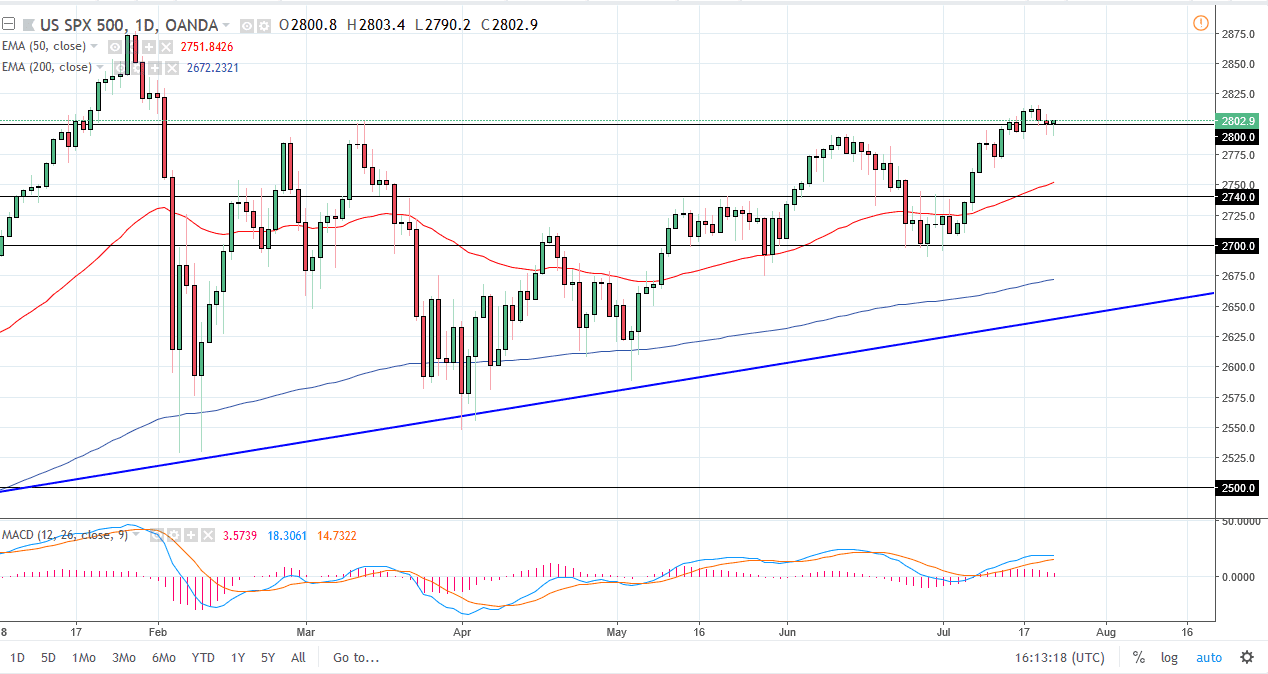

S&P 500

The S&P 500 initially fell during trading on Monday but turned around of form a hammer that sits at the 2800 level. This shows just how resilient this market is, and I believe that we are in fact trying to break out to the upside. I see a significant amount of support for this market just below, but at the same time I also see a significant amount of resistance at the 2825 region. Because of this, I think we will continue to go back and forth, as there are a lot of moving pieces around the world as far as geopolitical concerns are concerned, and then of course there is concern about a strengthening US dollar, and beyond that we will have to pay attention to earnings. So far they’ve been very good though, so I think there is an underlying strength of this market.

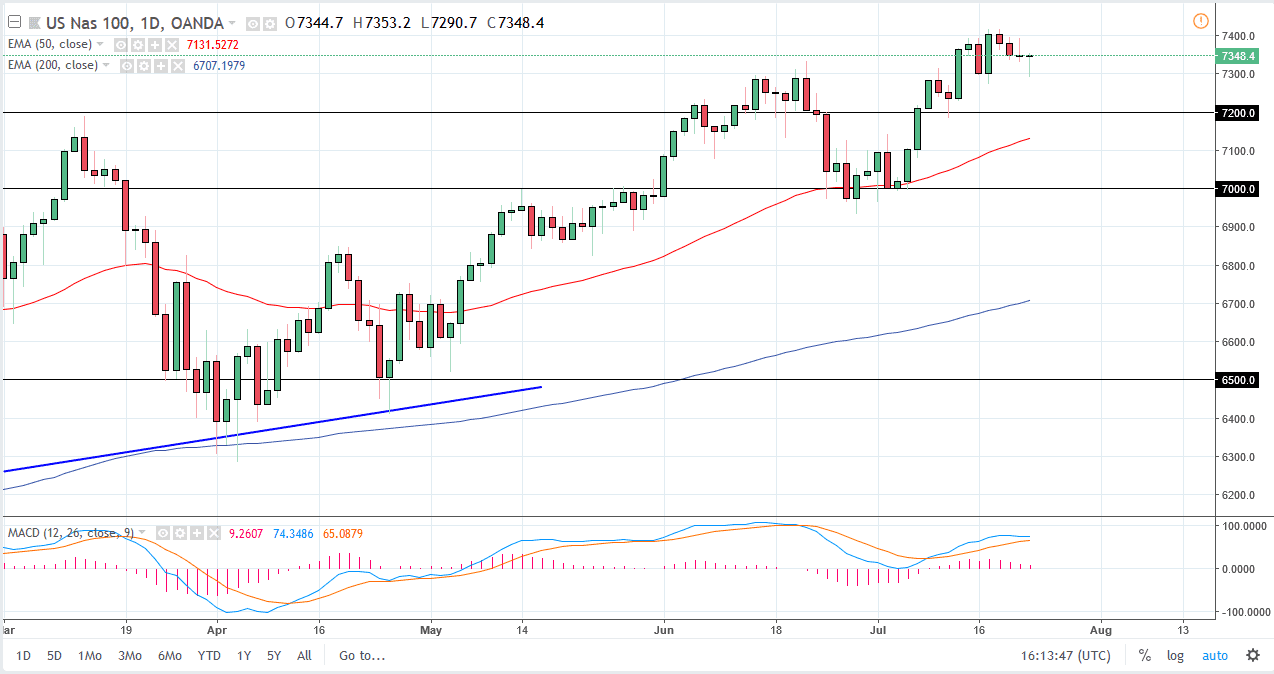

NASDAQ 100

The NASDAQ 100 also fell during the trading session but found enough support at the 7300 level to turn around and form a hammer. The hammer is a very bullish sign, and I think that if we can break towards the 7400 level, we would be testing the highs again, and therefore a bit of resistance. Once we break that level, then I would be aiming for the 7500 level. I believe that the 7200 level underneath is the short-term “floor” in the market, and therefore I don’t have any interest in trying to short this market. It’s only a matter time before the value hunters come back into the marketplace, and it should continue to see a “by on the dips” type of mentality over here. The 7000 level underneath is the bottom of the uptrend for me currently.