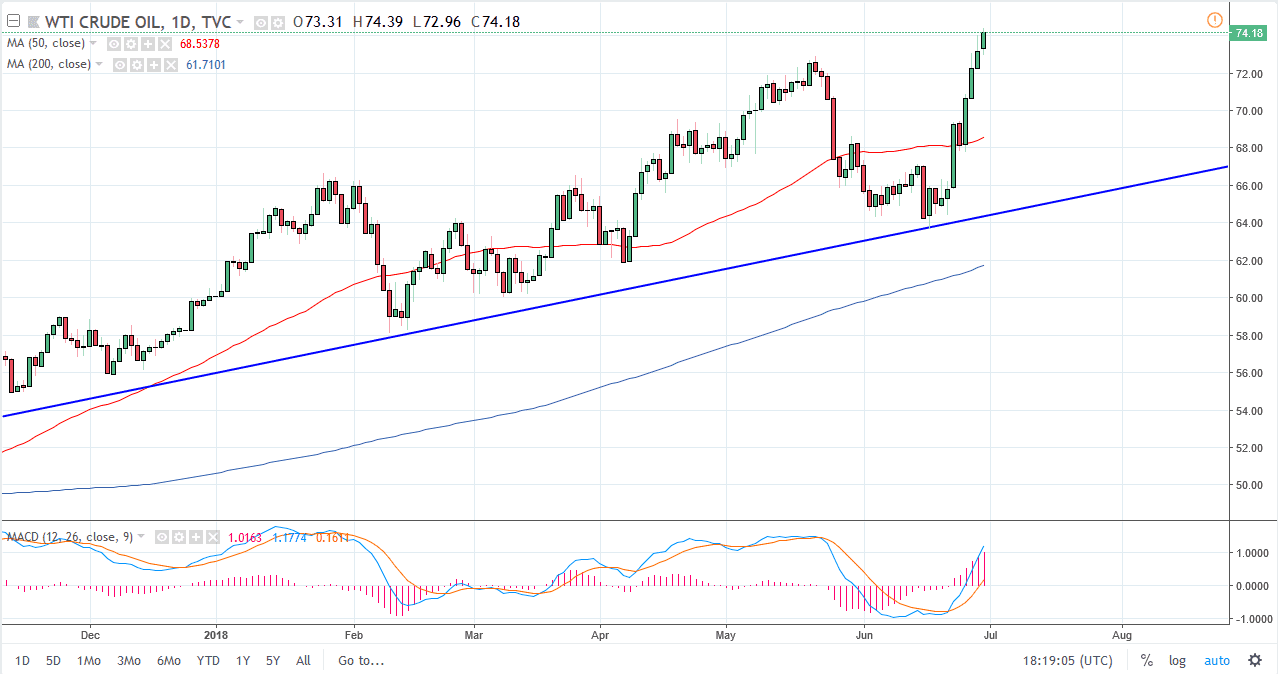

WTI Crude Oil

The WTI Crude Oil market rallied again on Friday, reaching towards the $74.25 level. We have made a fresh, new high, and I don’t see much to keep us from reaching towards the $75 level above. However, we are overbought by just about any measure you can use, so I think a pullback is not only likely, but it’s necessary at this point. If you are not long of this market already, then I would stand on the sidelines and wait for the market to pullback significantly, perhaps forming some type of supportive candle on the daily chart. If you are already long of the WTI Crude Oil market, and then perhaps you could move your stop loss up to just below the $72 level, as breaking down below that level would show significant resistance, yet I would not be a seller at that point, I would simply wait to buy again.

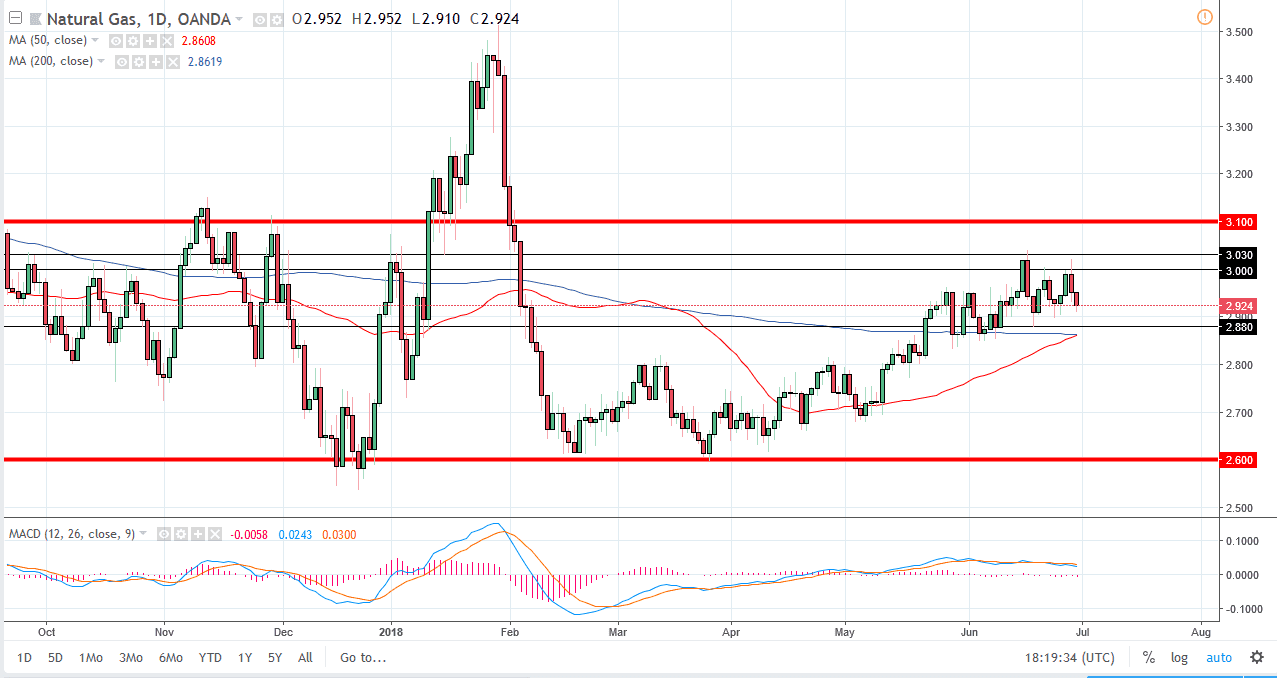

Natural Gas

Natural gas markets fell during the trading session losing 1% during the day, breaking towards the $2.90 level. There is a significant amount of support on the short-term charts down to the $2.88 level, so I think that short-term rallies are selling opportunities, and I think they will be necessary to build up the momentum to break down below that $2.88 handle. I think that the $3.00 level above will continue to be massively resistive, extending to at least the $3.03 level, if not the $3.10 level as it has been so much in the way of resistance lately that it’s almost impossible to imagine a situation where we break above it. Beyond that, I believe that longer-term fundamental still favor lower natural gas prices.