Gold prices settled slightly lower after shuffling between gains and losses as investors opted to remain on the sidelines ahead of a meeting between the U.S. and European Commission presidents and the release of key economic data. World stock markets were mostly higher yesterday. The U.S. stock indexes hit multi-month highs. XAU/USD retreated to the $1218.40-$1217.80 area after prices fell below $1221 but found enough support there to test the resistance at $1229.

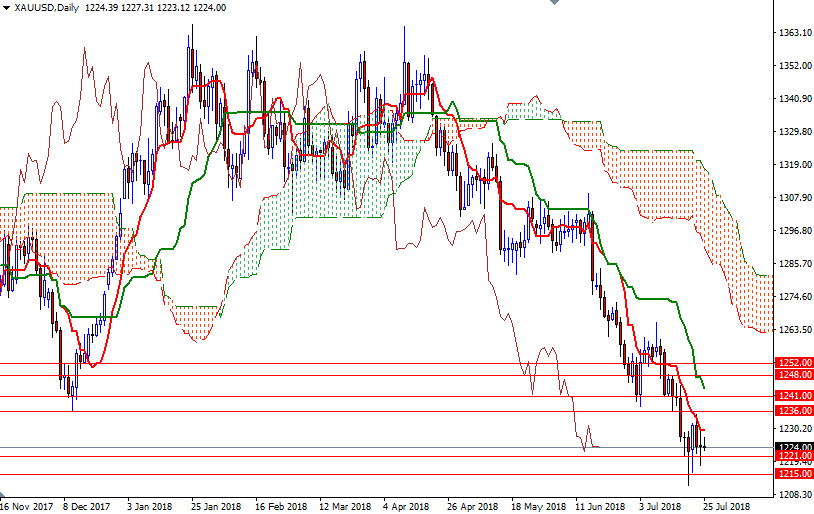

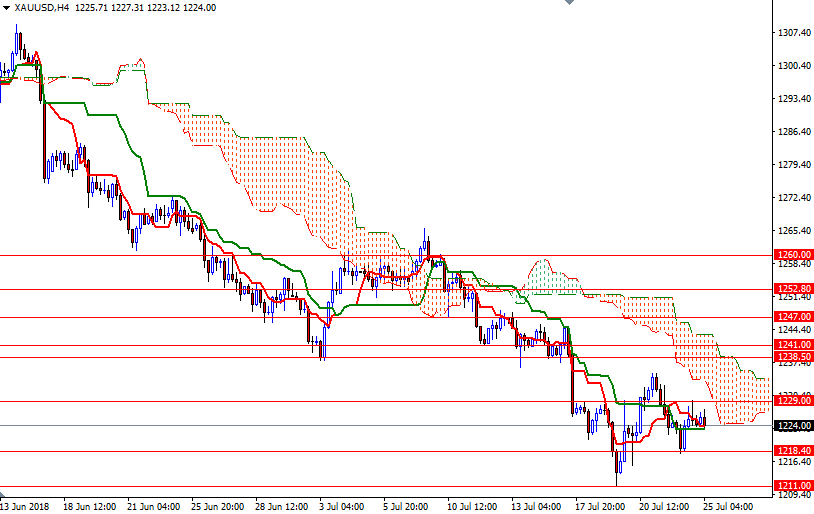

Technically, gold bears have the overall near-term technical advantage as prices are not far above last week’s 12-month lows. The market remains below the daily and the 4-hourly Ichimoku clouds. We have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on the weekly and daily charts. However, note that prices are stuck in a relatively narrow range recently, indicating that gold is likely to see a sideways trend for the next few days.

The bulls have to pass through 1229 to tackle the next barrier at 1236. If this resistance is broken, the market will be targeting the 1241-1238.50 area. XAU/USD has to push its way through 1241 in order to set sail for 1248/7. Similarly, the bears have to push prices below the aforementioned support in 1218.40-1217.80 to make an assault on 1215. A successful break below 1215 would set the market up for a test of 1211/09. If this support fails to hold, then the 1206/2 area will be the next target.