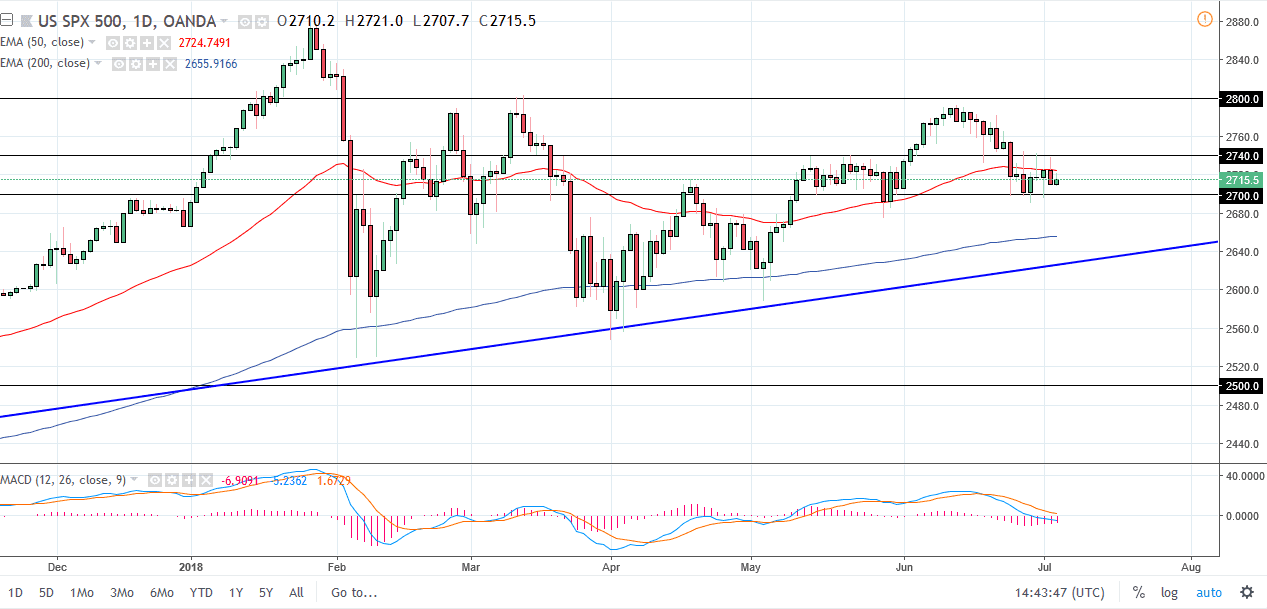

S&P 500

The S&P 500 obviously was being traded electronically only, and of course the underlying index itself was closed for Independence Day. I believe that we continue to be stuck in a short-term consolidation area, with the 2700 level underneath being massive support, just as the 2740 level above is resistance. I think that the market will be difficult to trade for longer-term move, and I believe that short-term back and forth trading based upon an indicator like the stochastic oscillator might be the way to go forward. However, if we break out of this 40 point resistance and support level, I think that we could get an opportunity to place a little bit longer-term trade with the 2650 level underneath being massive support based upon the longer-term trend line, and of course 2800 been massively resistive based upon the previous selling pressure that we have seen there.

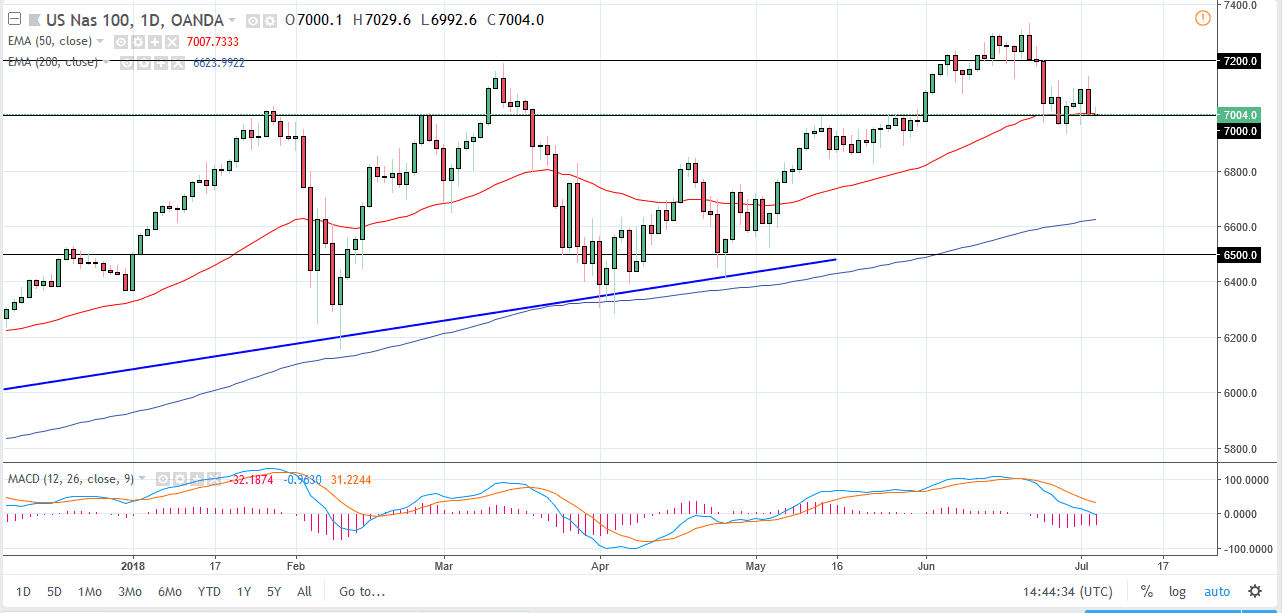

NASDAQ 100

The NASDAQ 100 did very little during the trading session in the CFD markets as the Americans were away for the holiday, and we continue to dance around the vital and psychologically important 7000 handle. You can see that the 50 day exponential moving average is currently right in the middle price, and that attracts a lot of attention. Keep in mind that although we are breaking away from the holiday today, the reality is that a lot of the volume will still probably be missing until early next week so keep that in mind. Because of this, I think that you can’t put too much faith into a move right now, but if we were to break down below the 6900 level, it’s likely that we could continue to go lower. I believe the 200 day moving average, pictured in blue, should be massive support going forward.