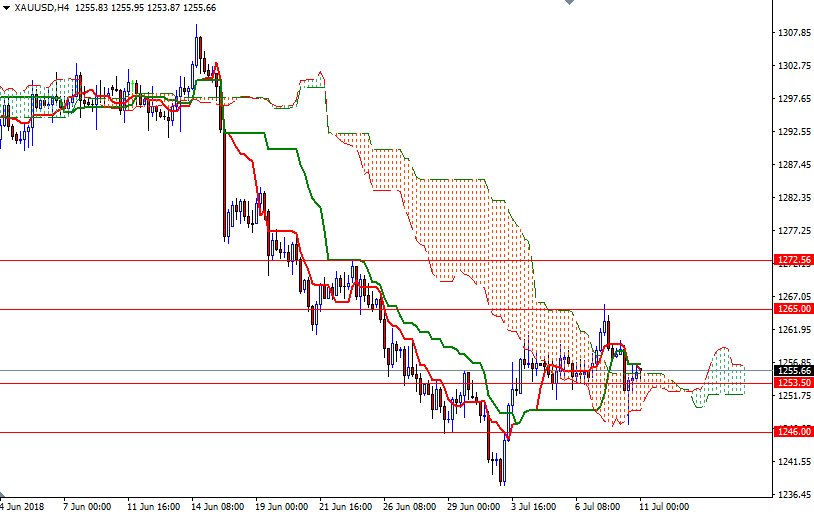

Gold prices ended a choppy, two-sided trading session lower on Tuesday. A rebound in the U.S. dollar index from its recent slide helped to pressure the yellow metal yesterday. XAU/USD retreated to the bottom of the 4-hourly Ichimoku cloud before finding enough support to reverse its course. Concerns over trade tensions between the United States and China resurfaced after a Trump administration official said the White House is likely to announce more tariffs on Chinese goods.

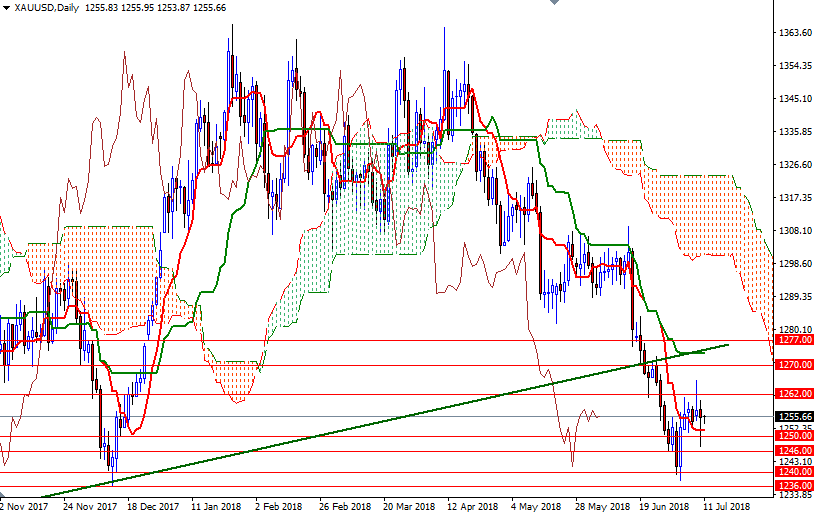

The price pattern on the daily chart, along with the flat Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), suggests that the bulls and bears struggle for near-term control. However, keep in mind that prices are still below the daily Ichimoku cloud. The support in the 1240/36 area will be in danger as long as the resistance in 1273.50-1270 is not broken. In order to reach there, the bulls have to break through 1262 and 1265.

Similarly, the bears have to drag prices below 1246 to march towards the 1240/36 zone. If this support is broken on a daily basis, look for further downside with 1230 and 1227/5 as targets. Once below 1225, the market will be targeting 1218/15.