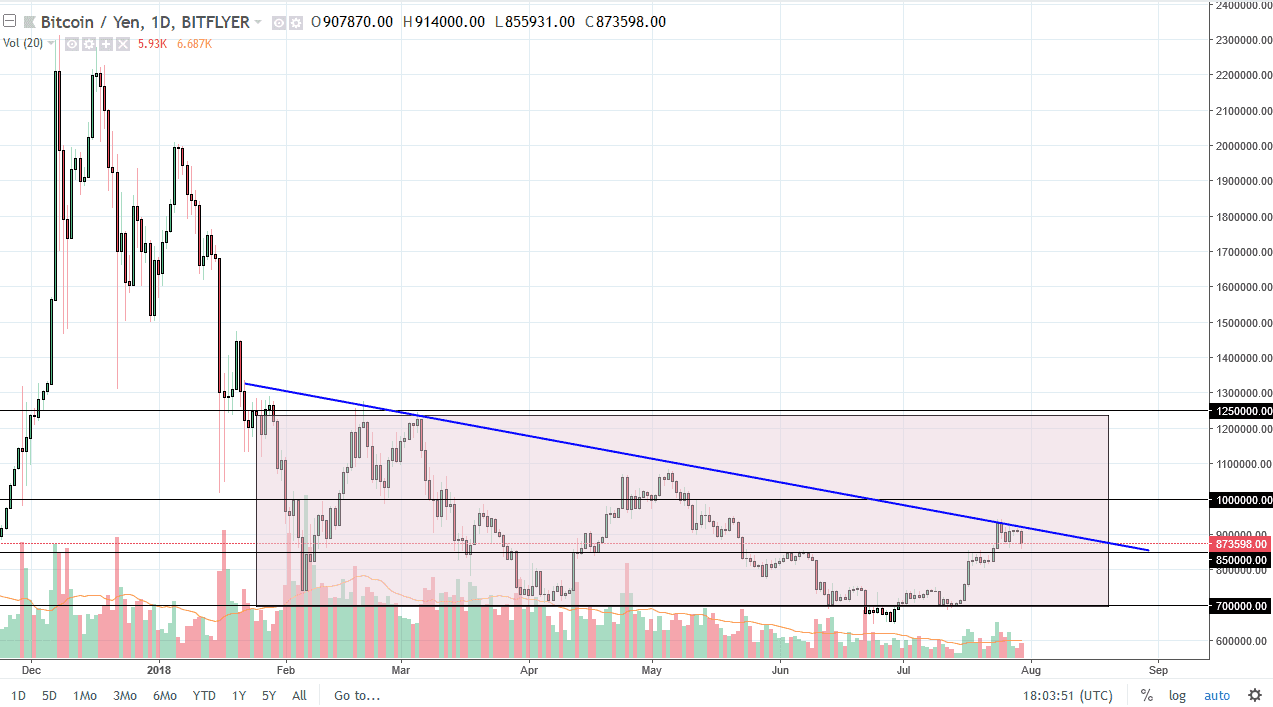

BTC/JPY

Bitcoin also fell against the Japanese yen, no big surprise there. Will be interesting is to see how this market reacts to the statement by the Bank of Japan later today. If they continue with their quantitative easing, this should be a bullish turn of events for bitcoin against the Yen. However, if they do that in the market breaks down anyway, that shows you just how fragile it really is. I’m looking at the downtrend line as a trigger at this point. If we can break above it, then I would be more apt to buy and would expect to move to the ¥1 million level. Otherwise, if we break down below the ¥825,000 level, the market could drop from there and go looking towards the ¥700,000 level next. I think the next couple days will be crucial here as well, so keep an eye on the chart and keep an eye on those levels.