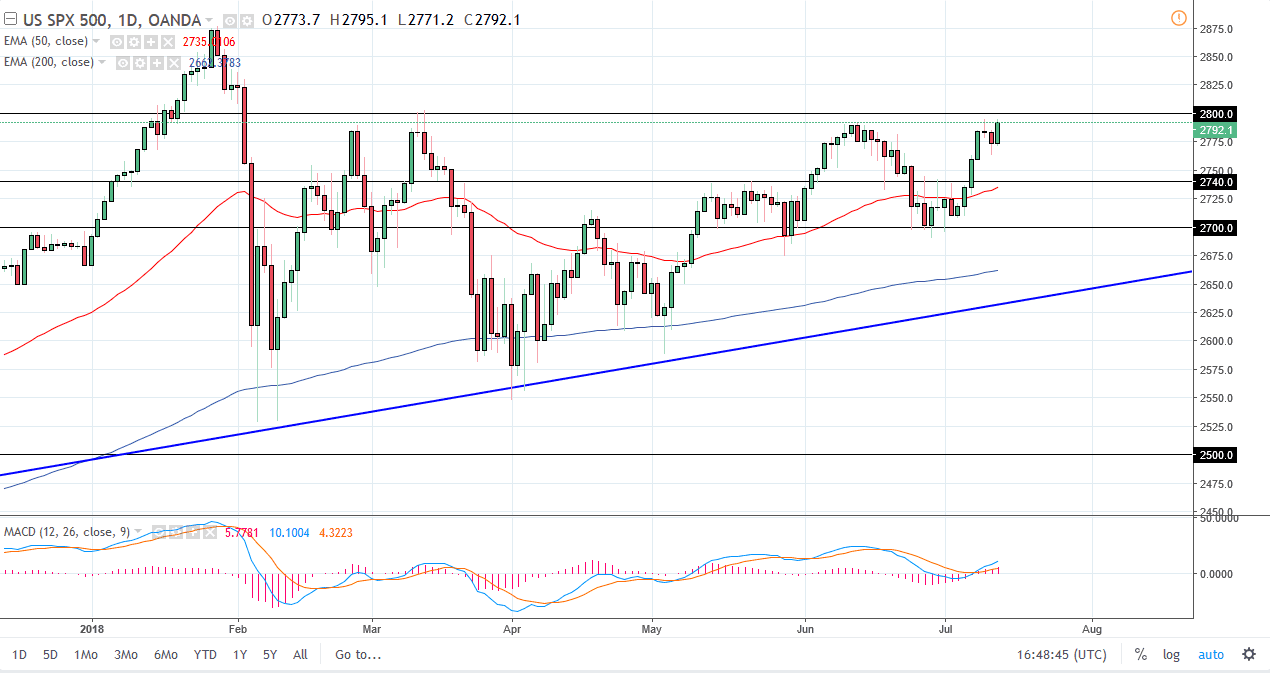

S&P 500

The S&P 500 rallied significantly during trading on Thursday, testing the major resistance just above. I think that the 2800 level above current trading levels will continue to be important, so I think that if we can break above there it’s likely that the S&P 500 will break out significantly. I do not think that we will be able to break above there usually, but if we do on a daily close then it would be a very bullish sign. Alternately, I would anticipate pullbacks as opportunities to pick up momentum to make that move. If we were to turn around and break down below the 2740 level, then the market probably unwinds to the 2700 level. I expect volatility, especially considering that there’s so much movement based upon headlines about trade wars and the like, so certainty is not something they are going to find much of. All things being equal though, it does look like the buyers are trying to make their statement.

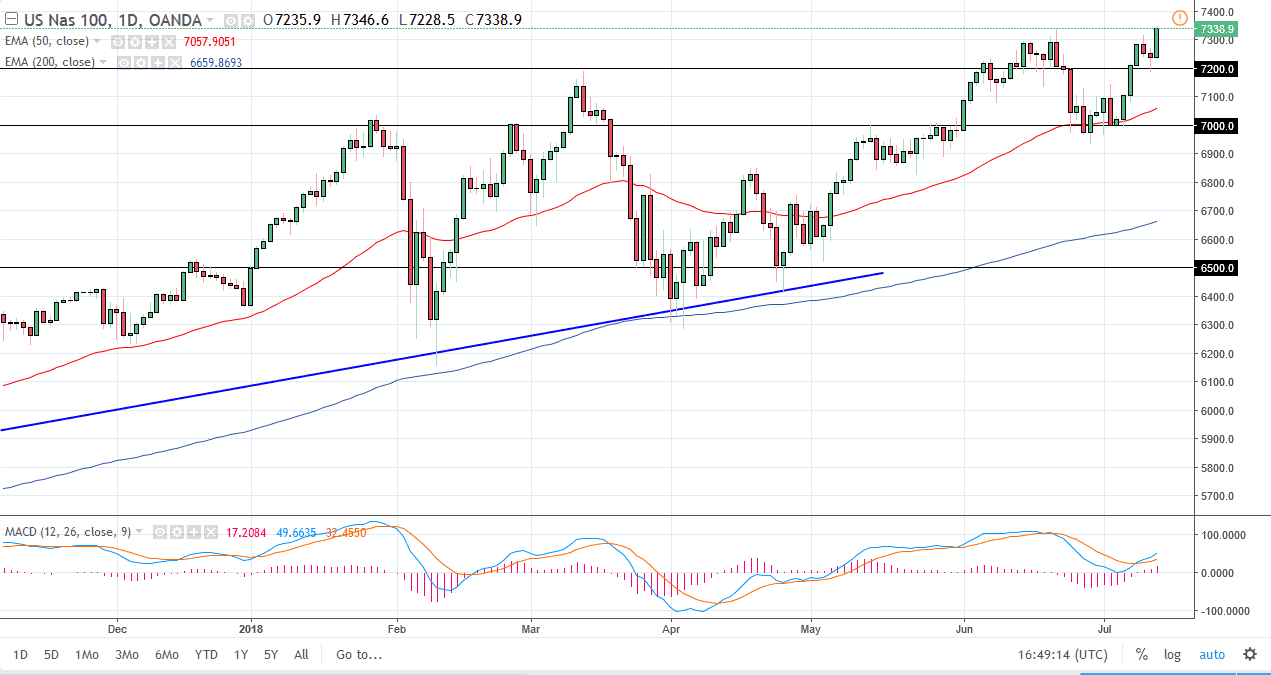

NASDAQ 100

The NASDAQ 100 has made a fresh, new high, and it looks as if we are ready to go towards the 7400 level, possibly even the 7500 level over the longer-term. Short-term pullbacks offer buying opportunities, and it appears that there is a significant amount of support near the 7200 level. If we were to break down below there, then I think we go looking towards the 7100 level, an area that was significant resistance. There is a significant amount of buying pressure at the 50 day EMA as well, so at this point I am bullish of the NASDAQ 100 and look at pullbacks as value opportunities.