Gold prices ended Monday’s session slightly higher as uncertainty over Brexit negotiations deepened. World stock markets were mostly higher yesterday. U.S. stocks extended their recent rally despite heightened trade tensions. XAU/USD tested the resistance at $1265 but it was unable to break through. The equity market remains more attractive for now and consequently, investors demonstrate limited interest in gold.

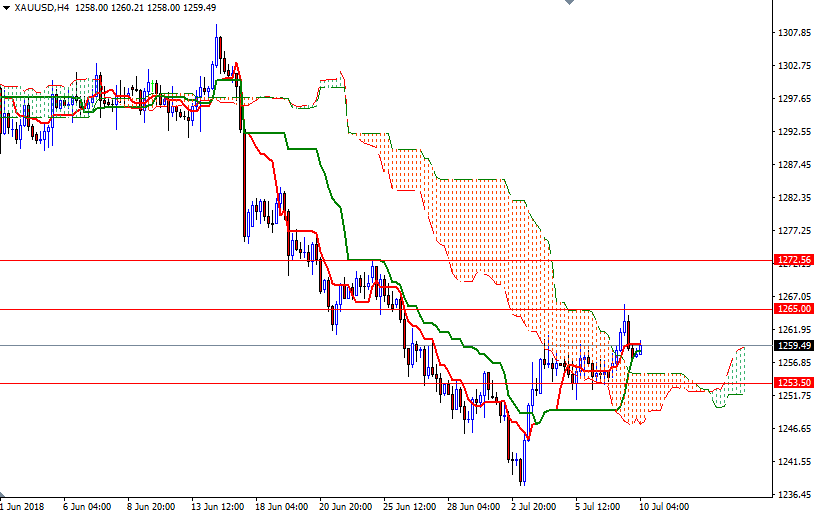

The market is trading above the Ichimoku clouds on the H4 and the H1 time frames. On the H4 chart, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, the failure to hold above the 1262 level is a sign of weakness, and it indicates that prices may head back to the 4-hourly cloud. The bears will need to push the market below the 1255-1253.50 area to test a nearby support in 1252/0. If prices dive below 1250, keep an eye on the 1246 level.

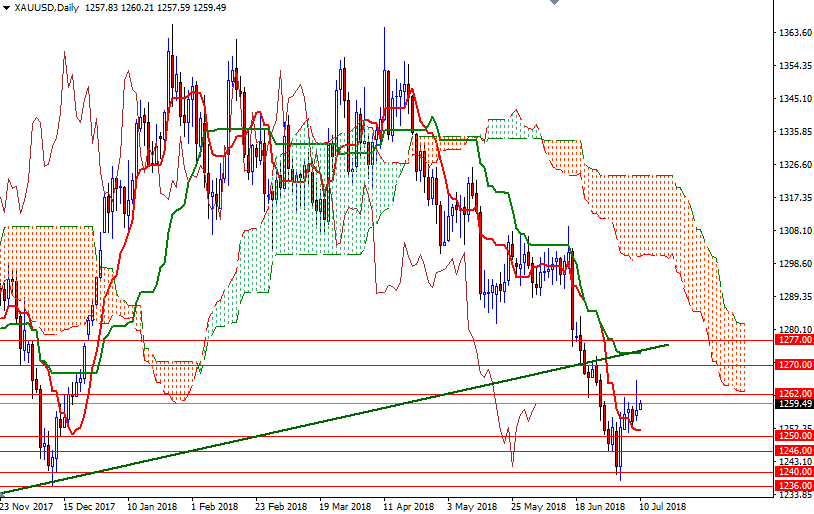

On the other hand, if XAU/USD climbs back above 1262, it is likely that we will revisit 1265. A break through there suggests a push up to 1273.50-1270. The bulls have to produce a daily close above 1273.50 to gain momentum for 1284/2. On its way up, expect to see some resistance at 1277.