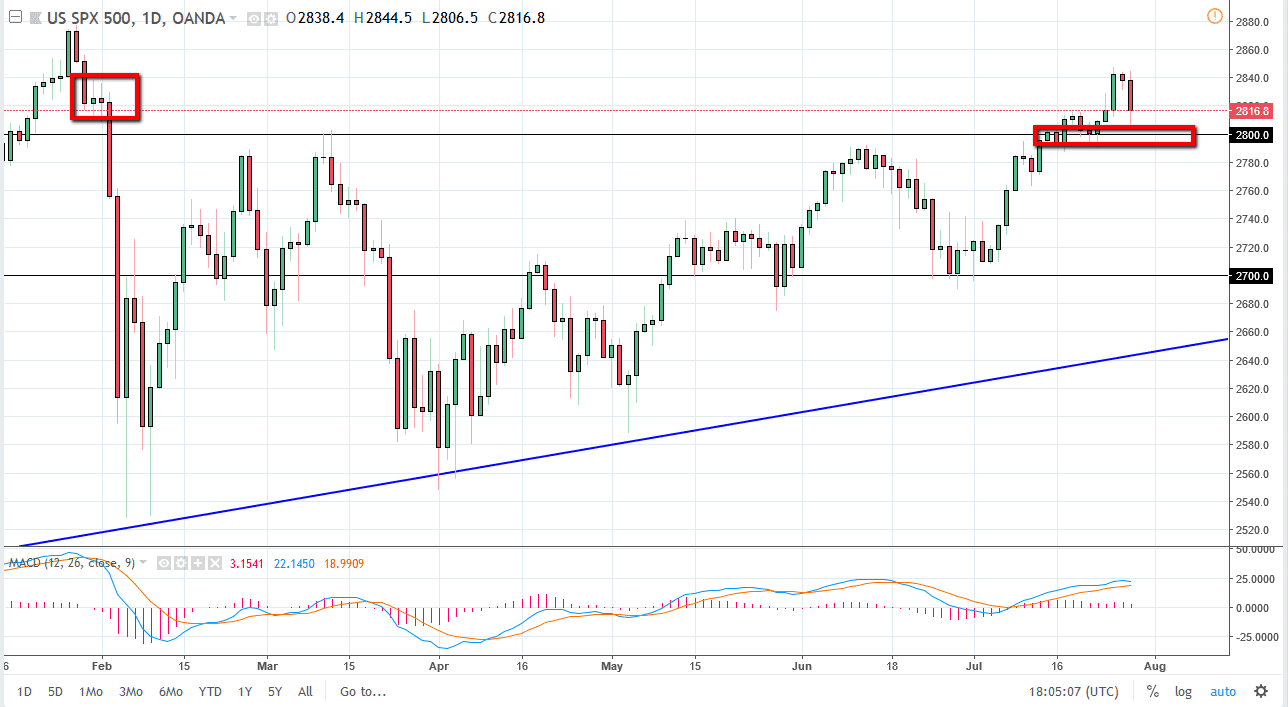

S&P 500

The S&P 500 has fallen a bit during the trading session on Friday, reaching down towards the 2800 level as GDP came out at 4.1%. Some estimates were for a print of 4.2%, but at the end of the day the economy is growing rather strongly, and therefore I think this dip will end up being a buying opportunity. There is a significant amount of demand near the 2800 level, perhaps extending down towards the 2790 level in the short term. Even if we break down below there, I see far too many areas that could be supportive, so I don’t have any interest in shorting this market in the near term. I believe eventually we will go looking towards the 2880 handle, which was the most recent high.

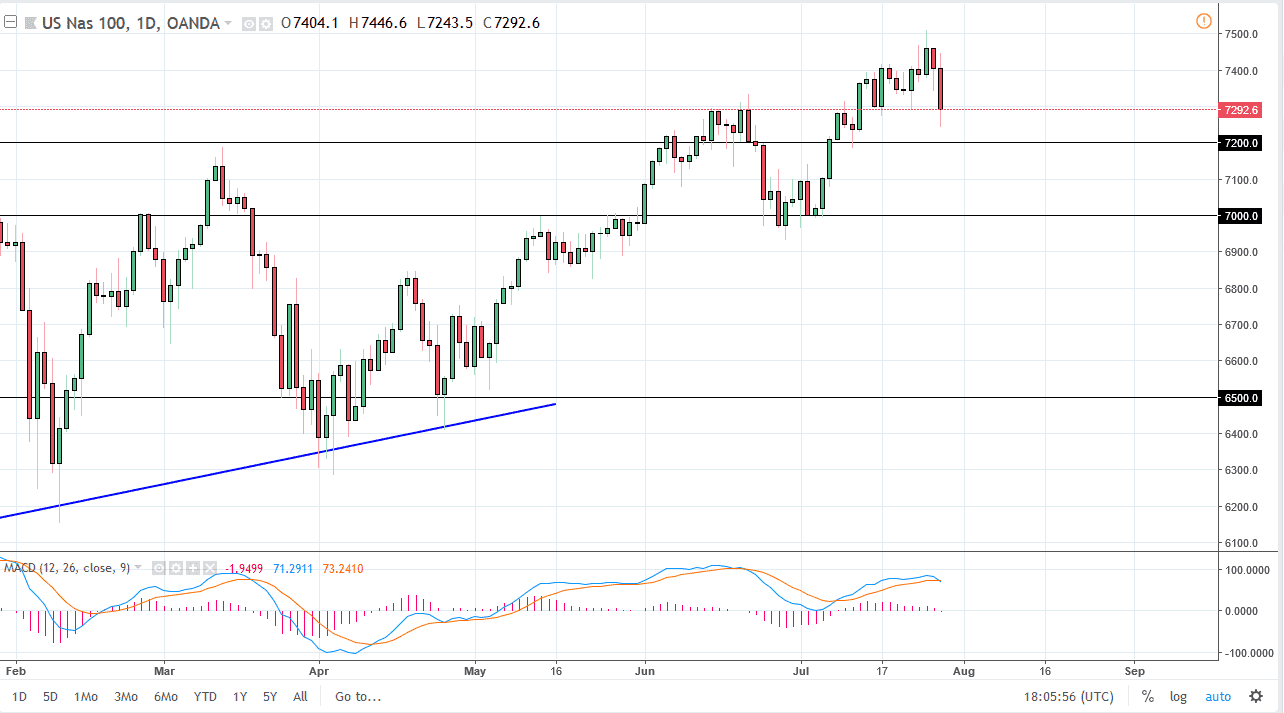

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Friday but then broke down towards the 7250 level. We did eventually find buyers, so the day did not end up at the lows. I think there is plenty of support to be found near the 7200 level, and I think that the sellers will continue to get pushed back every time they tried to get aggressive. Yes, I realize the Friday was a bit rough for the NASDAQ 100, but a lot of that could have been due to Facebook and Intel. On the whole, the index is still in a strong uptrend, so this could end up being a nice buying opportunity for those who are willing to step out and put some money to work. Ultimately, I think that the 7500 level above offering resistance makes sense as it is a large, round, psychologically significant number, but at the end of the day, I anticipate that we will break above this market level soon.