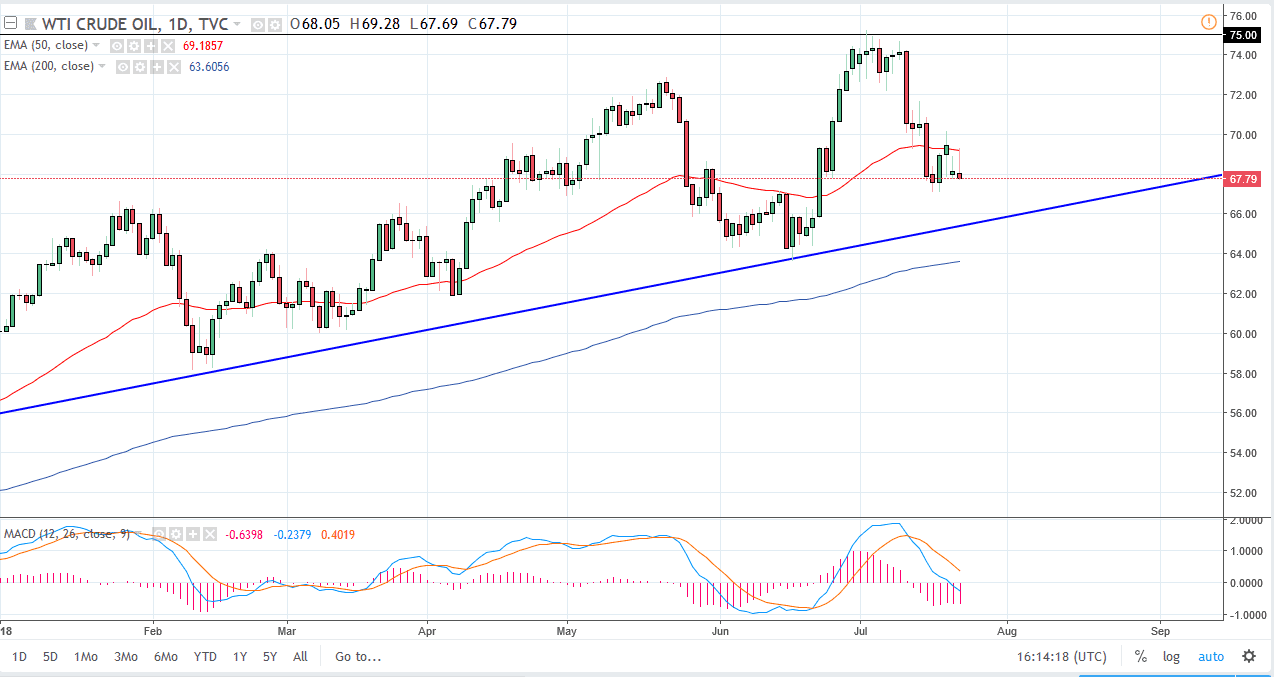

WTI Crude Oil

The WTI Crude Oil market rallied to fill the gap from Friday during the Monday session, but then turned around to form a shooting star. The 50 EMA has offered resistance, and I think that the market will more than likely go looking towards the uptrend line underneath, which means that we should visit the $66 level eventually. If we break down below that uptrend line, then the market will test the 200 day EMA after that. In the short term, I certainly think there is a negative pressure, but I think that value hunters will enter the market relatively soon. If we were to break down below the 200 day exponential moving average, and of course the $64 level, then I think the market breaks down rather rapidly. Pay attention to the US dollar, if the greenback rallies in strength, that could push this market lower.

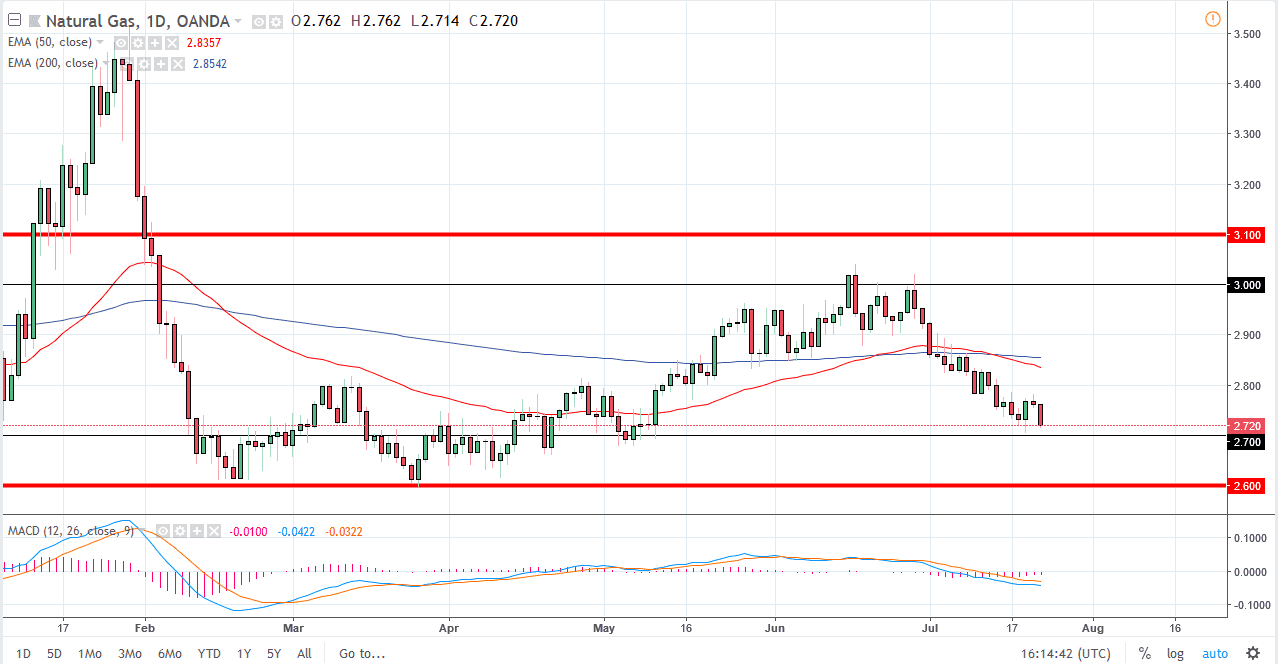

Natural Gas

Natural gas markets broke down significantly during the trading session on Monday, reaching down towards the $2.72 level as I record this. I believe that the $2.70 level is of course supportive due to the psychological support, but the significant bounce that we had seen from that level has all but been wiped out from last week, and I think it’s only a matter time before we break down below the $2.70 level. Once we do, I believe that the market goes lower, perhaps reaching down to the $2.65 level, and then the $2.60 level. Rallies are to be sold, and the first signs of exhaustion will have me jumping into the market to punish them. I do not think that we will break down below the $2.60 level though, it has been far too important over the longer-term.