Gold prices rose $6.81 an ounce on Wednesday as a weaker U.S. dollar index took some pressure off the metal. The dollar index fell after U.S. President Donald Trump and European Commission President Jean-Claude Juncker agreed to begin discussions on eliminating the tariffs and subsidies on non-auto industrial goods. In economic news, the Commerce Department reported that new-home sales decreased 5.3% in June. U.S. economic data due for release Thursday includes the weekly jobless claims report, and durable goods orders. Trading during the Asian session has been quiet as investors turned their focus on the European Central Bank’s policy decision.

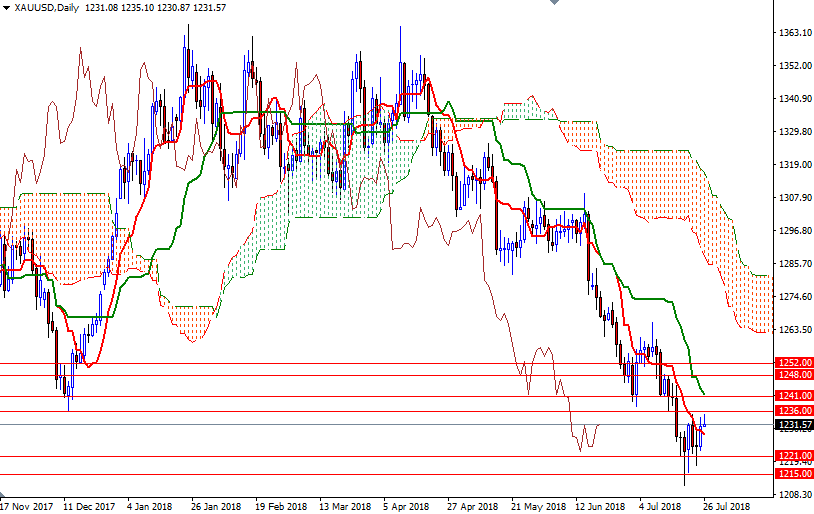

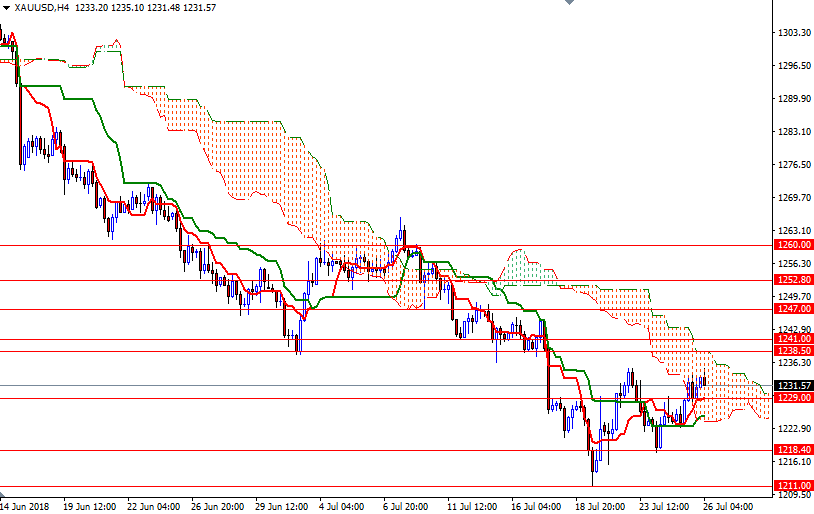

XAU/USD moved higher as expected after prices climbed above the 1229 level, but found resistance in the 1236/5 area. Prices are above the Ichimoku clouds on the H1 and the M30 time frames. However, the market is still in a three-month-old downtrend on the daily chart. To the downside, keep an eye on the 1230-1228.50 area, which is occupied by the Ichimoku cloud on the M30 chart. If the bulls can hold prices above there, they may revisit the 1236/5 area. As I pointed out yesterday, a break above 1236 is essential for a test of 1241-1238.50, the top of the 4-hourly cloud. A daily close above 1241 implies that the bulls are getting ready to challenge 1248/7.

On the other hand, if prices dive below 1228.50, then we may return to 1225-1223.50, the bottom of the 4-hourly cloud. The bears will have to drag prices below 1221 to gain momentum for 1218.40.