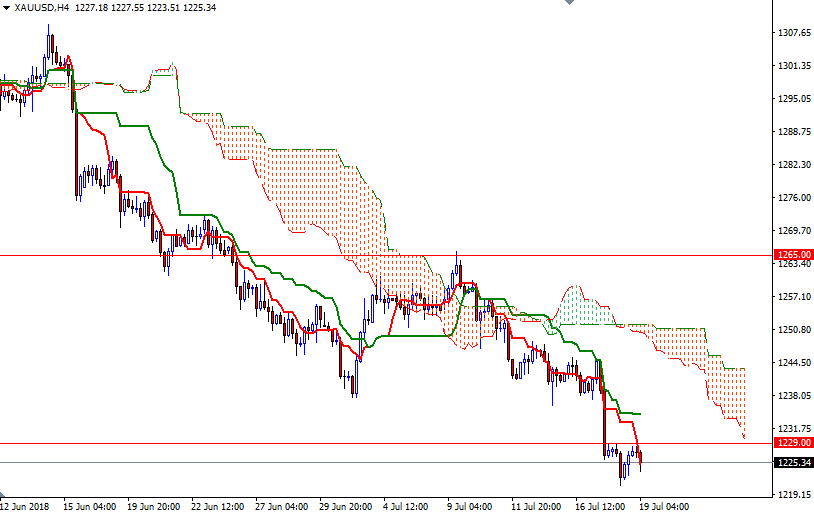

Gold ended the day almost unchanged as the market took a breather after prices dropped to a one-year low. Comments from Federal Reserve Chairman Jerome Powell lent support to U.S. stock indexes. An appreciating U.S. dollar and little risk aversion in the marketplace are working against the yellow metal. XAU/USD tested the anticipated support at around $1221 before revisiting the resistance in the $1230-$1229 zone.

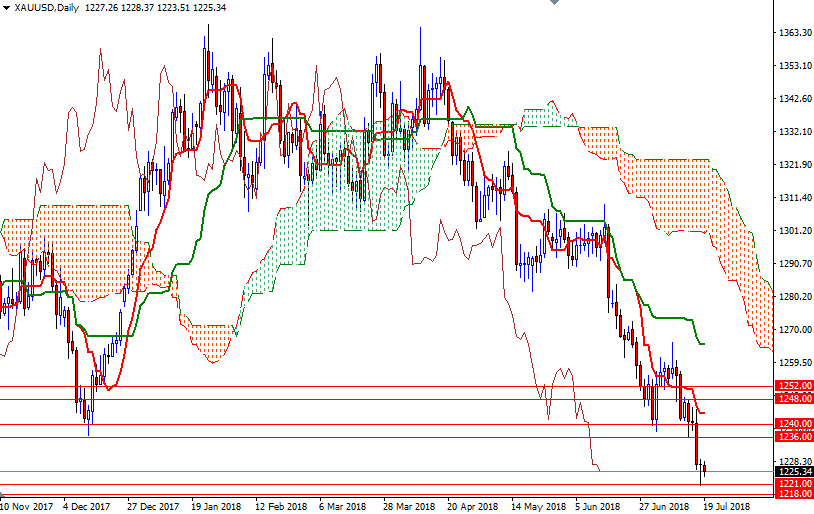

The bears have the overall technical advantage, with the market trading below the daily and the 4-hourly Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The bulls will need to lift prices above 1230 to challenge the next barrier standing in the 1236-1234.50 area. If the market overcomes this hurdle, we may see a push up to 1242/0.

However, if the resistance in the 1230/29 area remains intact, then keep an eye on the 1221 level. The bears have to capture this camp to make an assault on the key technical support in 1218/5. A break below 1215 could send prices down to 1209.