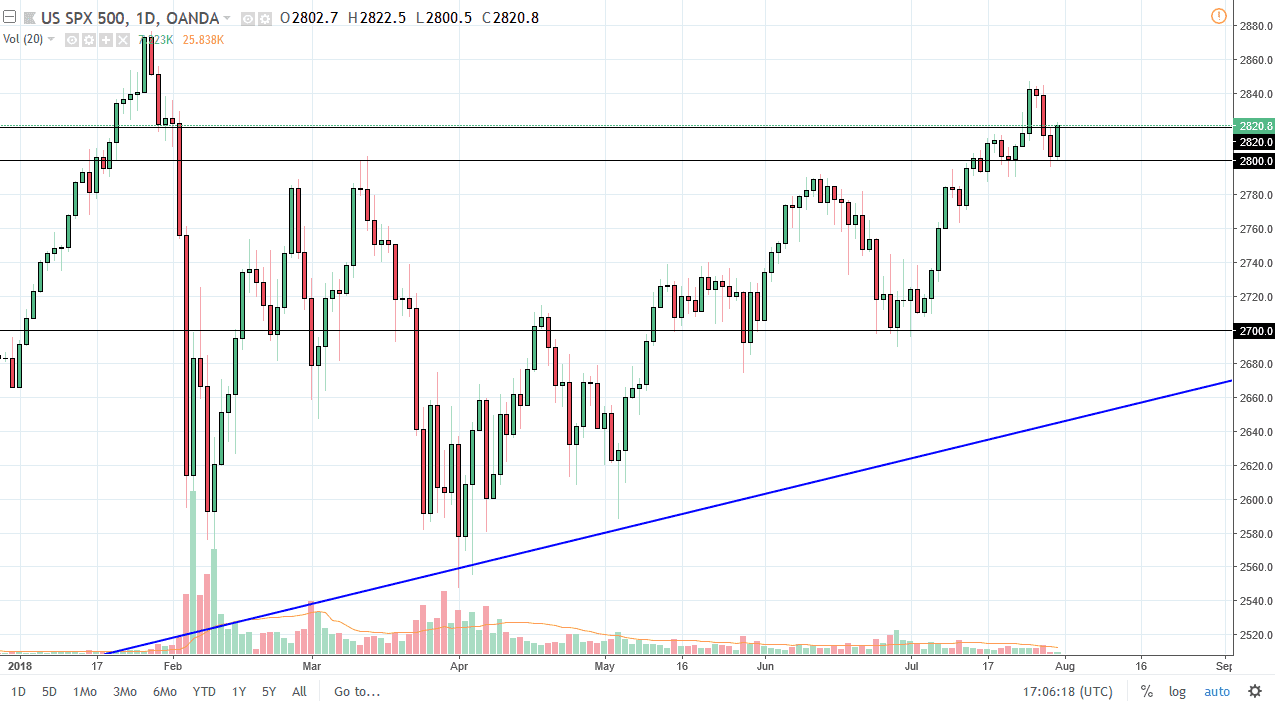

S&P 500

The S&P 500 has found the 2800 level supportive enough to turn things around and reach towards the 2820 level, an area that I think could cause a little bit of resistance. With a central bank meetings over the course of the next couple of days and of course the jobs number, it’s likely that the market may be very noisy. I think short-term traders will continue to buy on dips, but things could change drastically by the time we get through the week. Because of this, I would keep my position size small, and of course take profits quickly. If we break down below the 2790 handle, the market then could drop down towards the 2740 handle. The alternate scenario is that we clearly break above the 2820 handle, then we should go to the 2840.

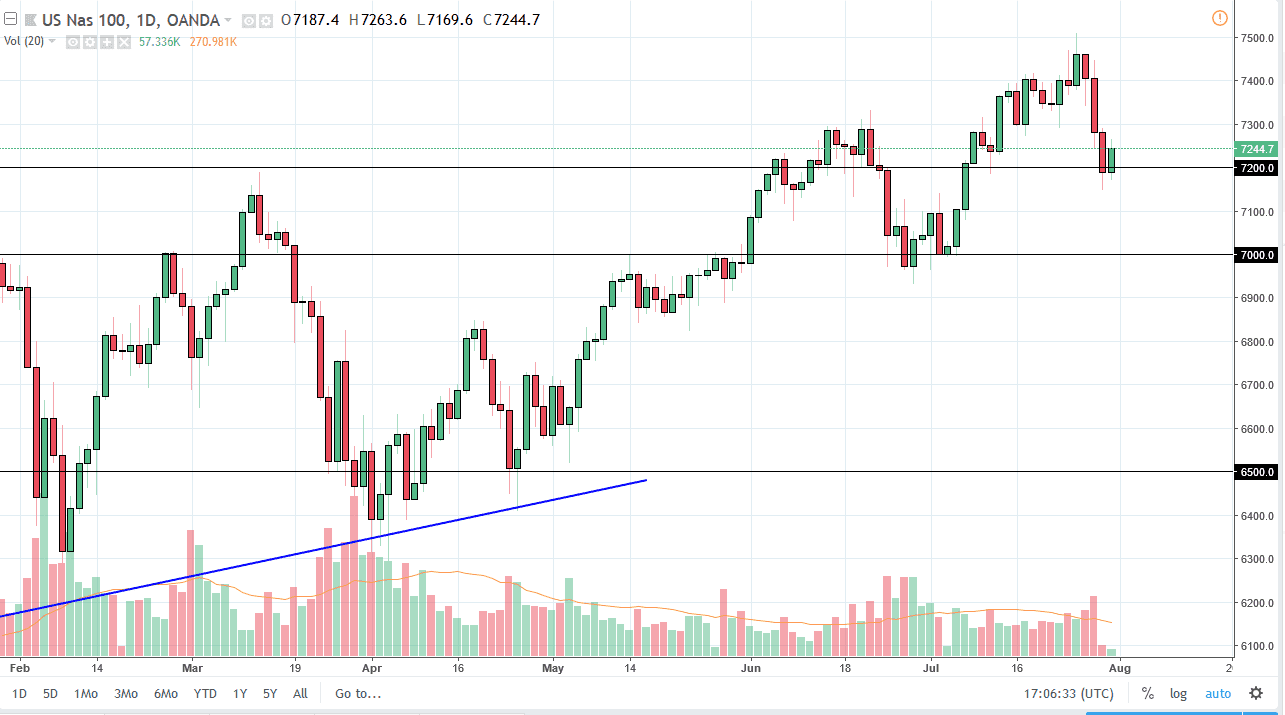

NASDAQ 100

The NASDAQ 100 has bounced a bit during the trading session on Tuesday, using the 7200 level as support. The market should continue to go higher, perhaps reaching towards the 7500 level. I think that longer-term, that’s probably what happens, but I think that the market will probably be paying the most attention to Apple and the reports that it releases overnight. If it’s a good report, then it’s possible that the NASDAQ 100 will have a sympathy move to the upside. Otherwise, I suspect that we could drop down towards the 7000 level. I do believe that eventually we will rally, but the question is whether or not we can do it now. With the central banks and the jobs number all making headlines over the next couple of days, I think the one thing you can count on is a lot of volatility.