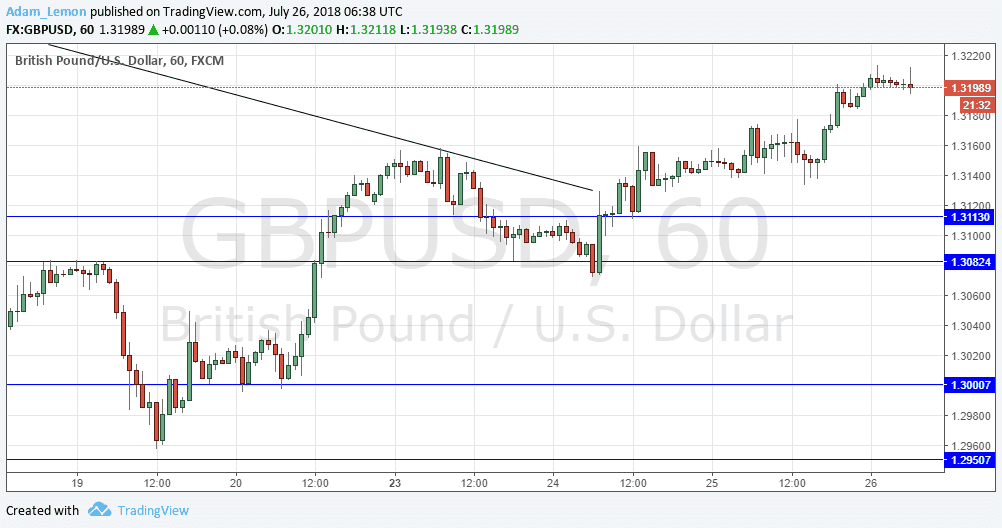

Yesterday’s signals were not triggered, as there was no bearish price action at 1.3158.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trade

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3113.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that 1.3158 was likely to be the pivotal level today. If the early London session saw a solid break above that, there was plenty of room to rise, so it should be a good up day. There was probably going to be more scope for movement to the upside than to the downside. This was a good call although the bullish break wasn’t as firm as it could have been. We now see the resistance level at 1.3158 invalidated, and the price has plenty of room to rise, so we have a more bullish technical picture here, with the Pound also – significantly – looking more bullish than the Euro, although that could easily change after the ECB release due later today. However, the short-term price action is suggesting a bearish pull-back. The next few hours are hard to predict, but there are reasons to expect a bullish move will be stronger than any bearish movement which might happen

There is nothing important due today concerning the GBP. Regarding the USD, there will be a release of Core Durable Goods Orders at 1:30pm London time.