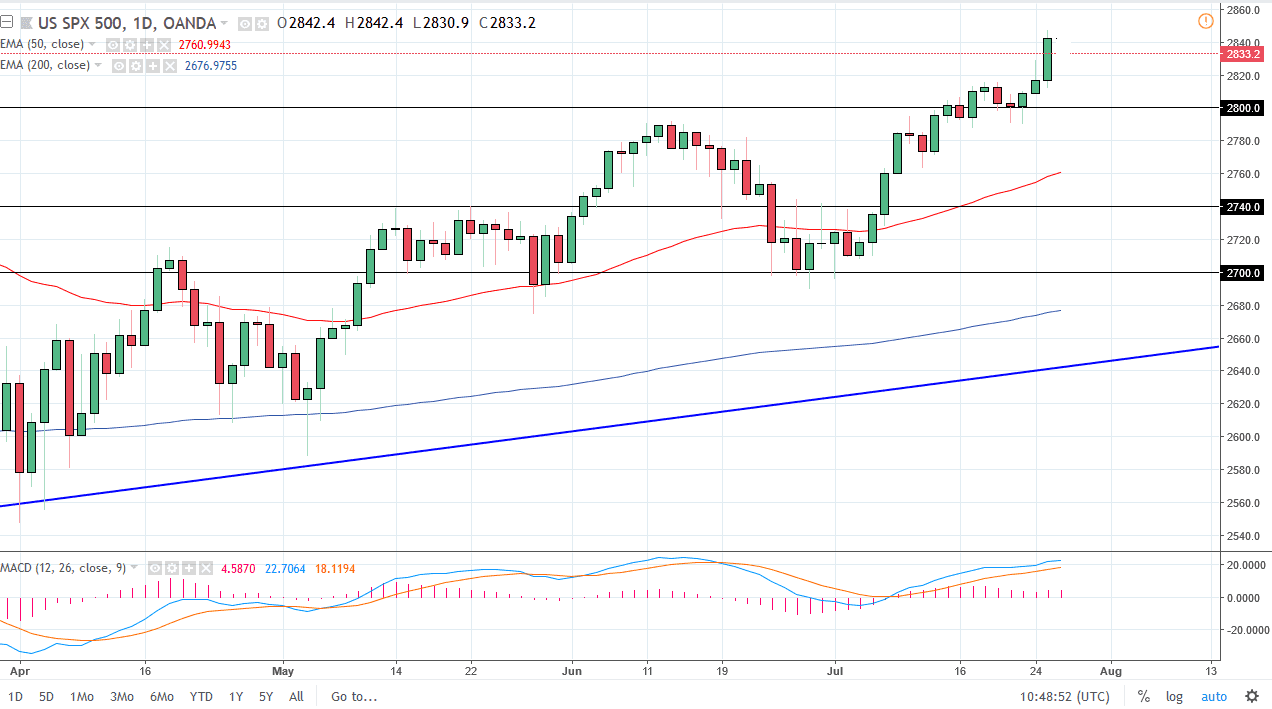

S&P 500

The S&P 500 has rallied again during the trading session on Wednesday, crashing into a major supply area in the form of the 2830 area. If we can break above this level significantly, I believe that the market will probably go looking towards the 2880 handle, and perhaps even 2900 after that. Earnings have been decent, and of course the US economy has been much stronger than many other ones around the world so it makes sense that we would continue to see a lot of money flowing into the US markets in general. We did form a bit of a shooting star during the day on Tuesday, and now it looks as if we are trying to break above the top of that shooting star, which is an extraordinarily bullish sign. Pullbacks at this point should have plenty of support down to the 2790 handle.

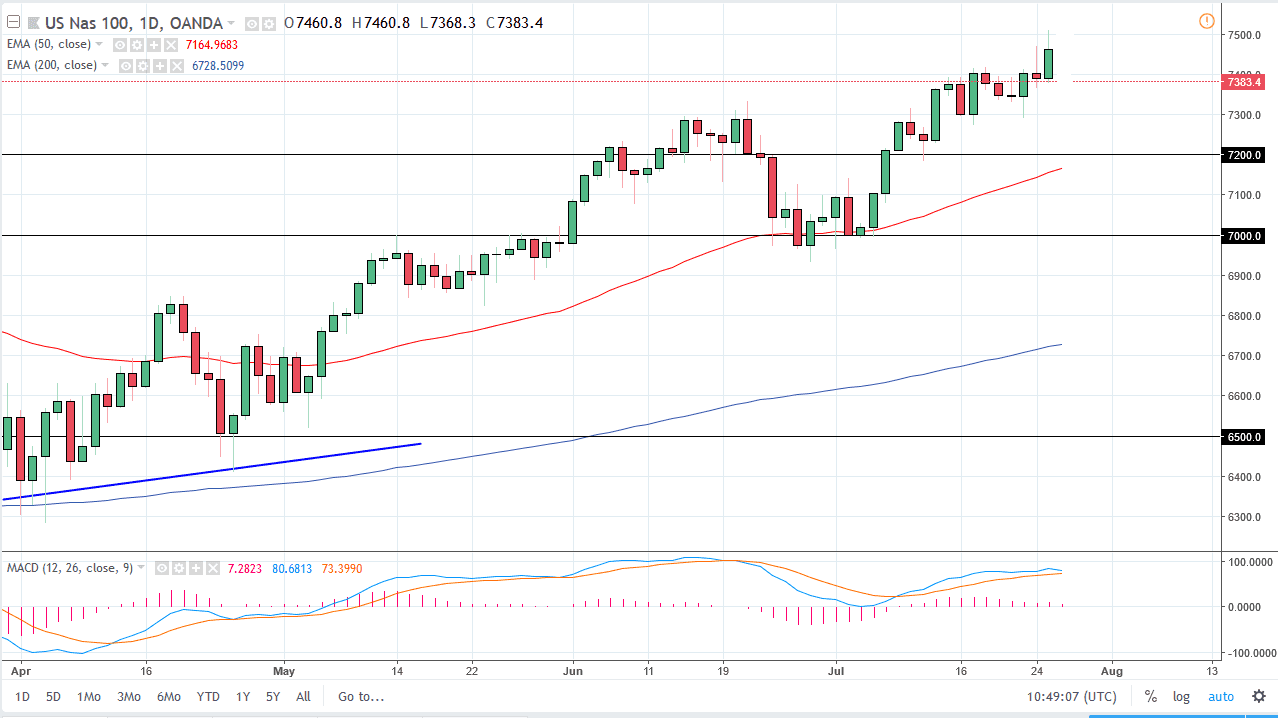

NASDAQ 100

The NASDAQ 100 rallied during the day as well, testing the top of the shooting star from the Tuesday session also. I think that the market is ready to break out, and if we can clear the vital 7500 level, it’s likely that the market will continue to go much higher, perhaps reaching towards the 7750 over the longer-term. I believe that short-term pullbacks are nice buying opportunities, with a significant amount of support found that the 7300 level, and of course the 7200 level after that. Ultimately, I think that plenty of value hunters will come back into this market plays, as although there are a lot of headlines around the world that have spooked traders occasionally, this scenario has also offered plenty of opportunities for those who are patient enough to wait for value to present itself.