Gold prices ended Tuesday’s session up $10.92 an ounce, bouncing off their lowest level since mid-December, as the U.S. dollar weakened. Gold extended its gains after the market penetrated the resistance at $1246. Today’s trading volume is expected to be thin as U.S. financial markets will be closed for the Independence Day holiday. Traders are awaiting the release of the Federal Open Market Committee’s June meeting minutes on Thursday and U.S. employment data on Friday for validation of policy-makers’ forecasts for two more rate hikes this year.

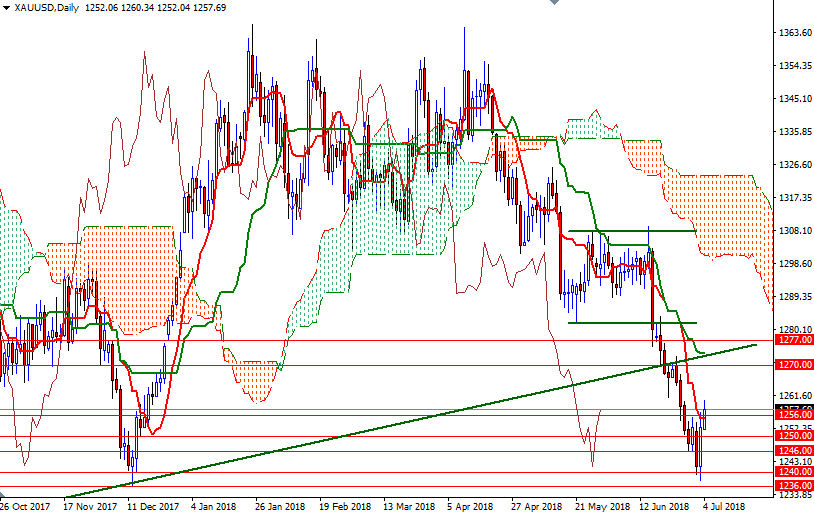

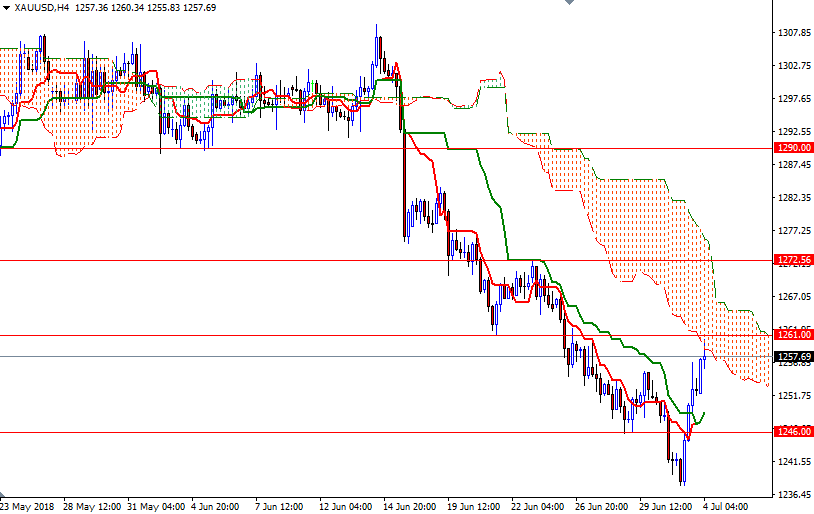

The short-term charts are slightly bullish at the moment, with the market trading above the Ichimoku clouds on the M30 and H1 time frames; plus, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line). However, keep in mind that a three-month-old downtrend is in place on the daily chart. The 4-hourly Ichimoku cloud is sitting right on top of us so the bulls will have to break through 1259.40-1262 if they intend to challenge 1266/5. A break above 1266 implies that XAU/USD is heading up to 1272.56-1270.

On the other hand, if the 4-hourly cloud continues to act as resistance, keep an eye on 1256/4. Breaking below 1254 suggests that the 1251.75-1250 area will be the next target. The bears have to produce a daily close below 1246 to make another assault on 1240/36.