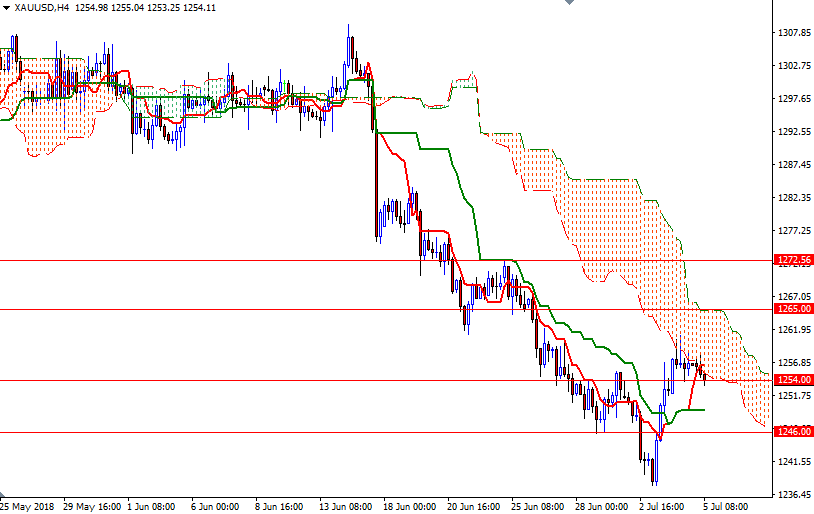

Gold prices rose for a second session on Wednesday, supported by a declining dollar. XAU/USD reached the $1259.40-$1262 area, but the 4-hourly Ichimoku cloud acted as resistance and sent prices back to the support at $1254. Focus of the marketplace today is on the release of minutes of the Federal Open Market Committee’s latest policy meeting.

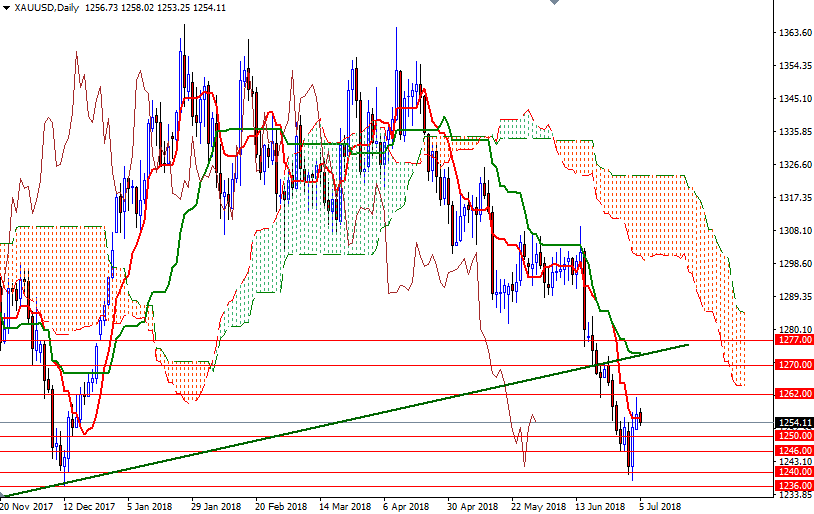

The key technical levels remain unchanged as the market consolidates in a tight range. XAU/USD is trading above the hourly Ichimoku cloud, but the daily chart indicates that the bears still have the overall near-term technical advantage. We will probably have to wait for the release of the Fed minutes before the market sees a strong move. In the meantime, XAU/USD is in the process of testing the support at 1254.

If this support is broken, the bears will have a chance to challenge 1252.48-1250. A successful break below 1250 paves the way for a test of 1246. Below there, the 1240/36 area stands out as a solid technical support. The bears have to produce a daily close below 1236 to tackle 1230. To the upside, the initial resistance sits in 1259.40-1262. A break through there could trigger a push up to 1266/5. The bulls have to capture this camp in order to make an assault on a strategic resistance in the 1273.50-1270 zone. A daily close above 1273.50, which happens to be the daily Kijun-Sen (twenty six-period moving average, green line), suggests that the market is targeting 1277.