Gold prices rose 0.64% on Friday, posting the first gain in six sessions, and settled at $1231.49 an ounce as the dollar fell after President Donald Trump said he’s not thrilled by recent interest rate hikes by the Federal Reserve and objected to a strong dollar. Despite Friday’s gains, gold prices ended the week with a loss of 0.75%. XAU/USD had dropped to a one-year low following comments from Fed Chairman Jerome Powell that the economy was strong and the Fed would keep raising rates. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 57841 contracts, from 81434 a week earlier.

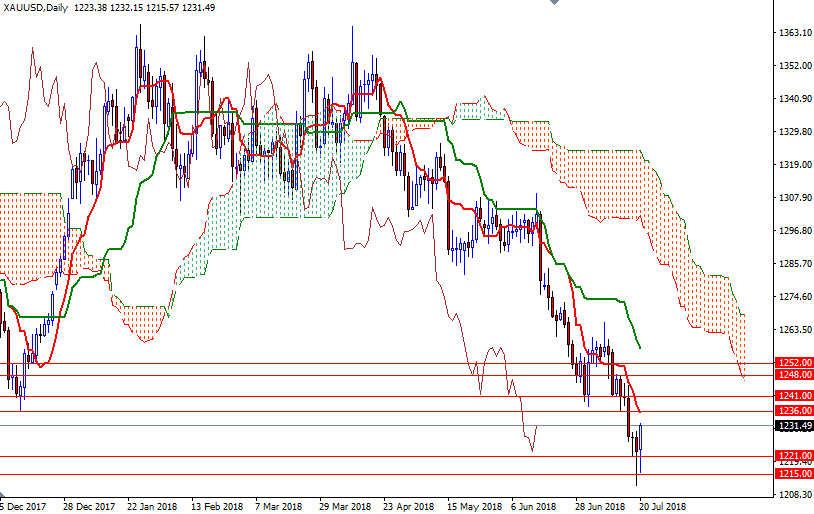

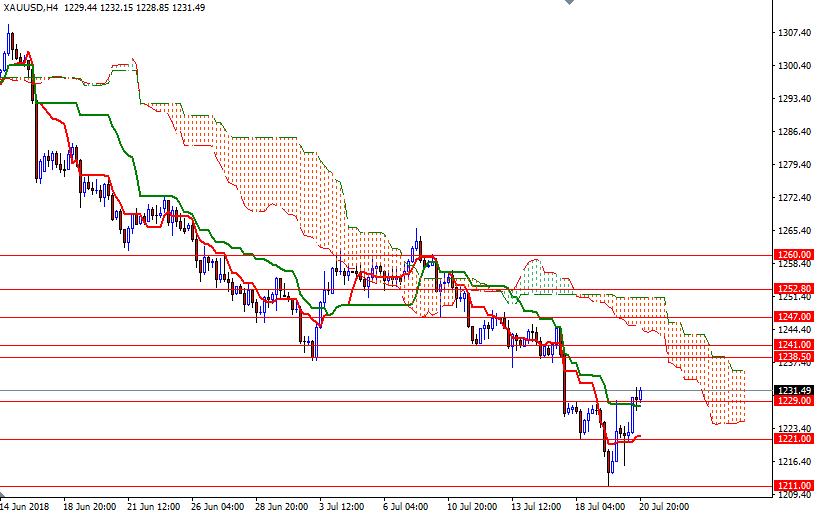

From a chart perspective, the bears have the overall technical advantage. XAU/USD is trading below the Ichimoku clouds on the weekly and the daily charts, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. However, as I pointed out on Friday, the market was short-term oversold and due for a corrective bounce.

If the bulls can continue to hold prices above the 1225 level, it is likely that the market will grind higher towards the 4-hourly cloud. In that case, XAU/USD could test 1236 and 1241-1238.50. The bulls have to produce a daily close above 1241 to march towards 1248/7. A break through there brings in 1252.80-1252. Beyond there, the 1263/0 area, where the weekly Tenkan-Sen sits, stands out as a strategic resistance. To the downside, the initial support comes in around 1225 and that is followed by 1221. The bears have to push prices below 1221 to revisit 1215. Down below there, we have a key technical support in the 1211/09 area. If this support is broken, look further downside with 1206/2 and 1199 as targets.