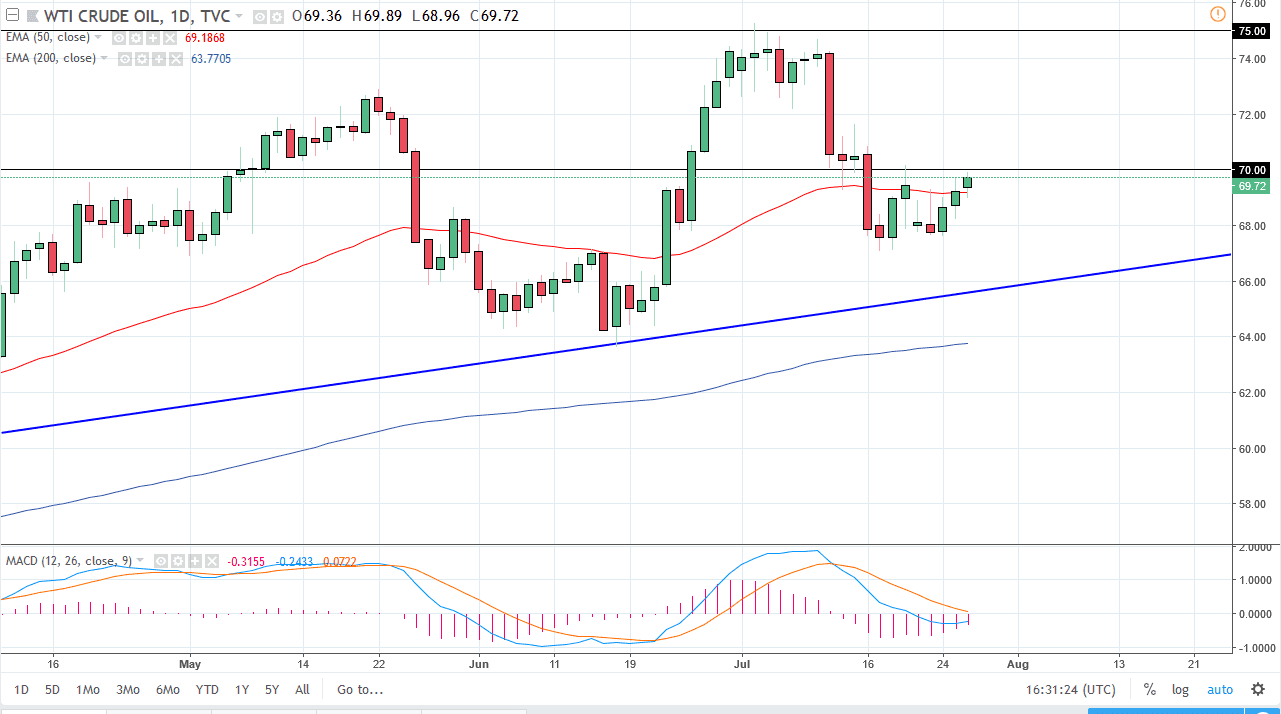

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Thursday, testing the $70 level. However, there is a certain amount of psychological significance attached to this level, and of course we have seen the massive selling at the $70 level recently. Because of this, I would not be surprised to see this market roll over from here, perhaps reaching down to the $68 level. I see a significant amount of resistance extending towards the $72 level, so at this point I’m a bit leery to start buying. If we break above $72, then I think there’s even more resistance just below the $75 level. At this point, I think rallies are to be sold, as the selloff has been so brutal as of late. Technically though, we are still in an uptrend and that is part of what causes all of the noise.

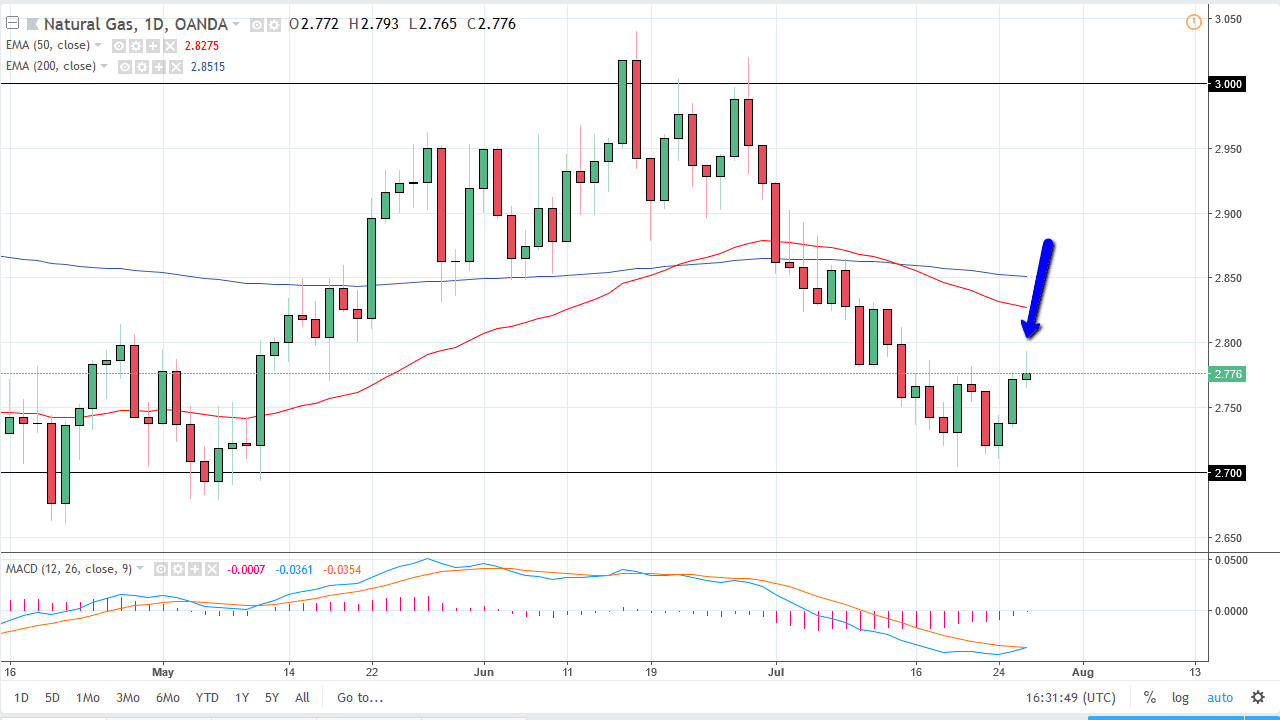

Natural Gas

Natural gas markets initially tried to rally during the trading session on Thursday but found the $2.79 level to be far too expensive to continue going higher. Towards the end of the day, we have formed a shooting star and it suggests that natural gas markets are ready to go lower again. If that’s the case, I anticipate a return to the $2.75 level, and then eventually the $2.70 level. There is significant support at the $2.70 level, so I don’t think it will be easy to break down below there, but if we did could unwind down to the $2.60 level which is the absolute bottom of the overall consolidation. I anticipate that we will probably consolidate in this general vicinity, between $2.70 and $2.80 over the next couple of days, and with the shooting star it suggests that we are going to see the market roll over just a bit.