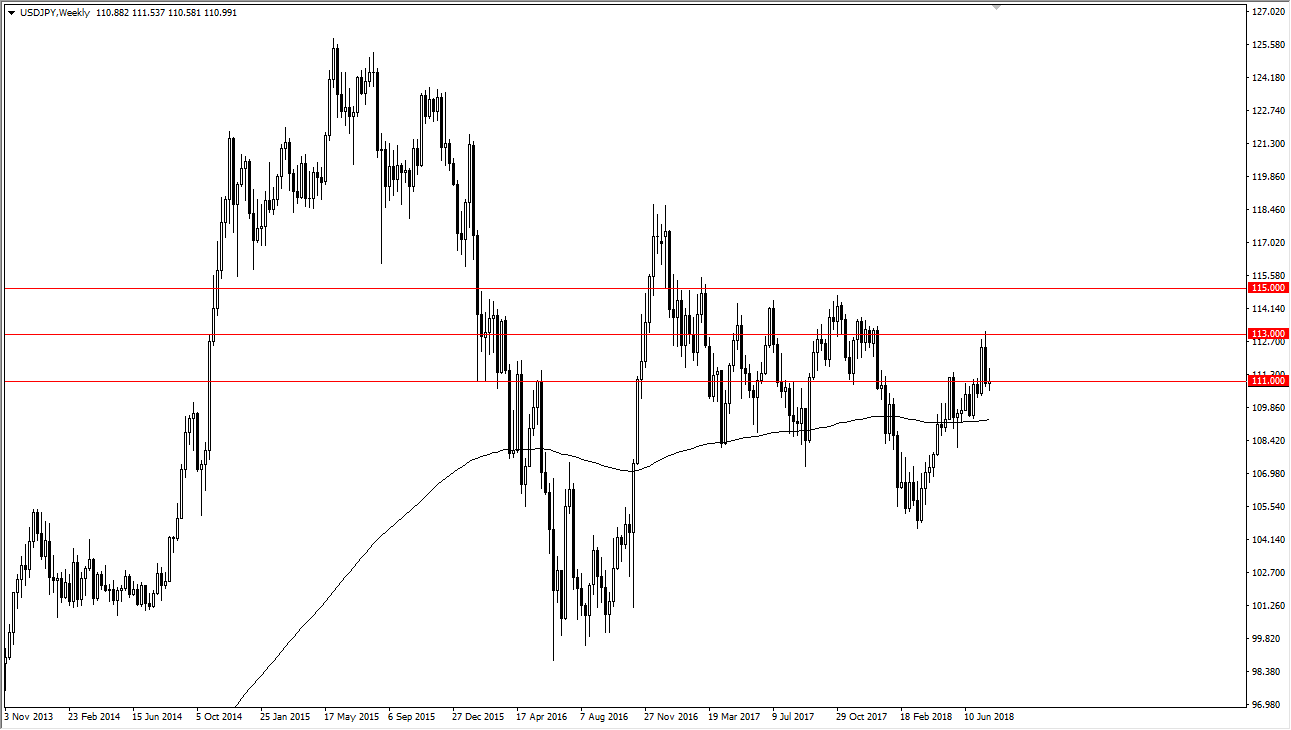

The US dollar has been very noisy against the Japanese yen over the course of the month for July, which makes a lot of sense as we continue to see a lot of noise when it comes to trade wars and currencies in general. Tariffs being levied against China and the US will affect global trade in a drastic manner, and that of course will affect this pair just like anything else. We had been rallying quite nicely but hit a bit of a “brick wall” at the ¥113 level. We pulled back from there, and the ¥111 level ended up being rather supportive. When I look at this chart, I think we are trying to rally from here, but I suspect that we will see a bit of weakness in the beginning part of the month at the very least.

One of the reasons that I say this is that the US dollar in general looks to be softening. I see support for the Euro, Pound, and the Australian dollar just below current levels, all against the US dollar. Because of this, the market is likely to reflect dollar weakness over here as well. I see a tremendous amount of supply above the ¥113 level, and I think it’s very likely that the level will continue to offer plenty of selling pressure.

This is a market that of course is sensitive to interest rate differential, which does favor the US dollar. However, I think we need to pull back a bit to try to find some type of value in the market to have traders come back in and start buying. There is a lot of noise just below though, so I think what we are looking at is choppiness underneath that could eventually lift this market, but I think in the short term we may see some selling.