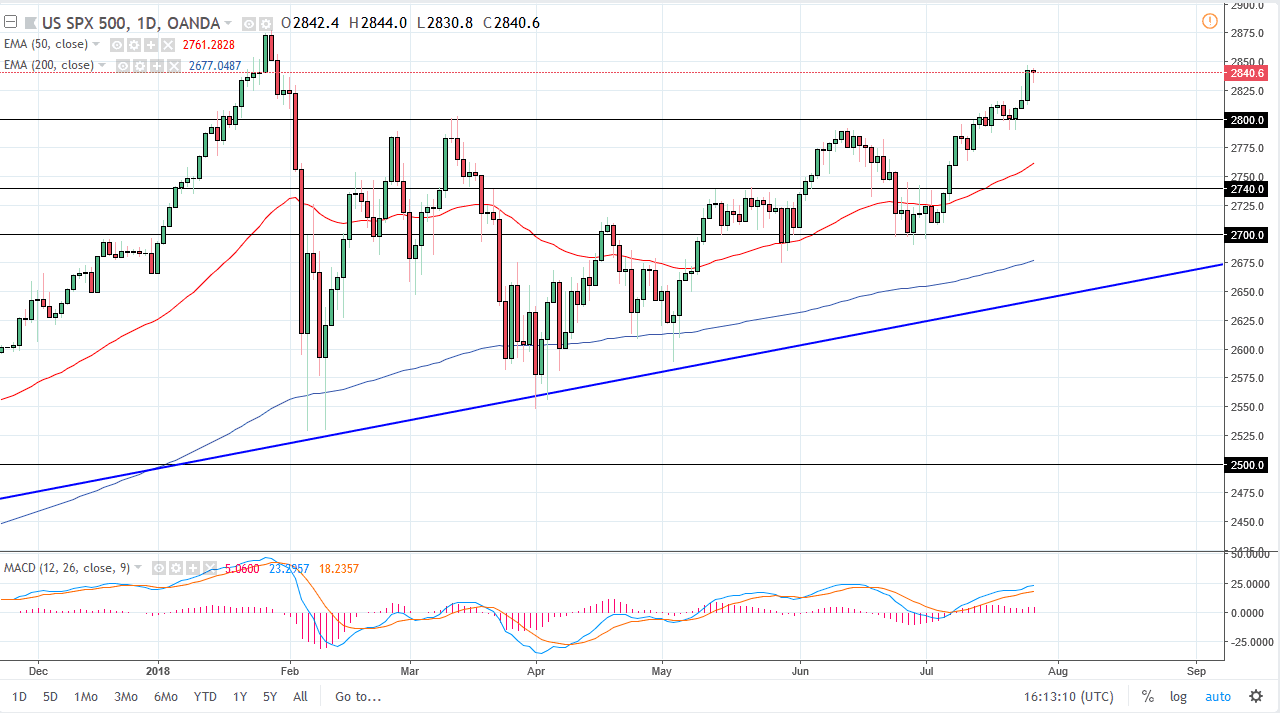

S&P 500

The S&P 500 initially dipped during the trading session on Thursday but turned around to form a bit of a hammer. The market looks as if it is trying to break out to the upside, and I think we will go towards the highs again at 28 A.D. over the next several days. Pullbacks continue to be buying opportunities, and I think that the “floor”, at least in the short term is at the 2800 level. I believe that the markets continue to rise based upon decent earnings, and of course the simple fact that the United States is by far the strongest economy that we see in the G 10 right now. I like buying dips and will continue to do so. I also believe that the 2800 level is essentially a “zone” of support down to the 2790 handle.

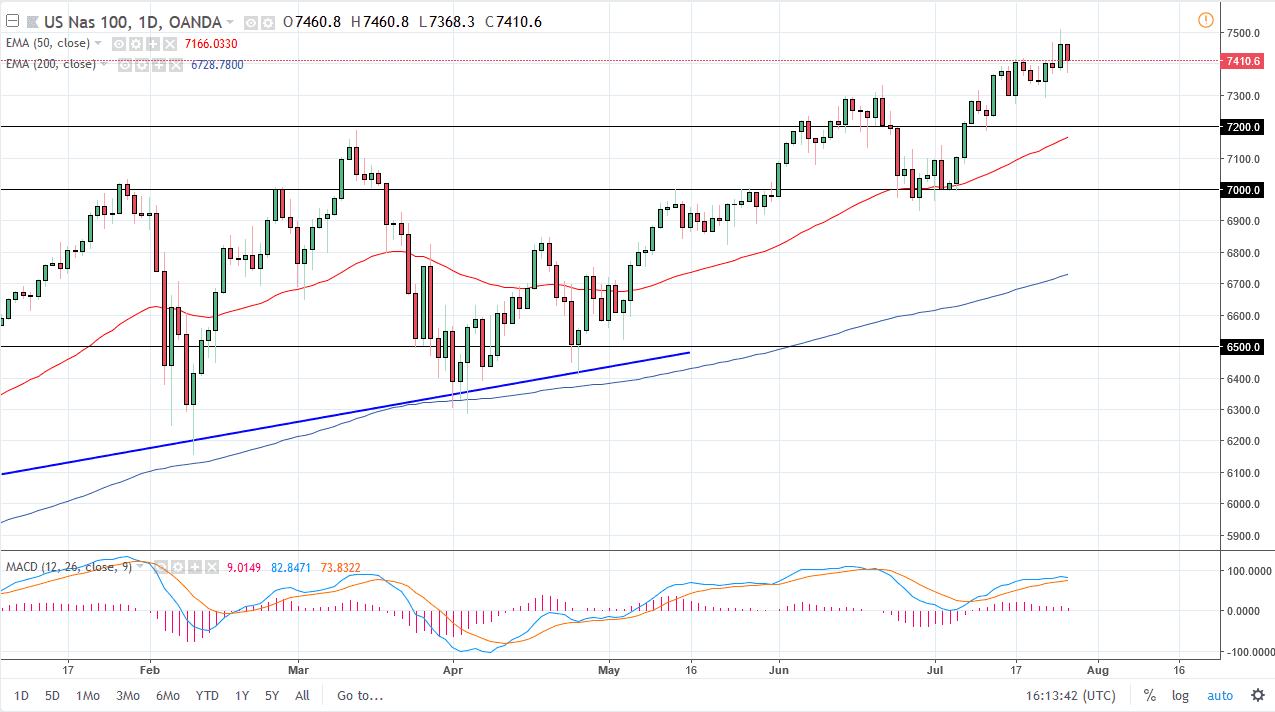

NASDAQ 100

Facebook got absolutely pummeled after hours on Wednesday, which of course has been a bit of an anchor around the neck of the NASDAQ 100. However, the 7400 level has been supportive during the day, and I think that this remains a “by on the dips” type of situation. I believe that the 7300 level offered support, as well as the 7200 level. The 50 day exponential moving average is offering support and bullish, so I think that what we are doing is trying to build up enough momentum to finally break above the 7500 level. Once we do, we can begin the next leg higher.

Obviously, Facebook imploding is a major problem for the NASDAQ 100, but at the end of the day the markets are still healthy and very much in and uptrend. Facebook is an anomaly, not the norm.