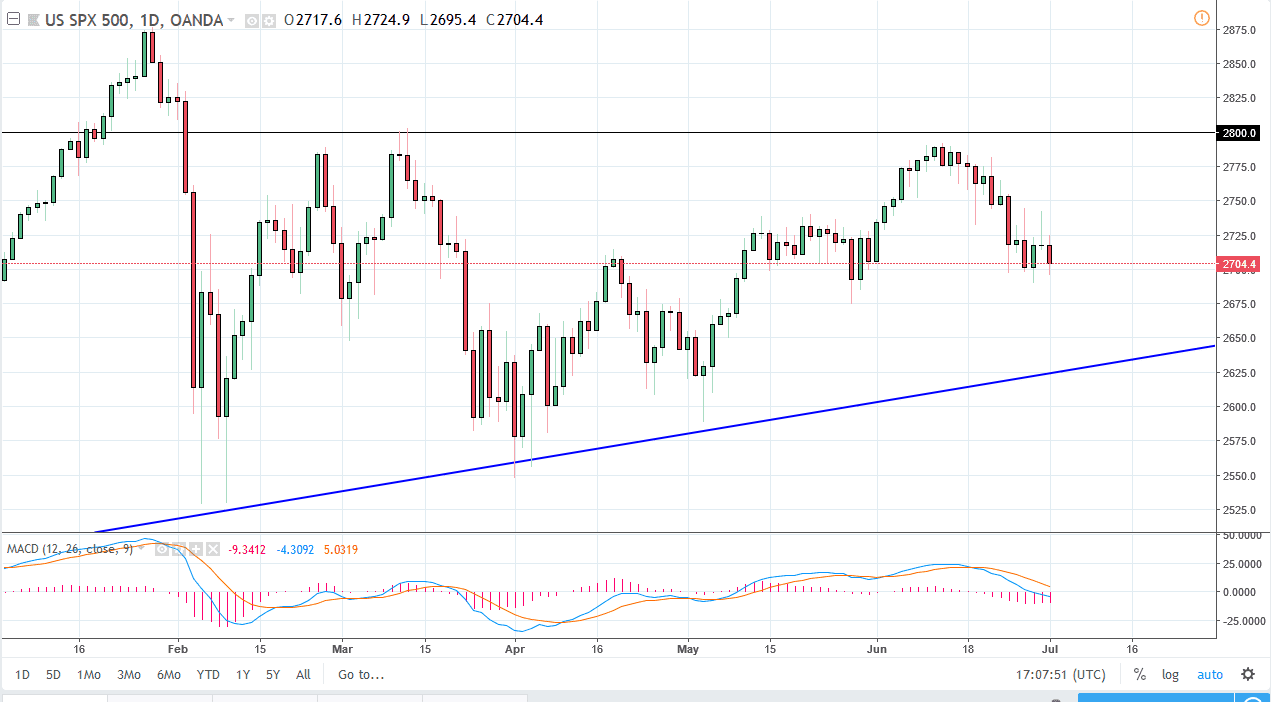

S&P 500

The S&P 500 was slightly negative during the trading session on Monday as traders came back to work, but let’s be honest here: one of the biggest things you need to pay attention to is that the next couple of days will either be nonexistent, or very thin. While the futures markets might be open electronically, the underlying index will be closed for the independence holiday on Wednesday, so therefore it’s difficult to do much with this market other than sell it off when there are fears of an escalating trade war, something that is definitely a reality at this point. The Americans are likely to slap the Chinese with more tariffs on Friday, and you can bank on the Chinese retaliating. Because of this, I think that the market has more downside pressure than up, but we are still technically in a bullish market.

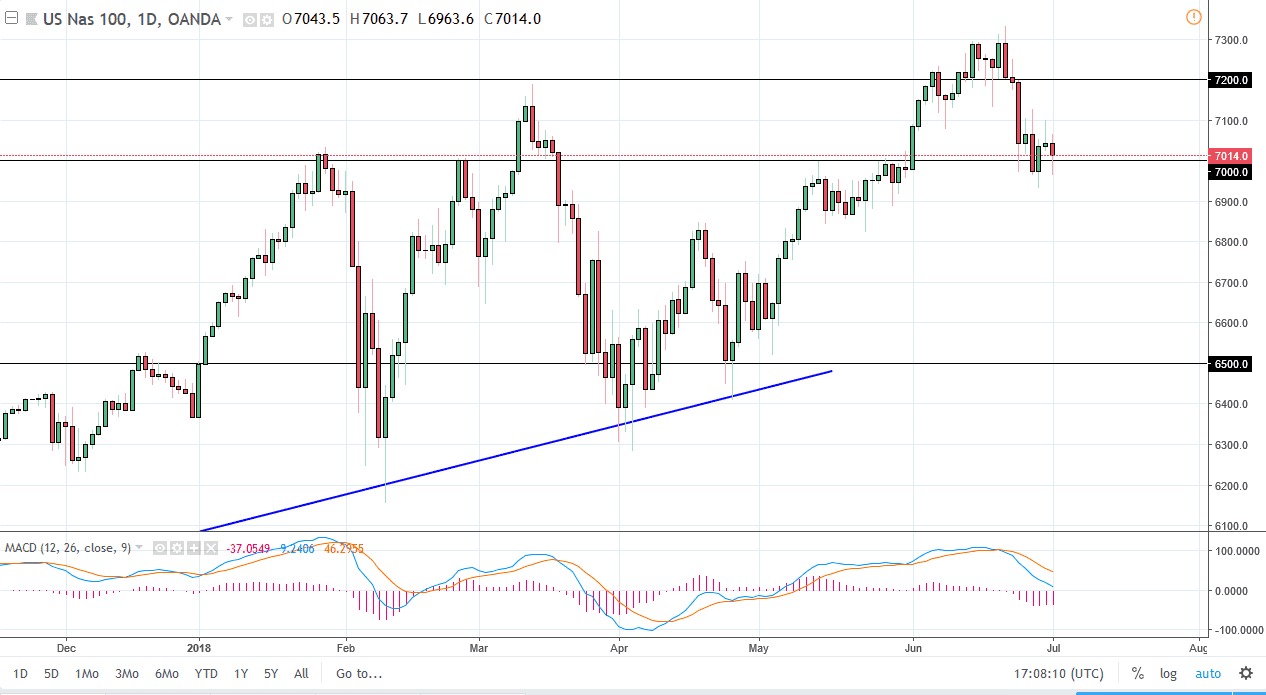

NASDAQ 100

The NASDAQ 100 broke down initially during the day, reaching down below the 7000 level before turning around on signs of support. I think there are plenty of buyers underneath, and right now I think we are essentially consolidating. That may be the case for the next couple of sessions as we have the July 4 holiday coming on Wednesday, which of course is Independence Day in the United States. The markets will be closed, so the underlying index won’t be moving. Because of this, it’s likely that this market will probably be fairly quiet, even in the CFD realm. However, I think there is plenty of support down to the 6900 level, so it’s only a matter time before the buyers get involved and push to the upside. If we break down below the 6900 level, that would be very negative sign.