Gold prices traded in a narrow range on Monday as worries about rising interest rates continued to weigh on the market. A flurry of economic data will be released throughout the week but the monthly non-farm payrolls report due on Friday will be the most influential one. The Federal Reserve is not expected to tweak monetary policy on Wednesday. I think the official statement will contain no big surprises, but it could end up being positive for the greenback.

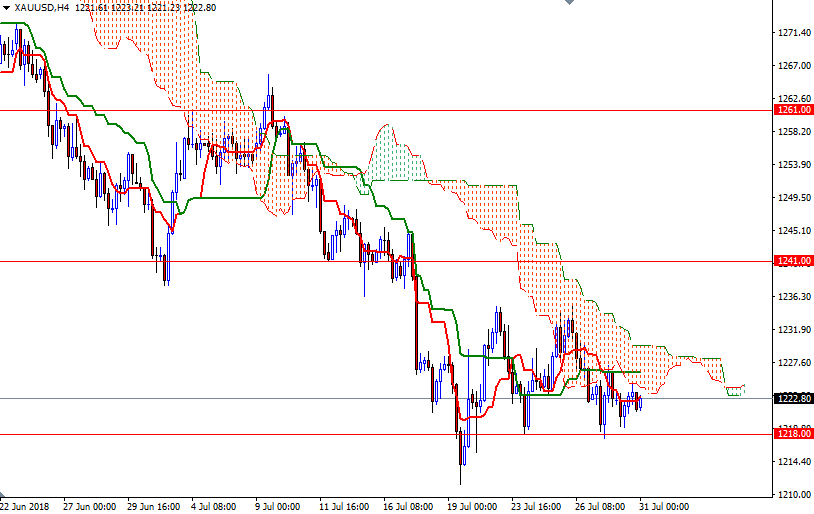

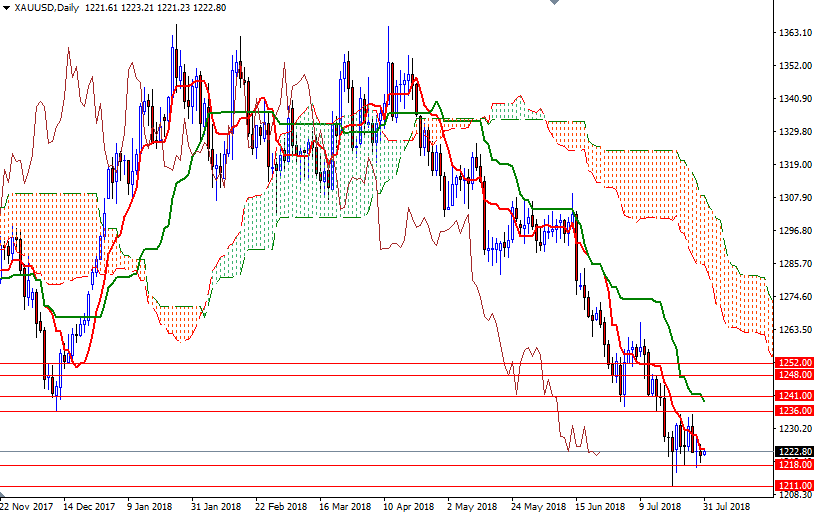

Technically, trading blow the Ichimoku clouds, along with negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line), suggests that the bears have the overall technical advantage. However, prices still remain within the trading range of the past eight sessions, and with no major fundamental news to drive the market, this range-bound nature will probably continue for now.

To the downside, the initial support comes in around 1218 and that is followed by 1215.50-1214.70. If XAU/USD dives below 1214.70, look for further downside with 1213.50 and 1211/09 as targets. Breaking below 1209 opens the door to 1206/2. The bulls have to pull prices above 1226.30, the 4-hourly Kijun-Sen, to test 1230/28, the top of the 4-hourly cloud. If this resistance is broken, XAU/USD will probably revisit 1236/4. A daily close above 1236 is essential for a bullish continuation to a strategic resistance in the 1242/1 area.