Gold prices ended Monday nearly unchanged after a quiet session as investors awaited Federal Reserve Chairman Jerome Powell’s testimony to the Senate. XAU/USD traded as high as $1245.48 an ounce but gave up gains after the Commerce Department reported that retail sales jumped 0.5% in June from the prior month.

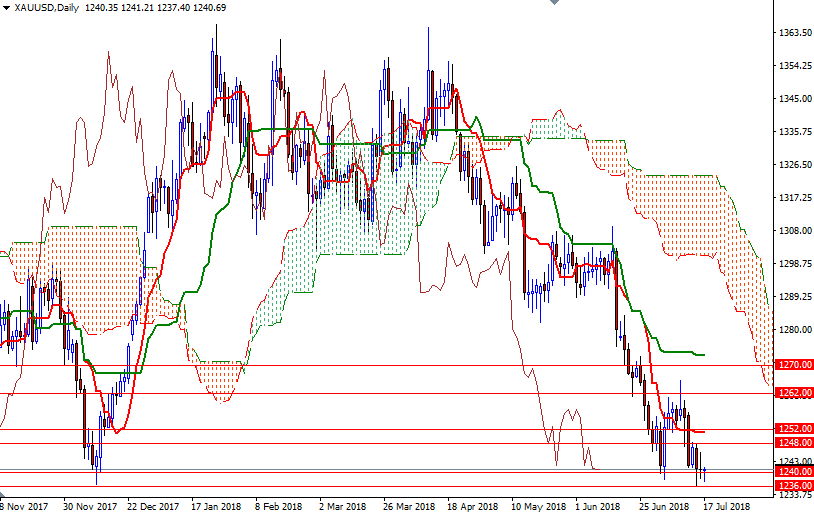

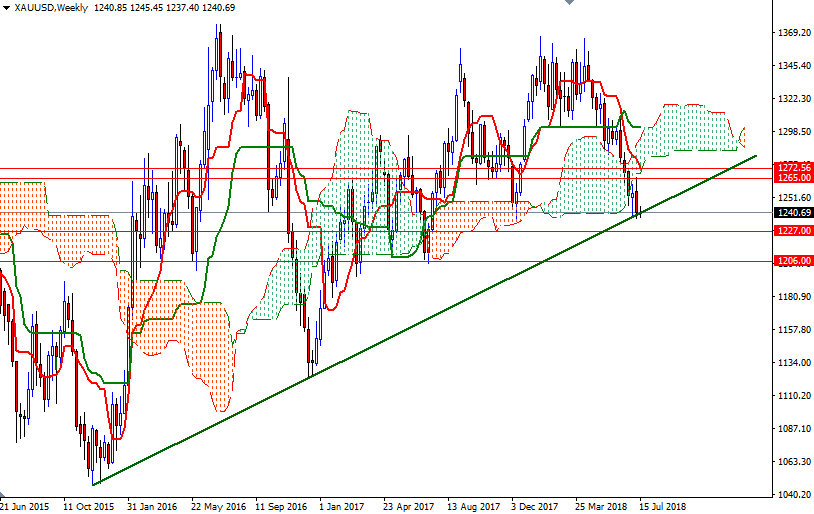

Prices still remain below the weekly and the daily Ichimoku clouds. We have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) on both charts. In addition to that, the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. The market is trying to stay above the 1240/36 area, and it seems that investors are reluctant to open new positions ahead of the upcoming events.

The first upside barrier comes in around 1248. That is followed by the daily Tenkan-Sen at around 1252 while the area between 1240 and 1236 continues to provide support. A sustained break above 1252 paves the way for a test of 1258/6. If prices dive below 1236, it is likely that the market will target 1230. Breaking down below this support could foreshadow a drop to 1225.