Gold prices ended Thursday’s session up $4.73 an ounce, snapping two sessions of losses, as concerns over escalating trade tensions lent some support. In economic news, the Labor Department reported the consumer price index increased 0.1% in June. Some short-covering was featured, following recent selling pressure. Still, buying interest remains subdued on expectations that the Federal Reserve will deliver a fourth interest-rate increase this year.

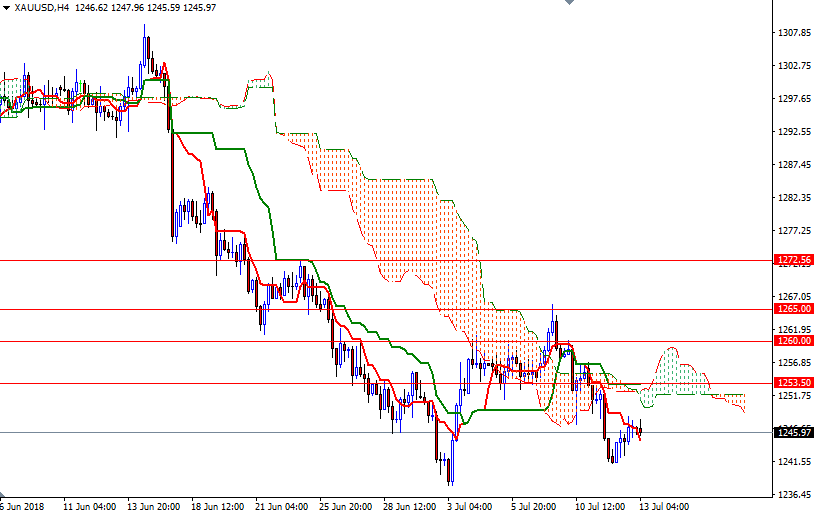

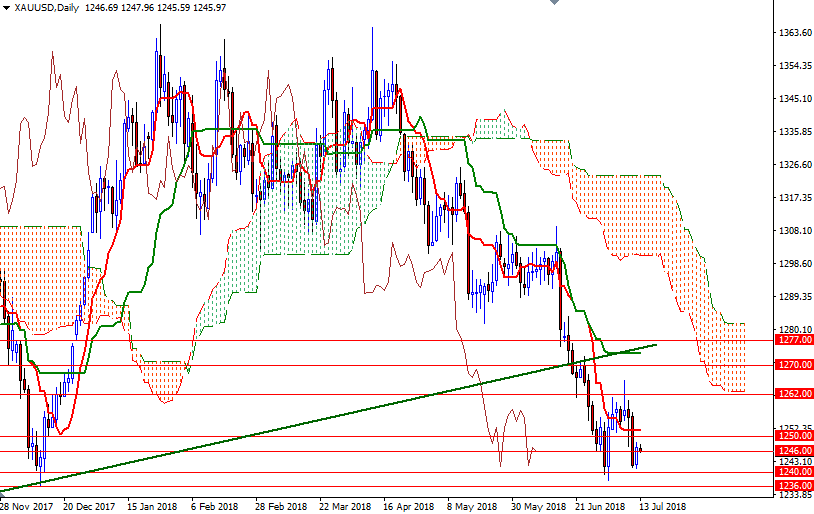

From a chart perspective, trading blow the Ichimoku clouds, along with the negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), suggests that the bears have the firm overall near-term technical advantage. The Chikou-span (closing price plotted 26 periods behind, brown line) is also below prices.

The first upside barrier comes in around 1250 and that is followed by 1253.50. The bulls have to push prices above 1253.50 to gain momentum for 1256-1257.70. If this resistance is broken, look for further upside with 1262 and 1265 as targets. Down below, there is a solid support in the 1240/36 zone. The bears have to capture this strategic camp to make an assault on 1230. A break below 1230 implies that XAU/USD will test 1227/5.