The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 29th July 2018

In my previous piece last week, I forecasted that the best trade would be long of the S&P 500 Index above the previous week’s high price. This trade ended the week at break even.

Last week saw a rise in the relative value of the Canadian Dollar, and a fall in the relative value of the Euro.

The Forex market has seen a major turnaround, as President Trump has begun to “talk down” the U.S. Dollar. There were also political developments in the U.K. which have increased the instability over the likely final Brexit terms, which has caused a lot of volatility in the British Pound.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look relatively strong. However, the U.S. Advance GDP figure came in very slightly below expectations, although 4.1% is impressive. The Dollar still failed to rise significantly by the end of the week. It seems that Brexit and the U.S. / E.U. trade war have been put on hold for a week at least, so there may be little to drive sentiment as we move into the typically quiet month of August.

The week ahead will probably be dominated by central bank input from the U.S. Federal Reserve, the Bank of Japan, and the Bank of England, as well as U.S. Non-Farm Payrolls data at the end of the week. There are also a few important data releases scheduled for many of the most important global currencies. This suggests the coming week is likely to be busier and more volatile than the past week.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that for the sixth week running, the U.S. Dollar Index has ranged between 12085 and 12008, suggesting indecision and a possible bearish reversal. However, the weekly candlestick is a little bullish even though it is almost a doji. The Index is clearly in a long-term bullish trend. This suggests that the outlook for the U.S. Dollar is very uncertain technically, but there seems to be a hint of a coming bullish breakout above 12085, which would be a bullish sign for the Dollar.

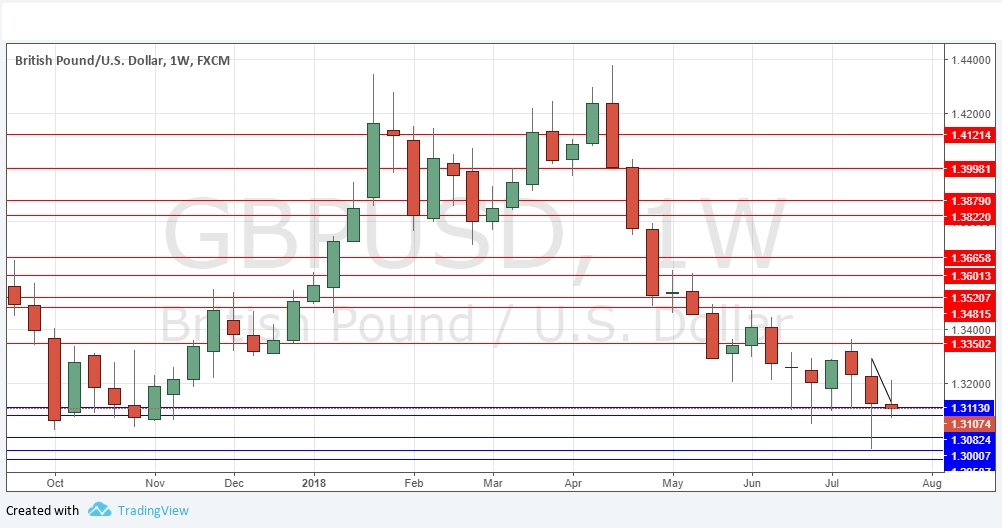

GBP/USD

This pair is technically in a long-term downwards trend, as is shown clearly by the bearish action over the past 15 weeks or so. Although we are seeing long lower wicks over recent weeks, suggestive of long-term buying close to 1.3000, the Dollar looks stronger here and is showing more momentum than in any other major currency pair. We had a bearish inside candlestick here last week, which suggests that the price is going to fall further over the next week. Bears must beware of strong buying close to 1.3000 however.

EUR/USD

Although we have seen a consolidation here over the past ten weeks, which suggests a long-term trend change to bullish is increasingly becoming a possibility, the action is still a little bearish over the short-term, and the pair is still in a long-term bearish trend. It looks as if a break below the support level at 1.1596 could produce a stronger downwards movement.

S&P 500 Index

The past six months have been choppy for the U.S. stock market, but the 200-day moving average has held even when the market was beginning to look very bearish. After last week’s small and indecisive doji candlestick, we saw the price make a nice rise over the week, despite falling back on Friday. This is a bull market, and the bullish case has been strengthened by the price getting established above the new level flipped from resistance to support at 1791.90. However, any bad news on trade or tariffs can sink the market in an instant, so it is important to either be very careful, or to take a long-term investment approach.

Conclusion

Bullish on the S&P 500 Index above last week’s high price; bearish on GBP/USD and on EUR/USD to a lesser extent.