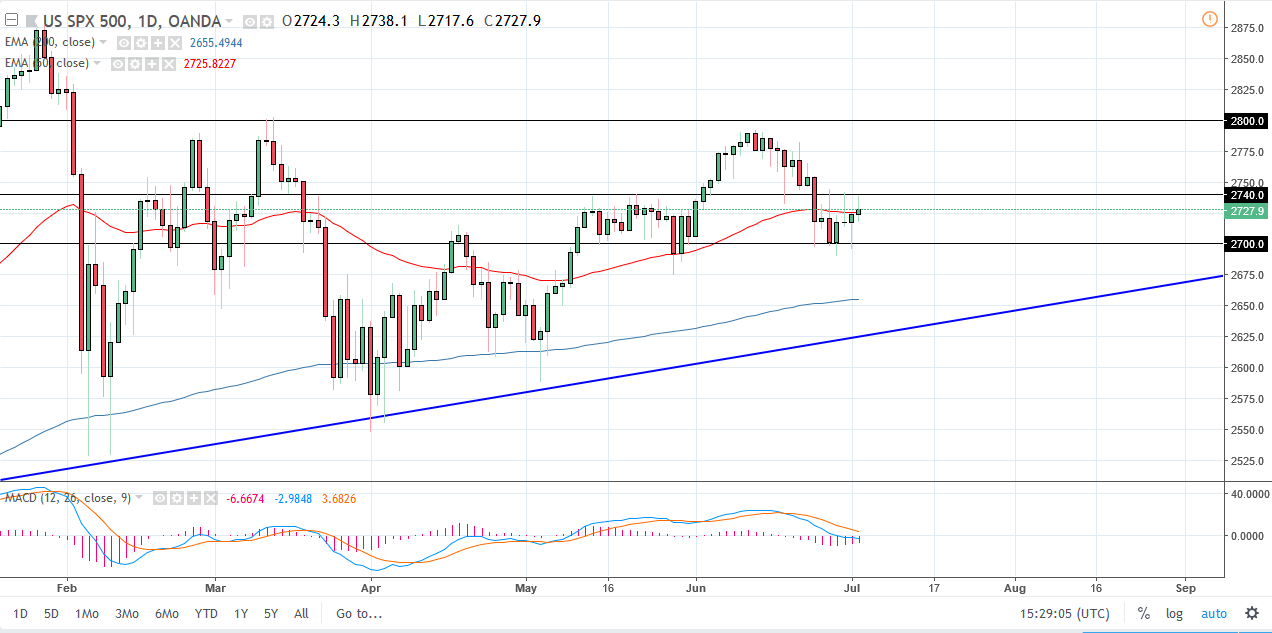

S&P 500

The S&P 500 will be closed during trading on Wednesday, as it is Independence Day in the United States. However, if you are a CFD trader there may be some action electronically based upon global electronic futures markets. Regardless, keep in mind that the underlying index is close, so action will be thin at best. I believe that the overall attitude of this market is one of a consolidation anyway, so I don’t think you’re going to miss much. This is because we have seen so much in the way of confusion when it comes to trade around the world and of course trade tariffs being added by both the United States and some of its larger partners such as China. As long as that is the case, I believe that back and forth trading is probably about as good as this is going to get. Break down below the 2700 level on a daily close could send the market looking for the 200 day exponential moving average underneath. The alternate scenario of course is a break above the 2750 level, which allows this market to go to the 2800 level.

NASDAQ 100

The NASDAQ 100 has initially tried to rally during the day on Tuesday, but turned around to form a shooting star. The shooting star of course is a negative sign, but I would not read too much in what we have seen over the last 24 hours, as we have been hanging around the 7000 level, an area that has been important more than once. If we can break down below the recent lows over the last couple of sessions, the market probably drops down to the 6800 level. Ultimately, if we can break above the top of the shooting star for the day, that would be positive in sin the NASDAQ 100 looking for the 7200 level. Remember though, any CFD trading today is going to be based upon very thin electronic global trading, so I would not read too much into the move until Thursday.