The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 1st July 2018

In my previous piece last week, I forecasted that the best trade would be long USD/CAD. USD/CAD ended the week down by 0.96% so this was a losing trade.

Last week saw a rise in the relative value of the Canadian Dollar and the Euro, while everything else fell, particularly the New Zealand Dollar.

The major event of last week was weaker then expected GDP growth in the U.S. Dollar, as well as continuing developments in global tariff disputes.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look relatively strong. The Canadian Dollar strengthened on slightly positive Canadian GDP data, while the weakest currency is clearly the New Zealand Dollar. Sentiment became increasingly negative on the Kiwi as the Reserve Bank of New Zealand said it expected to maintain an expansionary policy “for some considerable time.

The week ahead will probably be dominated by the release of U.S. FOMC Meeting Minutes and Non-Farm Payrolls data due towards the end of the week.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that for the second week running, a weak bearish pin candlestick move was made over the week, with the Index rejecting the resistance level at 12085 as shown in the price chart below. However, it is remaining above its price level from both 3 months ago and 6 months ago, sitting in a long-term bullish trend. There is also evidence that there may be new, higher support at 12011. This produces a partially unclear situation which suggests that the price may be bearish over the short-term, while still in a bullish trend that can be expected to reassert itself.

USD/JPY

This pair has been going sideways within a very weak bullish trend over the past few weeks. However last week produced a strongly bullish engulfing candlestick, which closed near its high just below the resistance level of 110.85. It looks as if the price is readying for a bullish breakout, which could happen next week and produce a move up towards 112.50.

NZD/USD

This pair fell very strongly to a new 2-year low price, printing a very large bearish candlestick which closed in its lower third. Although we got some support at the psychological level of 0.6750, it looks as if bearish sentiment on the NZD will mean we are likely to see still lower prices over the next week.

WTI Crude Oil

This pair was very bullish last week, printing a large bullish candlestick which closed very close to its high, while making a new 3.5-year high price. There is a long term, strongly bullish trend. Part of the reason for the recent strong rise is increasing instability in the major oil producers Iran and Venezuela. However, do watch out for the price opening lower on Monday and a possible bearish pull-back as the Saudis have just agreed to increase their oil production by 2 million barrels, according to President Trump a few hours ago.

USD/ZAR

I thought the multi-week bullish move was over one week ago as the price printed a pin candlestick. However, last week saw the price advance to new multi-month highs, although it may not have further to go. I am not strongly optimistic on this pair continuing to advance, but it is one worth keeping an eye on.

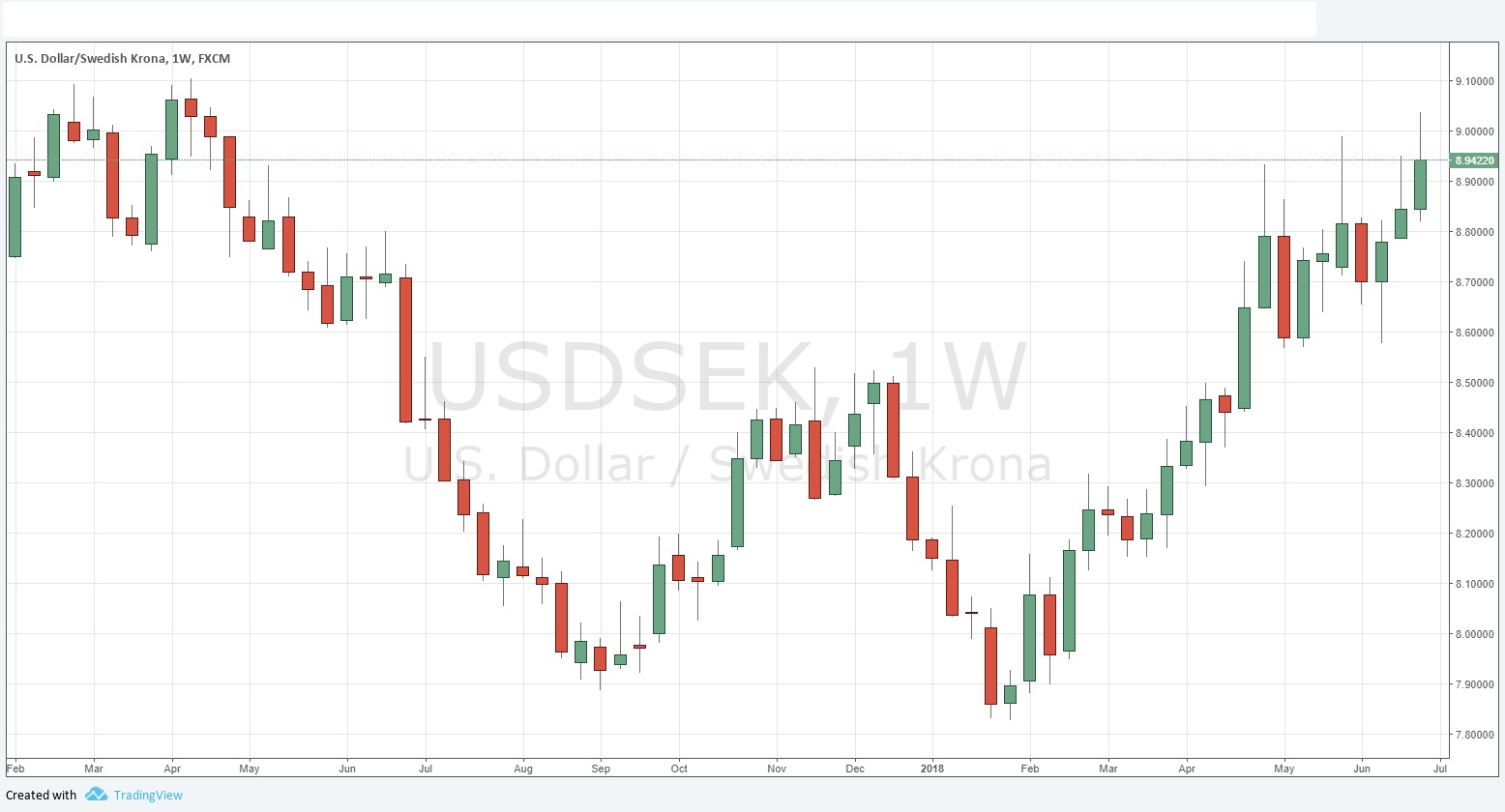

USD/SEK

The price has continued to advance slowly to trade at new multi-month highs, despite the relatively large upper wicks which can be seen on recent candlesticks within the price chart below. I am not strongly optimistic on this pair continuing to advance, but it is one worth keeping an eye on.

Conclusion

Bullish on the Crude Oil and the USD, bearish on the JPY and the NZD.