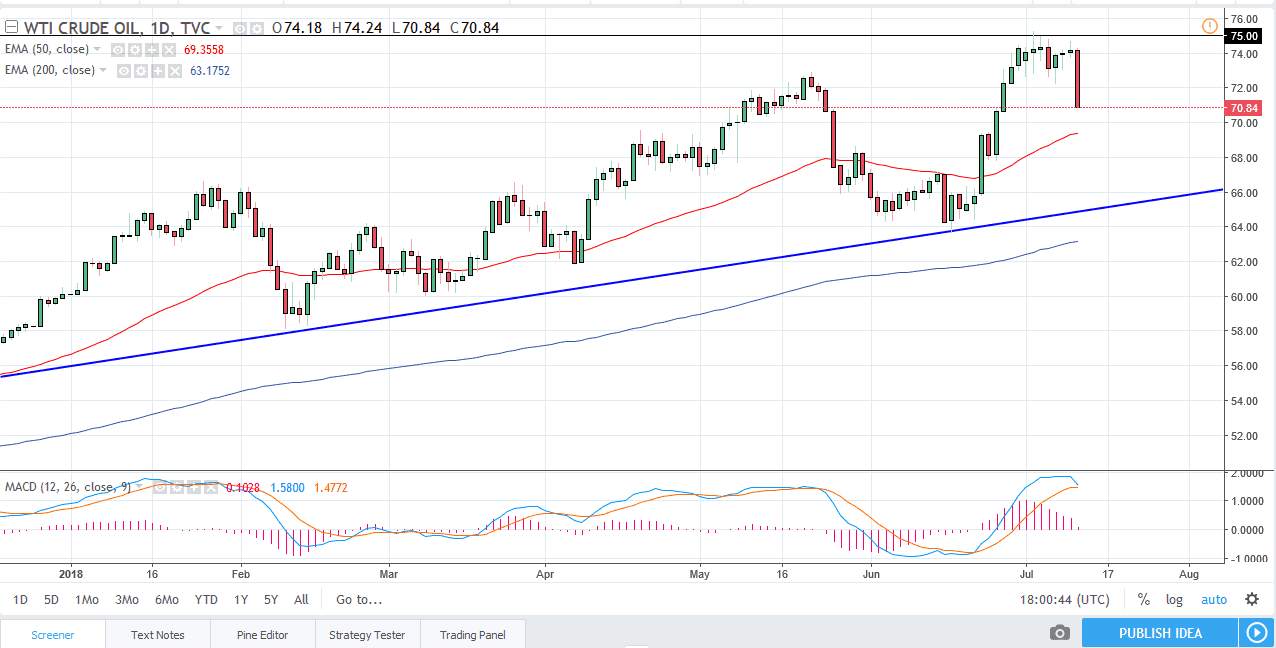

WTI Crude Oil

The WTI Crude Oil market has fallen drastically during the trading session on Wednesday, losing 4.5% as I record this. The market looks very vulnerable, as Libya has re-opened its oil ports. Because of this, more supply is coming online and that of course will drive down price. I believe that the markets are also starting to look at the fact that oil markets have spiked more than 13% over the last 10 days and have simply gotten far too ahead of themselves. With this in mind, I anticipate further weakness, and I certainly see the $75 level as a major resistance barrier currently. If we were to break above the $75 level, that would change everything and eventually send this market much higher. However, in the meantime I think we are going to see a couple of days’ worth of weakness, perhaps down to the $68 level.

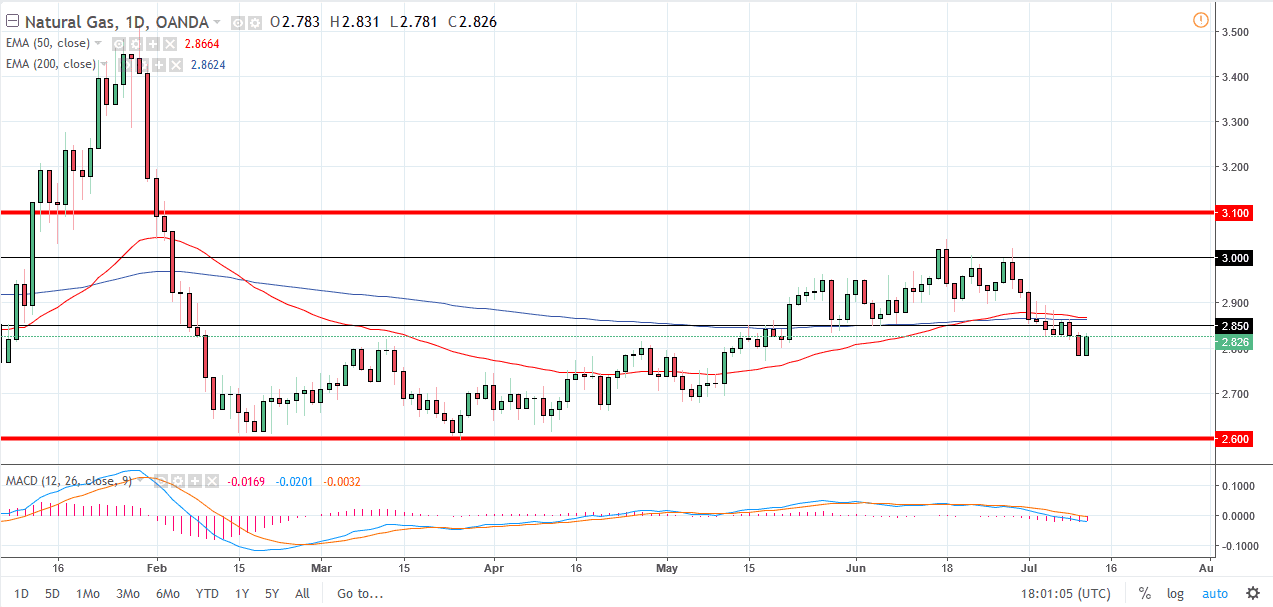

Natural Gas

Natural gas markets rose during the trading session on Wednesday, reaching towards the $2.82 level. The market is likely to see a lot of noise just above, especially near the $2.85 level, an area where I think there is plenty of supply in the futures market. With that being the case, I’m looking for a short-term bounce that I can sell. I would probably look to something along the lines of the 15 minute chart or even the hour time frame, and short the first signs of trouble. If we do break out to the upside, I think that the $2.90 level is even more resistive based upon previous price action from last week. I have no interest in buying this market as it certainly looks as if it is ready to roll over again.