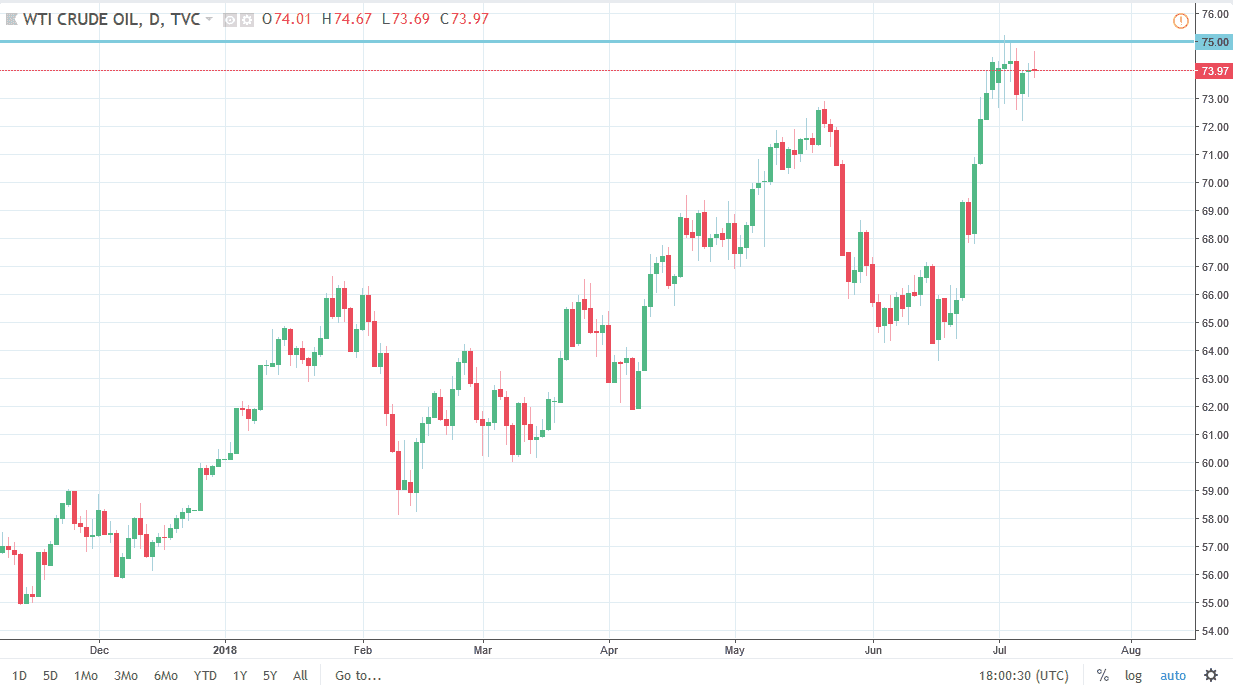

WTI Crude Oil

The WTI Crude Oil market initially rallied during the day on Tuesday but continues to find plenty of selling orders at the $75 level. That’s a level that is massively resistive, so if we can break above the $75 handle, then I think the market continues to go much higher. Otherwise, we will bounce around in this general vicinity, using the $72 level as massive support. I believe that the market should continue to go higher, but it’s likely that the market will need to build up enough momentum to do so. I think that pullbacks will be looked at as opportunity the people will be willing to take advantage of. With problems in Iran, Venezuela, and Libya. If the US dollar starts to fall, that could also push this market higher. Right now though, I think we are consolidating more than anything else, trying to build up bullish pressure.

Natural Gas

Natural gas markets collapsed during the trading session on Tuesday, slicing through the $2.80 level. Now that we are below this level, and the fact that we are closing out the futures day at the very bottom of the range, tells me that we will continue to see selling pressure. I believe that rallies are going to continue to offer opportunities to short this market, as we have seen such exhaustion near the $2.90 level. I believe that we now are going down to the $2.70 level next, an area that has been supportive. Overall, this is a market that should continue to be negative, and perhaps reach down to the $2.60 level after that which has been the bottom of the longer-term consolidation that we have seen. It looks like oversupply is finally causing selling again.