Gold ended Monday’s session down $7.18 an ounce as a rebound in the dollar and gains in equities pushed prices down. The U.S. dollar index was firmer yesterday, aided by higher Treasury yields. U.S. stock indexes were higher on the back of stronger-than-expected corporate earnings. XAU/USD initially edged higher but it was unable to climb above the $1236 level. Consequently, prices dropped below $1225 and returned to $1221.

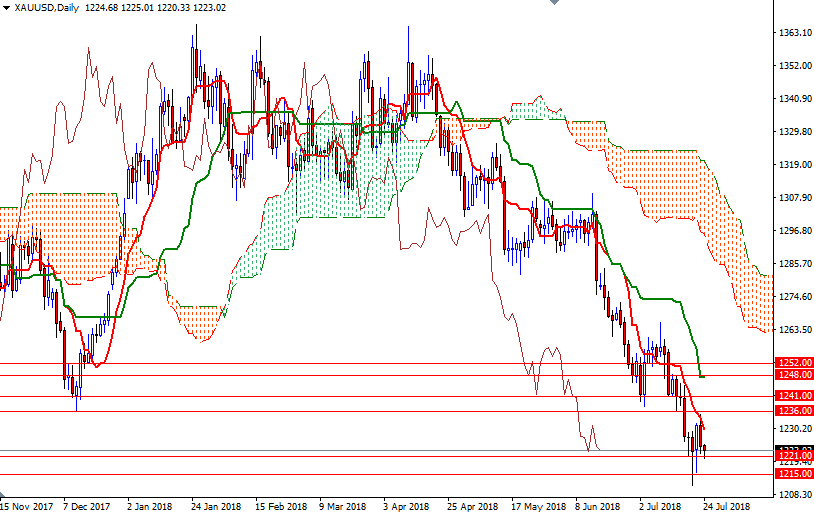

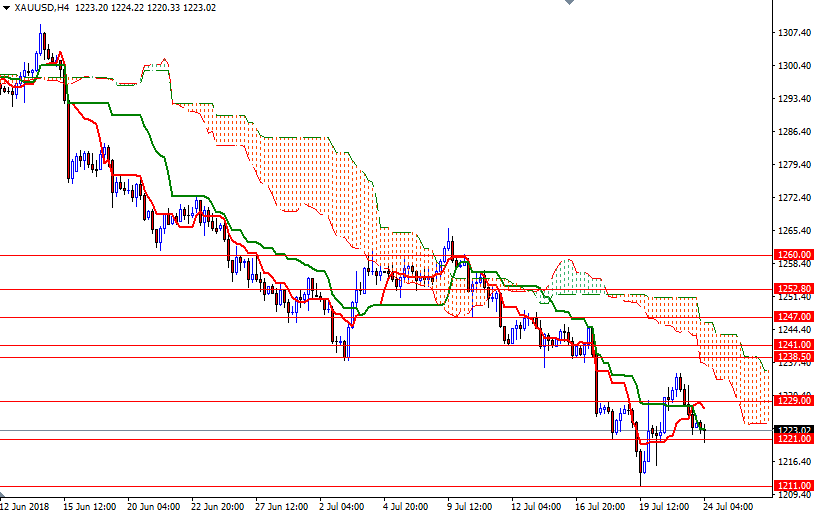

XAU/USD is trading below the daily and the 4-hourly Ichimoku clouds, indicating that the bears have the overall technical advantage. The market is in the process of testing the support at 1221. The bulls have to lift prices above the 1229 level to challenge 1236. If this resistance is broken, the bulls will have an opportunity to test a strategic barrier in the 1241-1238.50 area. A daily close above 1241 could foreshadow a move to 1247.

On the other hand, if the support at around 1221 fails to hold, then 1219.50 and 1218.40-1217.80 will be the next targets. The bears have to drag prices below 1215 to tackle a key support in the 1211/09 area. Breaking below 1209 could see a fall to 1206/2.