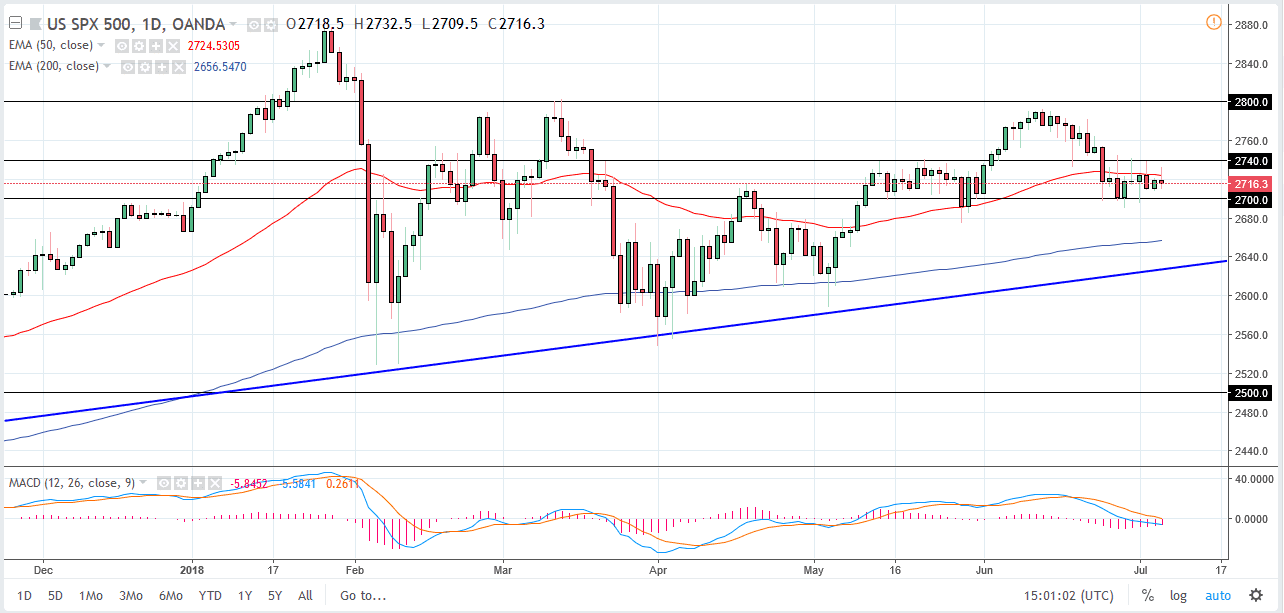

S&P 500

The S&P 500 tried to rally during the session on Thursday, but essentially ended up going back and forth as there is no clear route forward. I believe that the 2700 level underneath continues offer massive support, and the 2740 level above is massive resistance. I also believe that the market is simply waiting for the jobs number obviously, and then the possible tit-for-tat trade sanctions going back and forth between the Americans and the Chinese. The Americans are more than likely going to levy tariffs during the session, and then the Chinese will react. At this point, it’s very difficult to be confident buying. However, we are still technically in and uptrend, and I could even make an argument for potential ascending triangle. I think eventually we go higher, but it’s going take a lot of work.

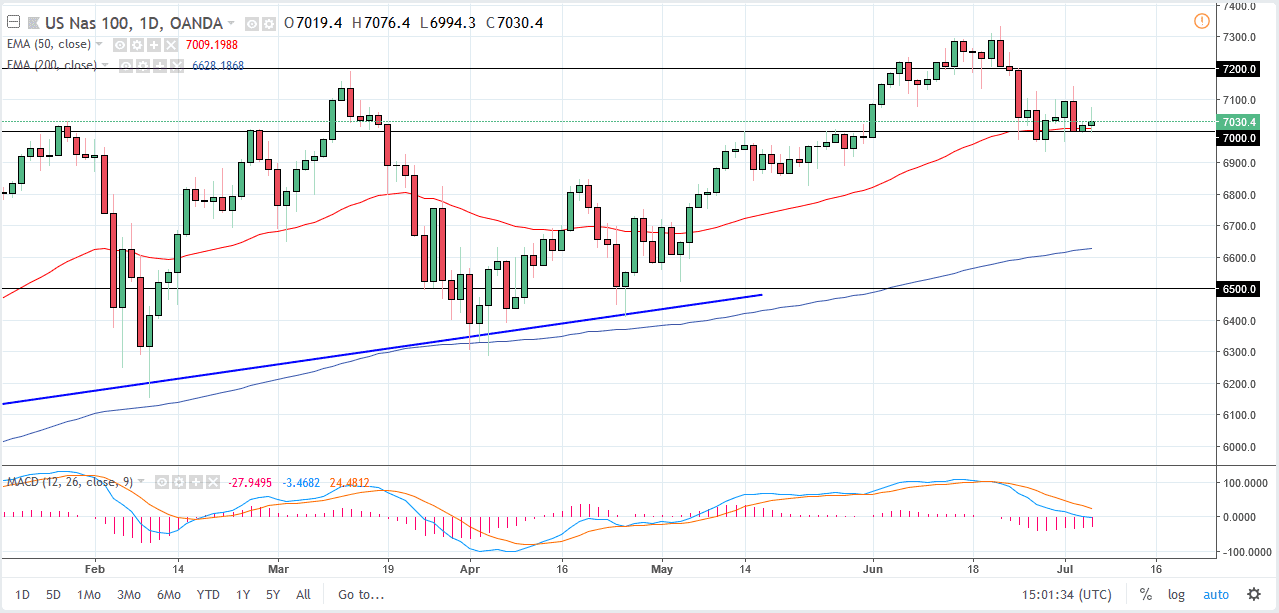

NASDAQ 100

The NASDAQ 100 had initially try to rally during the day but gave back a lot of the gains as I record this. The 7000 level seems to be a massive support barrier down to the 6900 level, so I think that we will more than likely find value hunters eventually, but certainly it looks as if it’s going to be difficult to deal with this market. I would trade it and other risk assets with small position sizes, because the markets are panicking it every little headline. With the jobs number coming out during the session, it seems almost impossible for market participants to put money on the table ahead of time. I believe at this point it’s probably best to wait for the daily close to make a decision, and I of course will keep you abreast as to my thoughts at Daily Forex, but I would say overall I believe in the uptrend.