Gold hit its lowest in a year on Tuesday after Federal Reserve Chairman Jerome Powell gave an upbeat assessment of the U.S. economy and inflation, which boosted expectations that the Federal Reserve could raise interest rates two more times in the next five months. “The FOMC believes that - for now - the best way forward is to keep gradually raising the federal funds rate,” Powell said in prepared testimony before the Senate Banking Committee. Investors are almost certain that the Fed will raise rates at its September policy meeting. Powell will appear before the House Financial Services Committee today. World stock markets were mostly higher yesterday, including U.S. stock indexes.

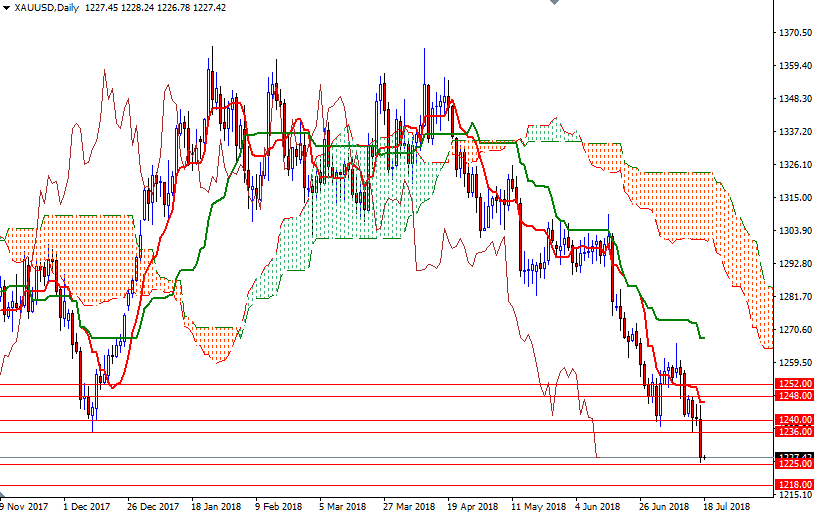

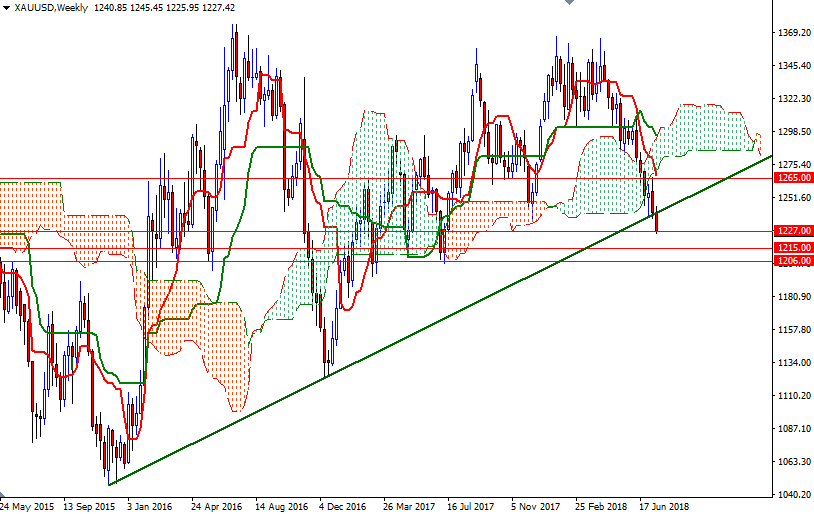

XAU/USD is trading below the daily and the 4-hourly charts, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) also confirms that the bears now have technical momentum on their side. A strong U.S. dollar index and a deteriorating technical posture will continue to inspire chart-based sellers.

Down below, there is a strategic support in the 1227/5 area, which could see some short-side profit taking. The bulls will have to push prices back above 1230/29 to revisit 1236-1234.50. Beyond there, the bears will be waiting in the 1242/40 zone. A sustained break below 1225, on the other hand, implies that more price pressure is coming in the near term. In that case, XAU/USD could test 1221.20. If the bears can eliminate this support, then 1218/15 will be the next port of call.