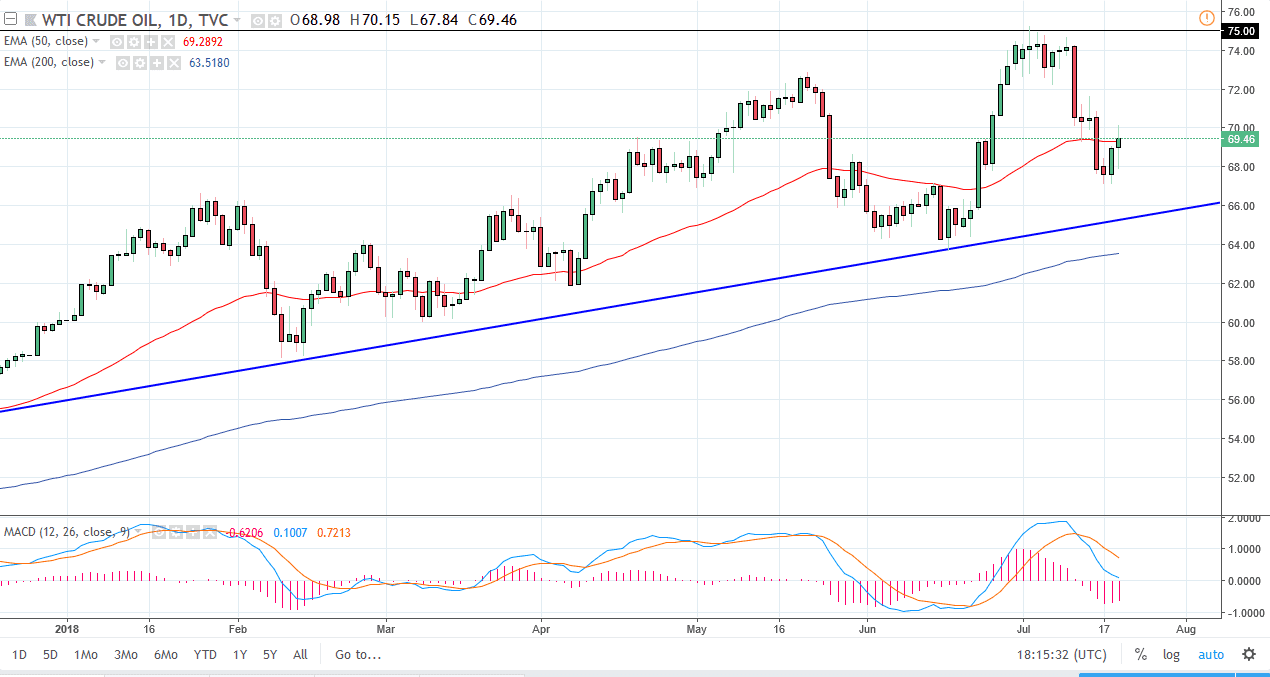

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Thursday, reaching towards the $70 level, an area that has seen a lot of sellers jump in. Now that we have formed a relatively neutral candle, I think we will continue to see somewhat bearish action in this area. That being said, there is a massive amount of support underneath near the $66 level and of course the $65 level, which is the uptrend line just waiting to pick things up. It wouldn’t surprise me to see a little bit of a bounce, but this bounce coming should probably be a selling opportunity as well. I would consider shorting this market on short-term charts, selling the first signs of exhaustion that I see you.

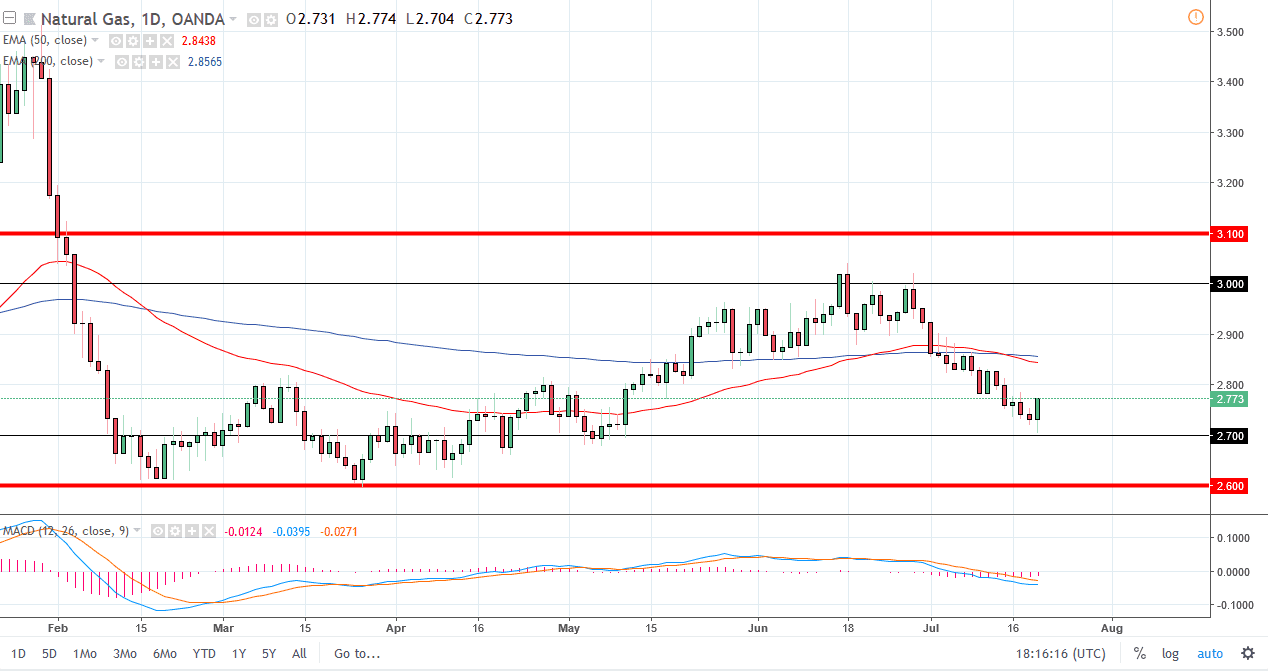

Natural Gas

Natural gas markets broke down a bit during the trading session on Thursday, reaching towards the $2.70 level before rallying quite impressively. Because of the strength of the candle for the day, I believe that we will probably continue to go higher, but I'm looking to short this market somewhere near the $2.85 level. If we can’t get there, then it would make sense to see selling pressure at the $2.80 level instead. I believe that the market is still attracted to the $2.60 level, but we are getting towards the lower part of the longer-term consolidation, so it makes sense that we may get some value hunting in this general level. If we were to break down below the $2.60 level, that would be catastrophic for natural gas, but it is not something I expect to see anytime soon. I believe that any bounce from here needs to look for exhaustion to start taking advantage of shorting again.