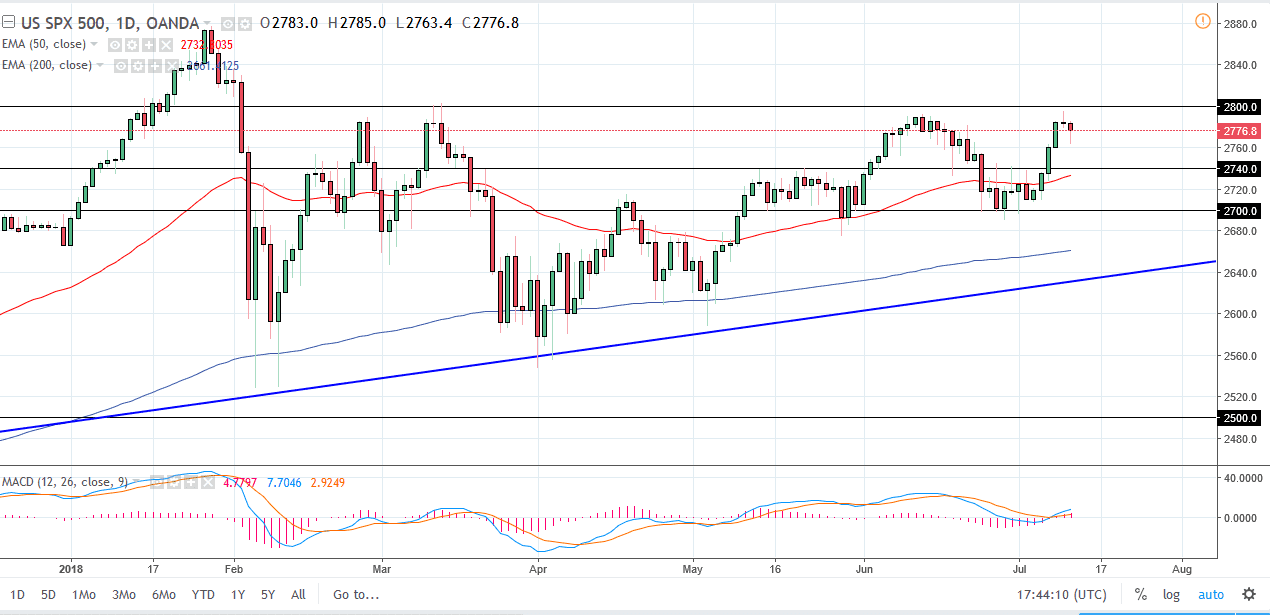

S&P 500

The S&P 500 initially fell during the day, as we have continued to see a lot of noise around the potential trade war. The United States announced that it was going to add another 200 million in trade tariffs against the Chinese, and of course the Chinese will retaliate. Because of this, most stock traders around the world got a bit skittish and started the selloff. However, by the end of the day we turned around to try to break out to the upside, and it looks as if we are going to recover most of the losses. If that’s the case, I feel that it is only a matter of time before the market breaks above the vital 2800 level above, freeing it to go much higher. Currently, I believe that the 2740 level is massive support.

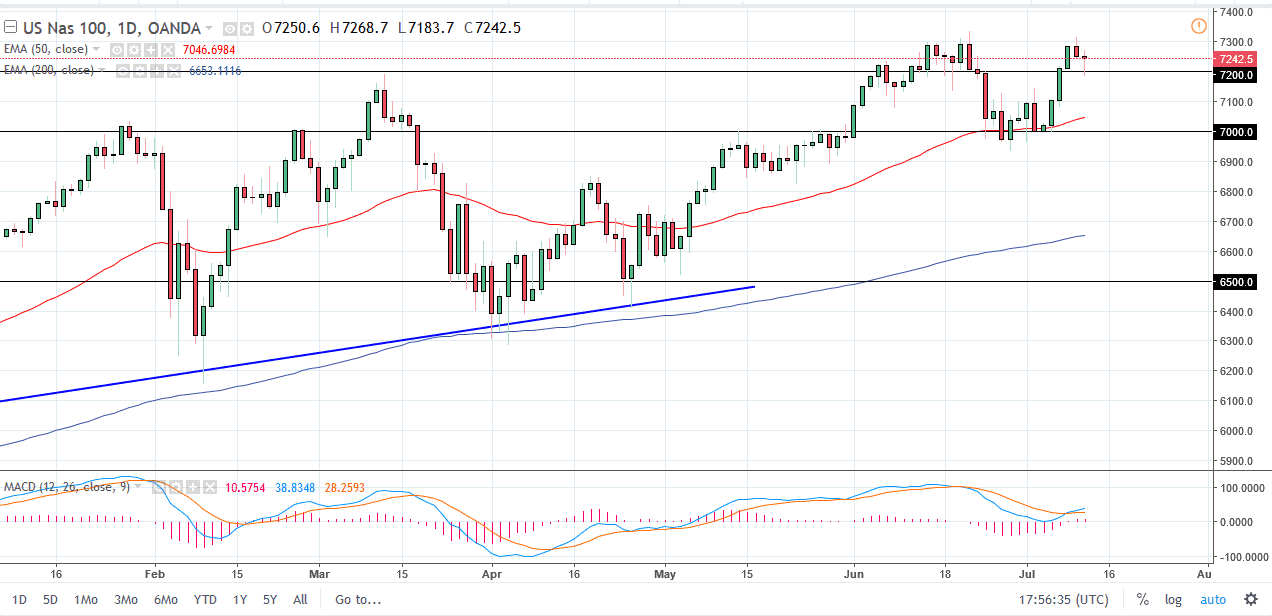

NASDAQ 100

The NASDAQ 100 had a very noisy trading session, initially falling during the day but finding enough support at the 7200 level to turn around of form a bit of a hammer. I think that we are going to make another attempt at the 7300 level, and it looks as if the buyers are coming into push things to the upside. If we can break above the 7300 level, the market could be free to go to the 7400, and then possibly 7500. I think it’s going to be a difficult ride, but I certainly think that we will more than likely find our way to the upside given enough time. I believe that the 7000 level underneath is going to be considered a massive support at this point, and therefore I like buying dips but I also recognize that it will take a certain amount of wherewithal.