Gold prices fell $4.65 an ounce on Thursday as the dollar continued to appreciate after Federal Reserve Chairman Jerome Powell suggested the U.S. economy is strong and inflation is tame. Gold drifted lower as expected after prices pierced below the $1221 level but it made a rebound after President Trump criticized the Federal Reserve for raising interest rates. XAU/USD is currently trading at $1219.68, lower than the opening price of $1223.38.

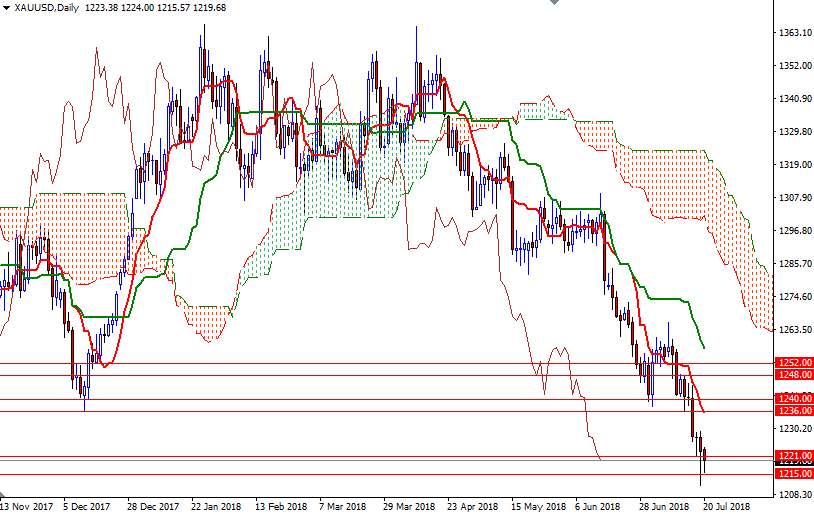

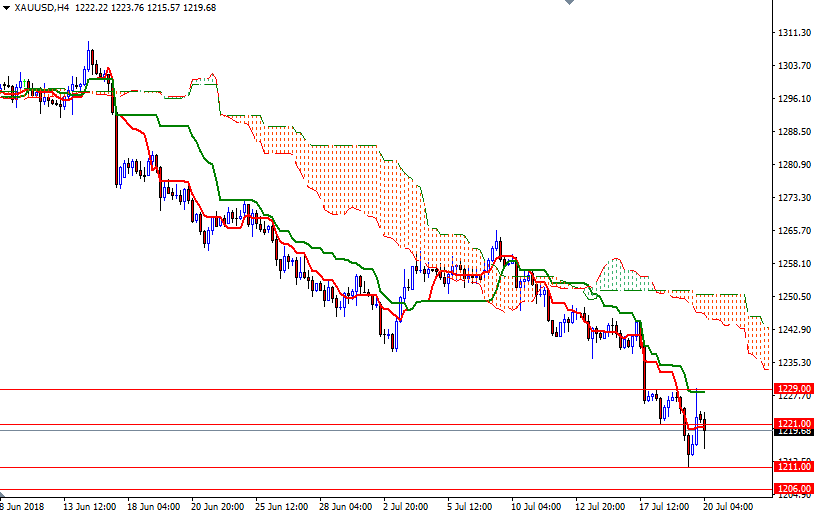

The market is still trading below the daily and the 4-hourly Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. The technical posture for gold remains strongly bearish. However, the market is short-term oversold, and the tall lower shadow of yesterday’s candle indicates the bears are getting exhausted after recent strong selling pressure.

If the bulls can lift prices back above 1221, we may revisit the intra-day resistance in the 1225/4 area. A break through there could foreshadow a move up to 1230/29. The bulls have to produce a daily close above 1230 to march towards the 1236-1234.50 zone. The bears, on the other hand, have to drag prices below the 1218/5 area to invite new sellers. In that case, XAU/USD could retest 1211/09. A break below 1209 implies that the market is targeting 1206/2.