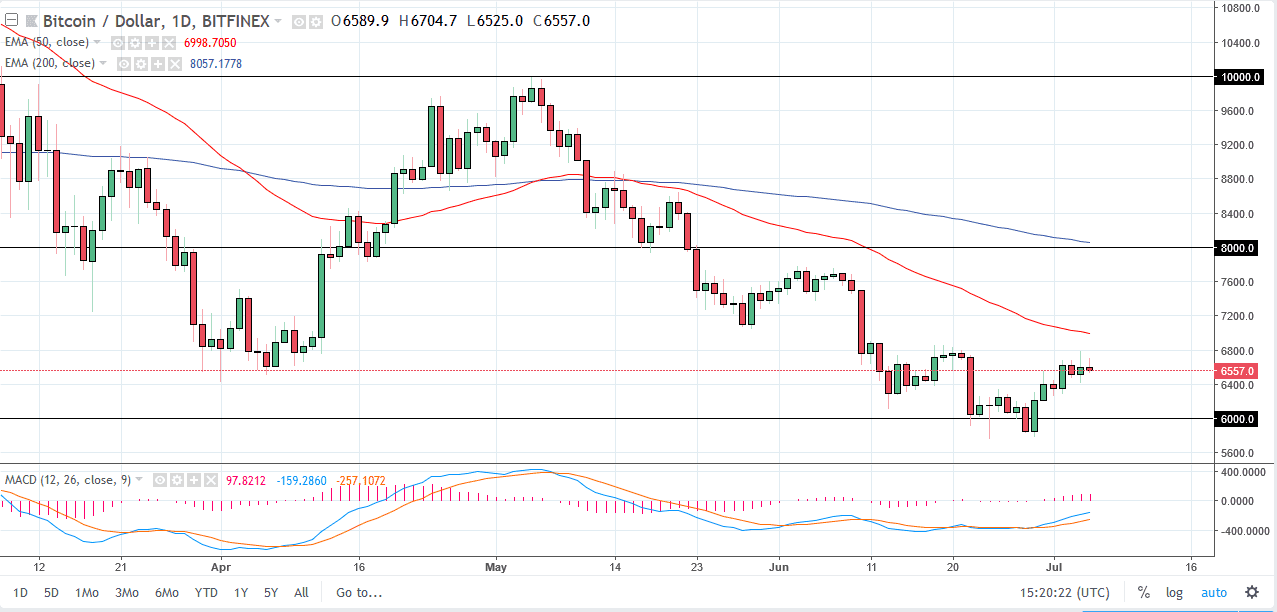

BTC/USD

Bitcoin tried to rally again during the day on Thursday, but as we have seen many times over the last couple of months, could not keep the gains. The shooting star from the Wednesday session was a precursor to what we saw on Thursday, and it now looks as if the $6800 level is going to start offer resistance again. I think that the market probably goes looking towards the $6000 level again, and the 50 day EMA just above at $7000 will offer a significant amount of resistance as well. Overall, I believe that Bitcoin continues to be something you sell, not by. Eventually, I think we break to a fresh, new lows.

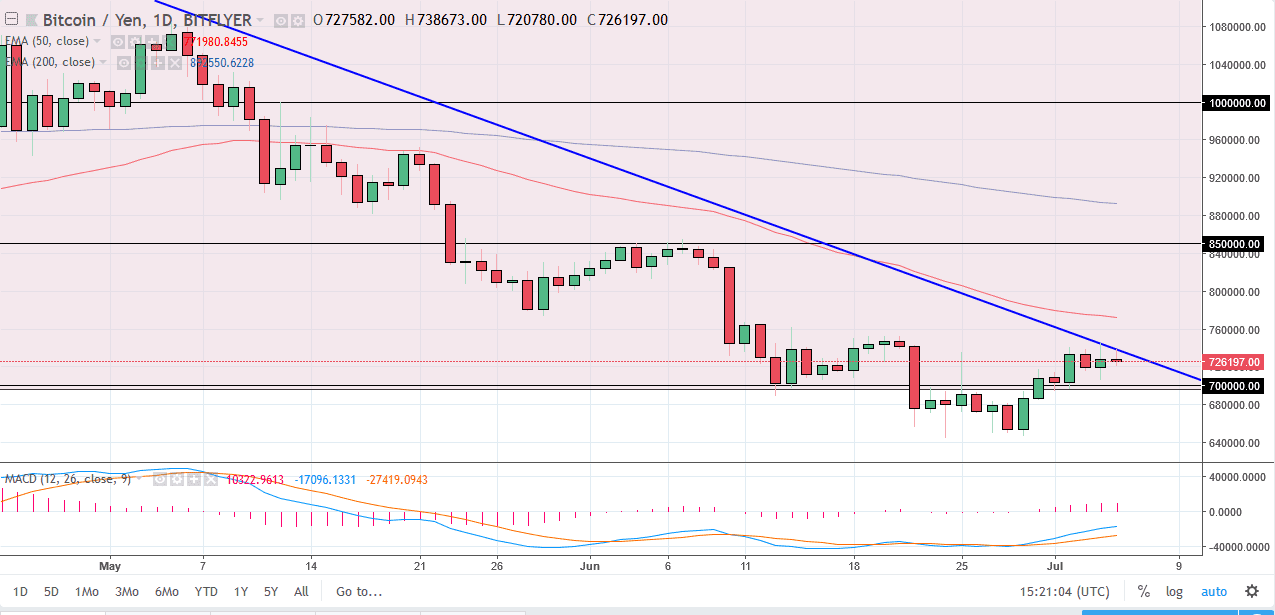

BTC/JPY

Bitcoin tried to rally against the Japanese yen as well, testing the downtrend line that I have marked on the chart. Just as we saw against the US dollar, Bitcoin couldn’t hold its gains and it looks as if it is ready to roll over again. Beyond that, we have the 50 day EMA just above, so I think at this point you sell signs of exhaustion. The last couple of candles show just that, so I would anticipate a move down to the ¥700,000 level, possibly even the ¥650,000 level over the next several days. Remember that the weekend is generally dominated by retail traders and bots, so be careful of the lack of liquidity and the mixed signals that these days can create. The Forex markets of course will be busy, and that could affect the value of the Japanese and overall, as the jobs number comes out of the United States during the day. Either way, I think this is a market that you are to be selling and not buying.