Gold prices slipped 0.78% to their lowest level in 6-1/2 months on Monday, weighed down by a rising dollar. The greenback received a boost from stronger-than-expected U.S. manufacturing data. The Institute for Supply Management (ISM) reported that its index of national factory activity rose 60.2 last month from 58.7 in May. This week sees the release of some important U.S. economic data, including the minutes from the U.S. Federal Reserve’s latest policy meeting on Thursday and the monthly jobs report on Friday.

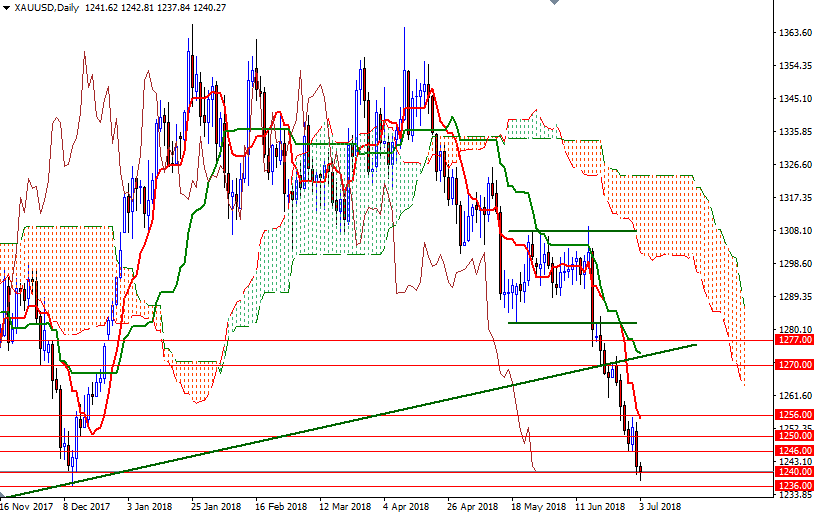

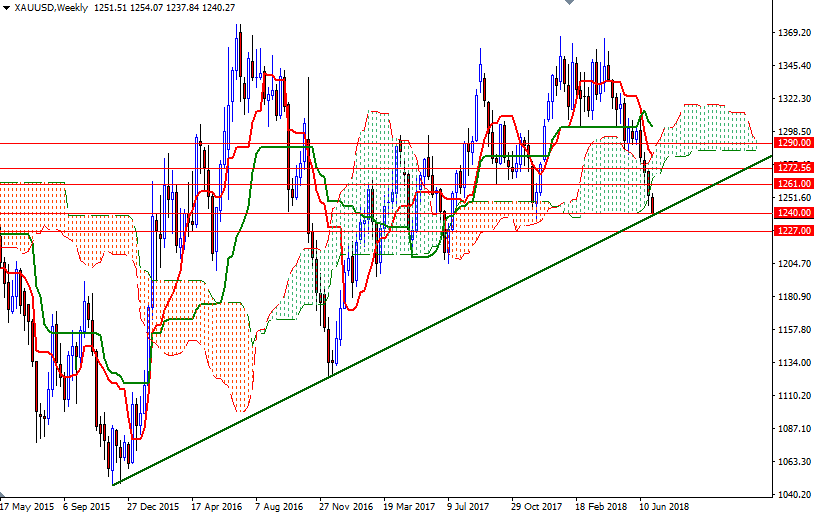

XAU/USD retreated to the 1240/36 zone as expected after the market failed to stay above the 1246 level. Technically, the bears have the firm overall near-term technical advantage, with the market trading below the Ichimoku clouds on the daily and the 4-hourly charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and the daily Chikou-span (closing price plotted 26 periods behind, brown line) is below prices.

To the upside, the initial resistance sits at 1246. If prices successfully get back above 1246, it is likely that the market will revisit 1252/0. A break through there brings in 1256. The bears, on the other hand, have to drag prices below 1236 so that they can challenge 1232/0. If this support is broken, the market will be aiming for 1227/5. Closing below 1225 on a daily basis could pave the way for a test of the 1218/15 area.