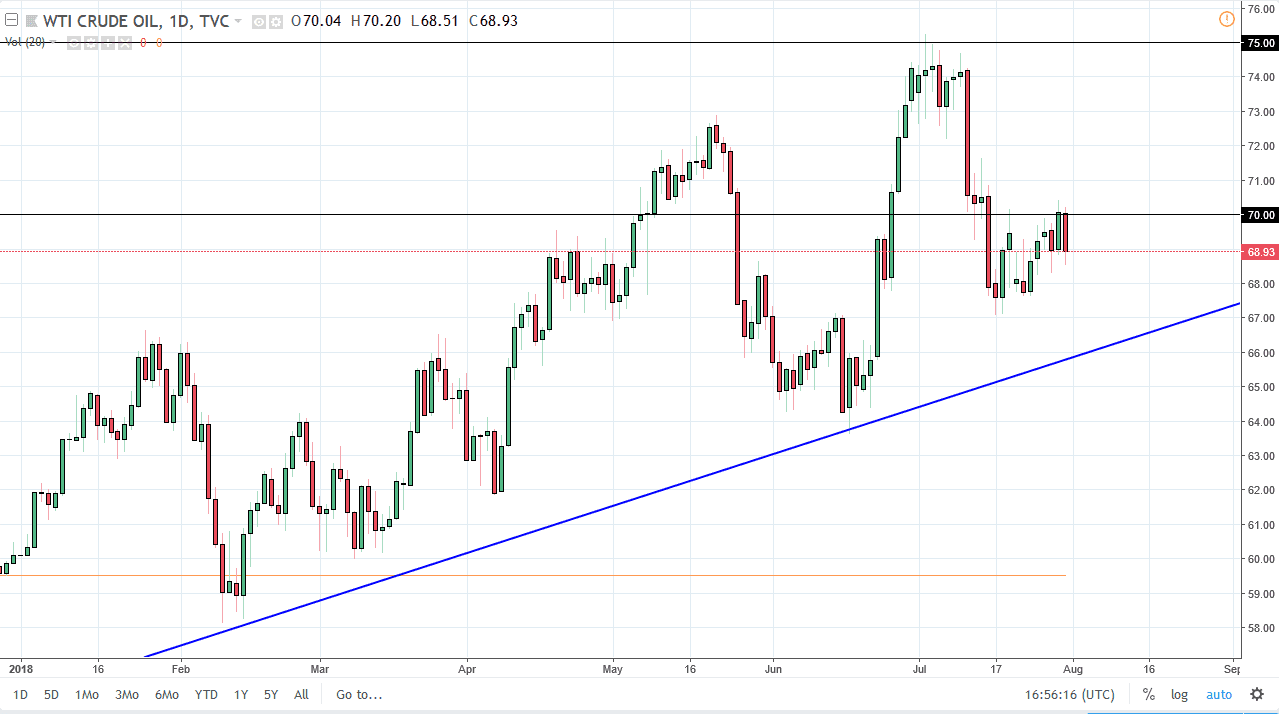

WTI Crude Oil

The WTI Crude Oil market fell hard during the trading session on Tuesday, as the $70 level has caused a significant amount of bearish pressure. The market has seen a lot of selling pressure just above that extends to the $71 level, so I think it is difficult for this market to rally at this point. However, I see a lot of support just below, so I think that the market will simply go back and forth in general, causing a lot of volatility to say the least. I think that the market will continue to be a short-term traders type of situation. The uptrend line underneath continues offer a significant amount of support, but again, I believe that the area just above is going to be very difficult to break above. Pay attention to the US dollar, it can also have a massive influence.

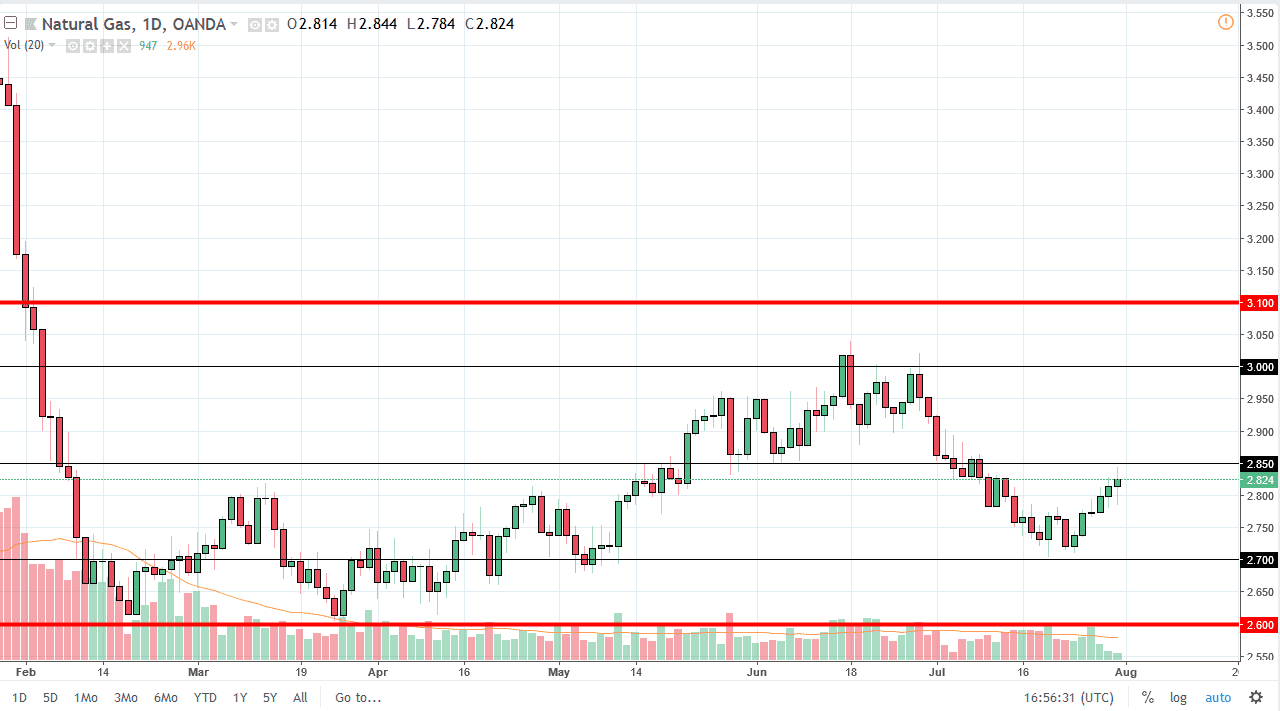

Natural Gas

The Natural Gas market has gone back and forth during the trading session on Tuesday, as we tried to break above the $2.85 level. We are getting close to that level again, and I think that will cause a certain amount of short-term resistance. It is the middle point of the overall consolidation area that I think has inner edges that the $2.70 level, and the $3.00 level. In general, the market should continue to be very noisy, but I think that if you take trades based upon the outer edges of the inner consolidation, you should continue to do fairly well. This is a market that continues to be very volatile, but I also recognize that we have bounced from a significant support level. I think short-term pullbacks should be buying opportunities if you have the ability to ride out the volatility.