Gold prices rose slightly on Thursday as the dollar came under pressure after the ADP private jobs data fell short of market forecasts. Figures from the ADP Research Institute revealed that the private sector added 177000 jobs in June. XAU/USD traded as high as $1259.65 an ounce but the market edged lower in early Asia session as minutes from the most recent Fed meeting showed policy-makers believed they should continue to raise interest rates on a regular basis. The key U.S. economic highlight of the day will be the monthly jobs report.

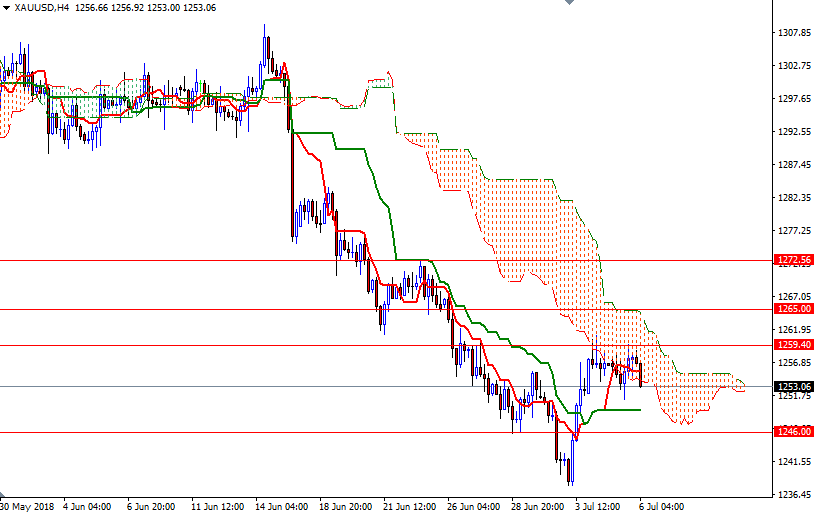

The market is trading within the borders of the Ichimoku clouds on the H1 and the M30 charts. On the H4 chart, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are flat. With that in mind, I think XAU/USD remain range-bound ahead of the Labor Department’s employment report.

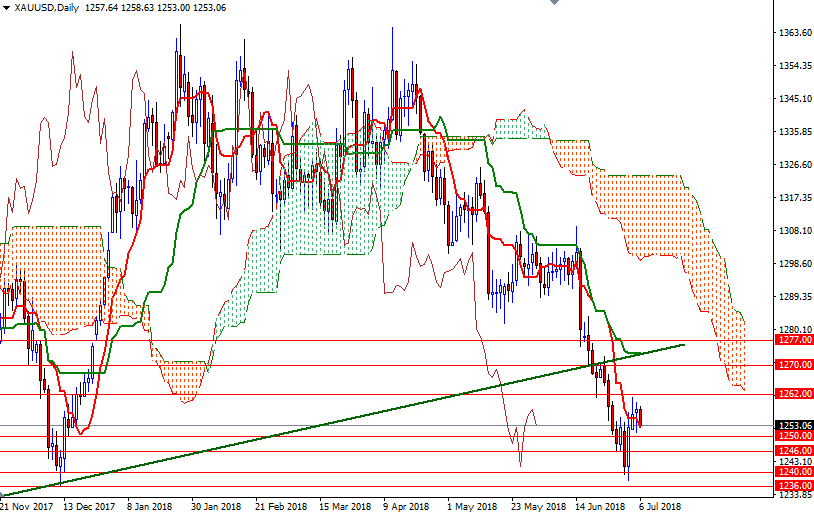

The bears have to drag prices below 1250 to march towards 1246. A break down below 1246 could see a fall to 1240/36. If this key technical support is broken, then the 1230 level will be the next port of call. Similarly, the upside potential will be limited until prices climb above the resistance in the 1262-1259.40 area. The top of the 4-hourly cloud sits at 1265 so the bulls have penetrate this barrier to gain momentum for 1273.50-1270. A daily close above 1273.50 would be a positive sign and help the bulls challenge the subsequent targets at 1277 and 1283.