Gold ended the week down $14.98 at $1241.05 an ounce as the risk-on investing attitudes in the world marketplace continued to support buying interest in other conventional assets. U.S. stocks recovered from earlier losses and posted weekly gains, driven by strong corporate earnings expectations. Markets increased their expectations for a fourth interest rate hike this year after Federal Reserve Chairman Jerome Powell said a strong economy will allow the central bank to keep raising interest rates gradually. Gold once again opted to trade in line with the raw commodity sector. Markets will keep a close eye on Powell’s congressional testimony this week.

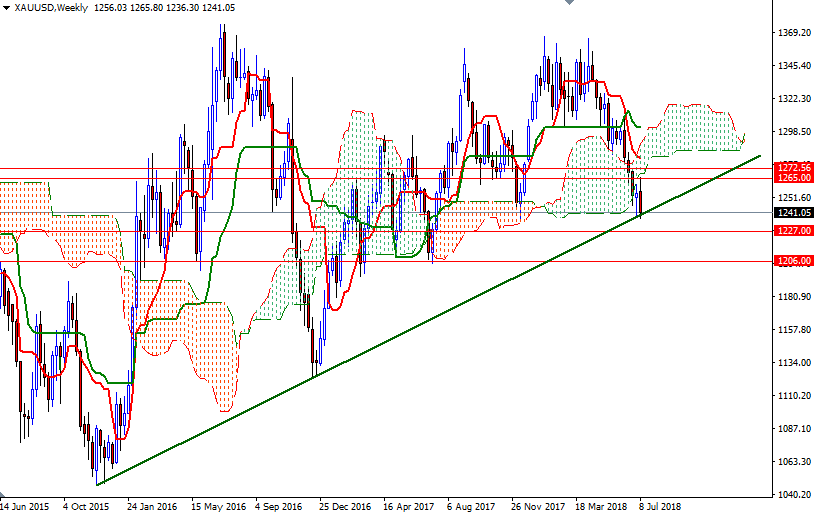

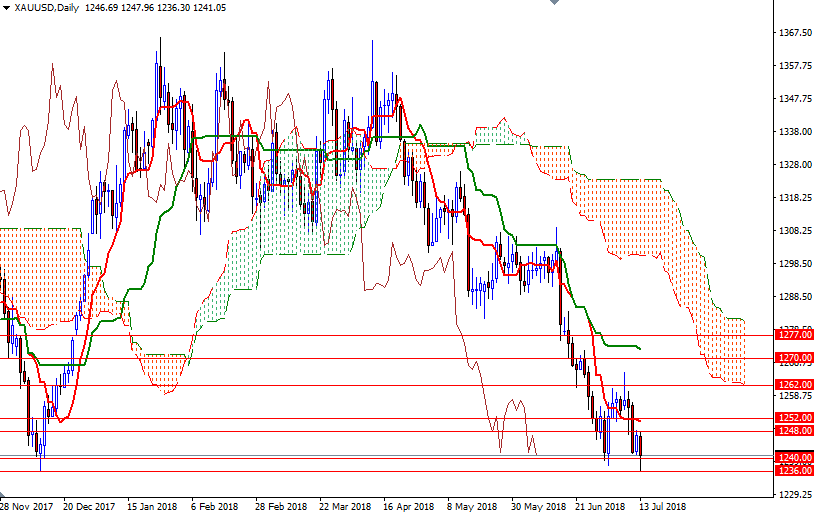

XAU/USD headed higher earlier in the week but the selling pressure increased after the market failed to sustain a push above the 1265 level. The bears have the overall technical advantage, with the market trading below the Ichimoku clouds on the weekly and the daily charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts, and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. The key technical support in the 1240/36 area held last week but it will be in danger as long as prices remain below the 1272.60-1270 zone.

If this support is broken, XAU/USD will probably test 1230 next. Further weakness below 1230 could encourage a selloff lower towards 1206/2. On its way down, expect to see some support at 1225 and again in 1218/15. The bulls, on the other hand, have to lift prices above 1248 so that they can challenge 1252 or even 1258/6. A daily close above 1258 is essential for a move up to 1265/2. If the bulls successfully penetrate this barrier, it is likely that the aforementioned resistance in the 1272.60-1270 area will be the next target.