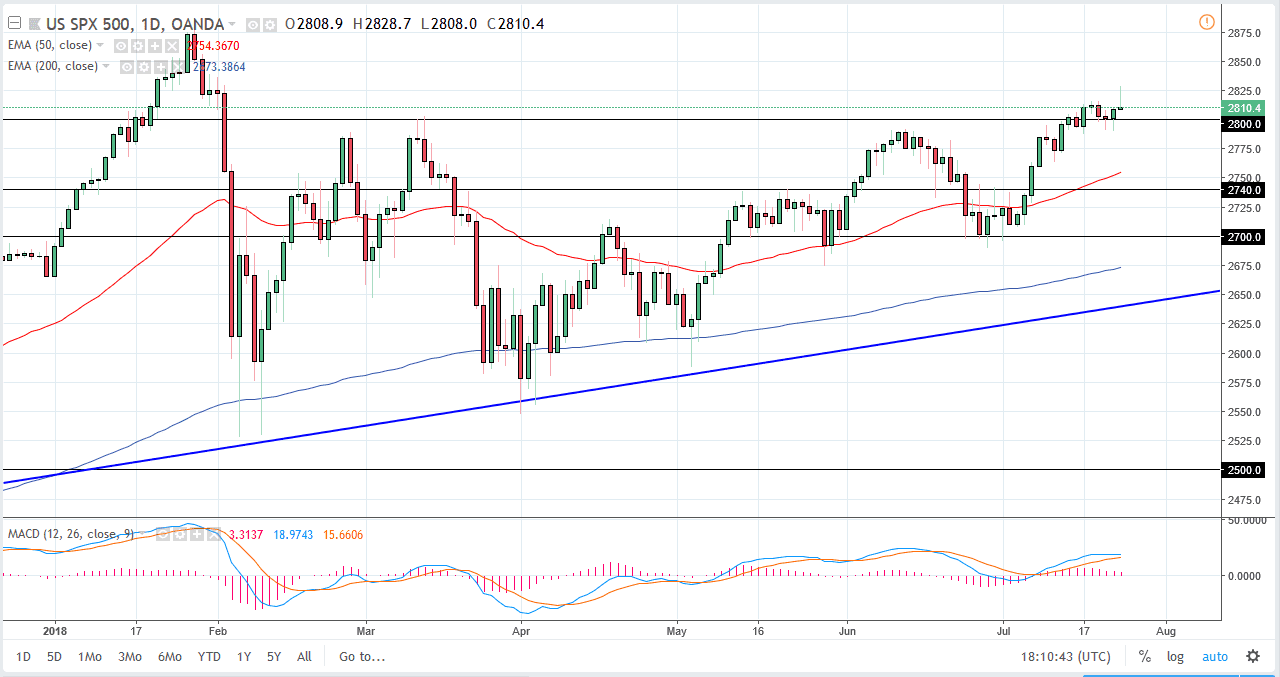

S&P 500

The S&P 500 rallied a bit during the trading session on Tuesday, reaching towards the 2830 level before pulling back. However, after the massive selloff it seems as if the later part of the day is featuring more buying, which is quite often the sign that larger funds are starting to get involved. After 3 PM New York time, large institutional pension funds and the like will jump into the market and placed their trades. At this point, I believe we will eventually break out, but we may need a short-term pullback to build up the necessary momentum. I would not be a short here, even though we could end up forming a bit of a shooting star. I believe there’s plenty of support underneath near the 2775 level. If we break out above the 2830 handle, then I think the market goes hunting the 2875 level, possibly the 2880 level after that.

NASDAQ 100

The NASDAQ 100 has also initially tried to rally but as we got close to the 7500 level, we did pull back. It makes sense that we would do so, as it is a large come around, psychologically significant number. I think that a pullback makes quite a bit of sense, and that there should be a bit of a floor closer to the 7300 level. I also believe that there is a significant amount of support at the 7200 level also. Overall, I also look at the 50 EMA, pictured in red on the chart, as a potential area of support as well. I think it will take a significant amount of momentum to finally break above the 7500 level, and when we do I think that will lead the next leg higher in the longer-term move.