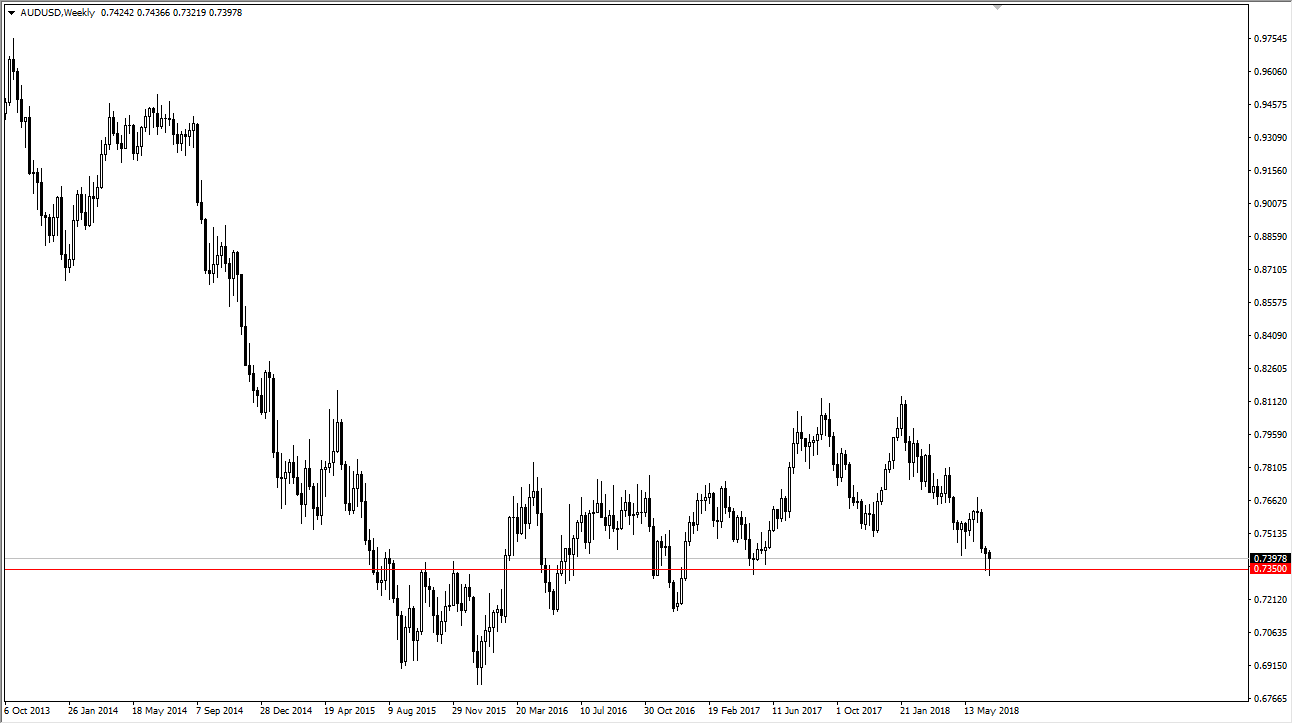

AUD/USD

The Australian dollar spent most of the week falling, but on Thursday and Friday we started to get signs of life again. The weekly chart has formed a candle again, which of course is a very bullish sign. I think that the market could very well find itself bouncing during the week, as the 0.7350 level has offered significant support yet again.

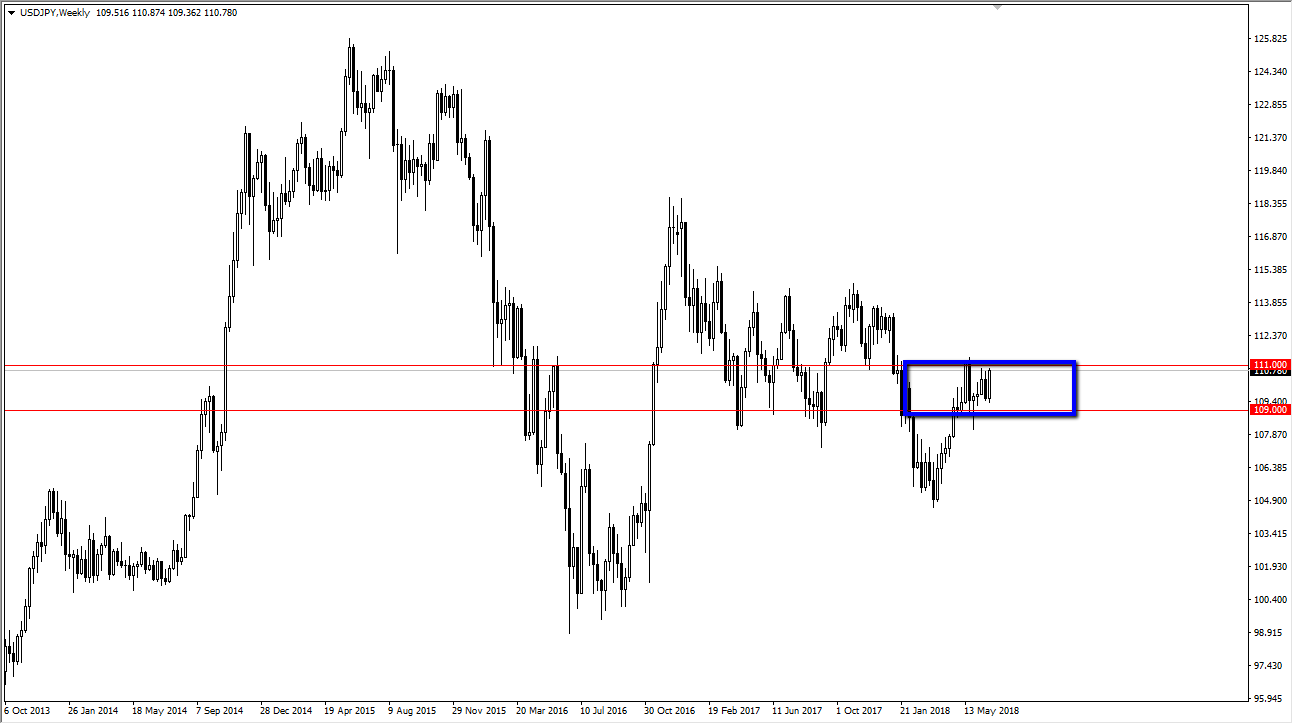

USD/JPY

The US dollar has been very noisy against the Japanese yen overall, but we continue to be consolidation bound, between the ¥109 level on the bottom, and the ¥111 level on the top. I think that the market continues to go back and forth more than anything else, and I don’t have any interest in trying to second-guess where we are going now. I assume that we are going to stay within these two levels until we can break above the ¥111 level on a daily close. If that happens, then I’m willing to aim for the ¥112.50 level next.

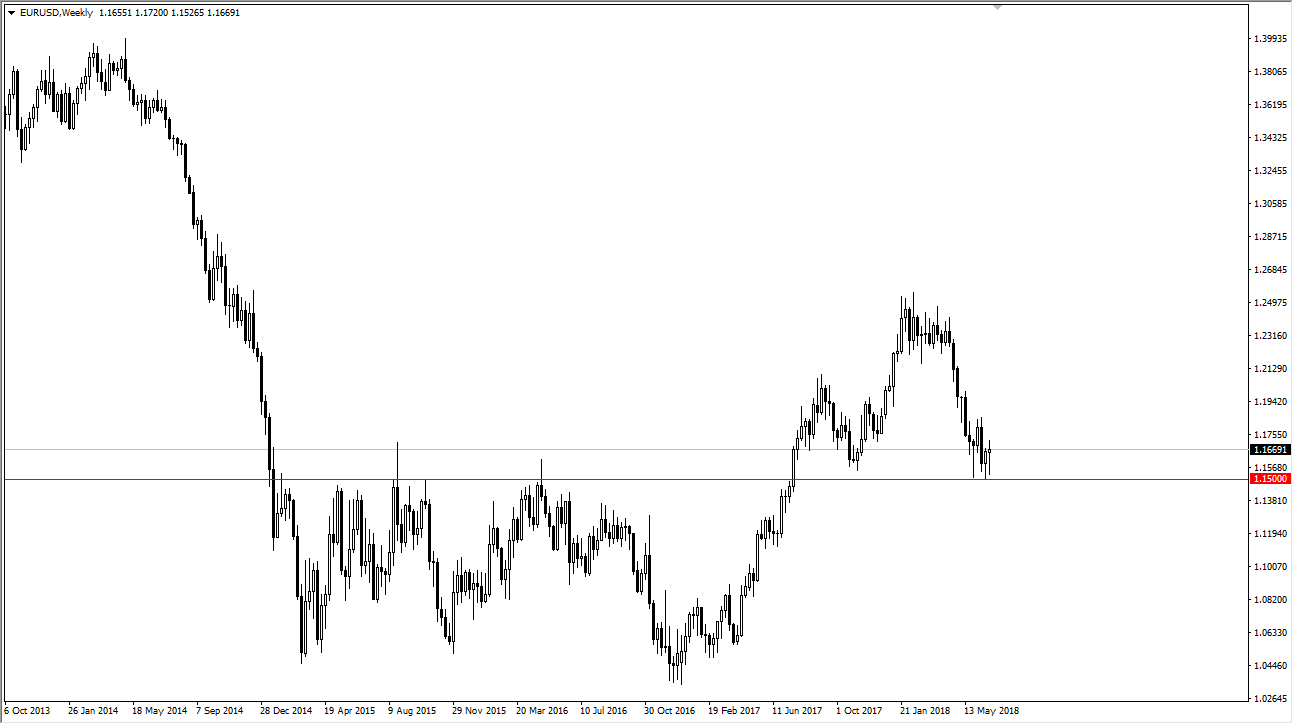

EUR/USD

The Euro fell during most of the week but got a reprieve on Friday as it was announced that European leaders had come to a basic framework for migration. While the details are thin, this shows just how important the situation was for the market. The 1.15 level has offered support again, so I think that every time we dip, if we can stay above that level value hunters will return to take advantage of the 1.15 level as massive support.

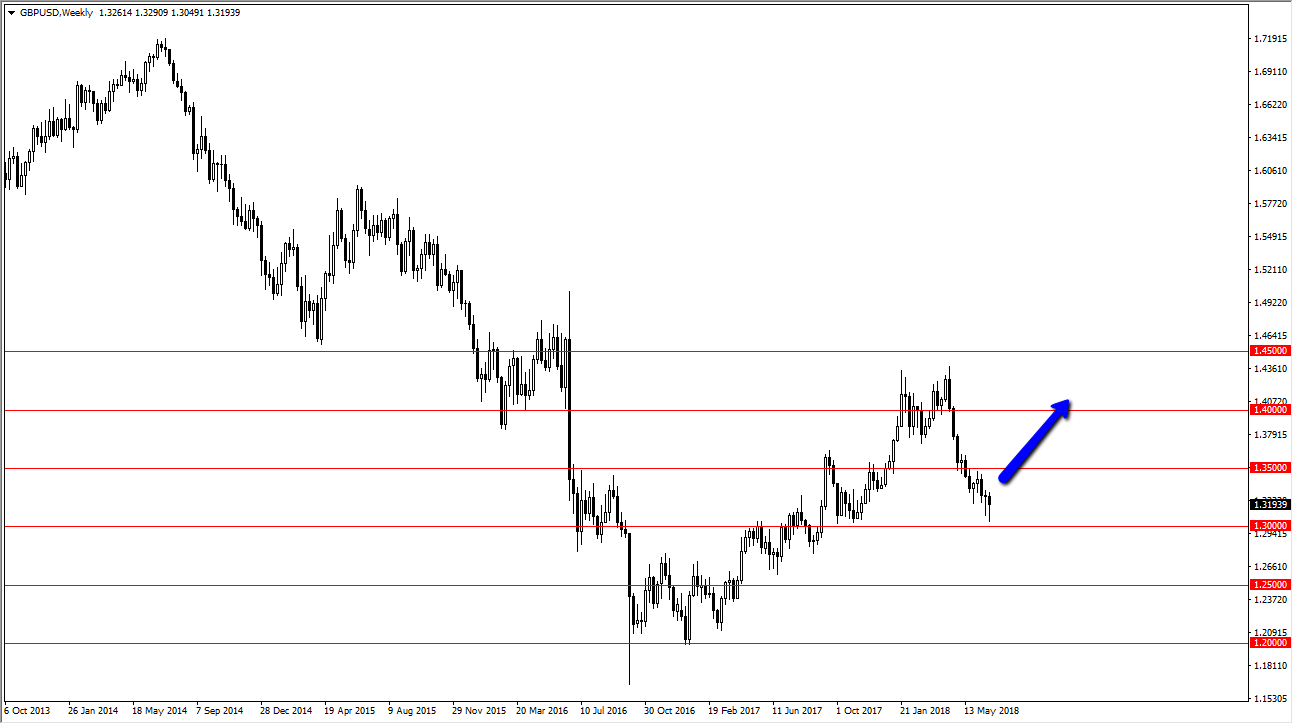

GBP/USD

The British pound has been negative during most of the week as well, but just like the Euro, but found a reprieve at the end of the weekend ended up forming a hammer. The hammer of course is a very bullish sign and I think that at this point we will probably see buyers of dips in this market but I would anticipate a lot of choppiness this week.