The WTI Crude Oil

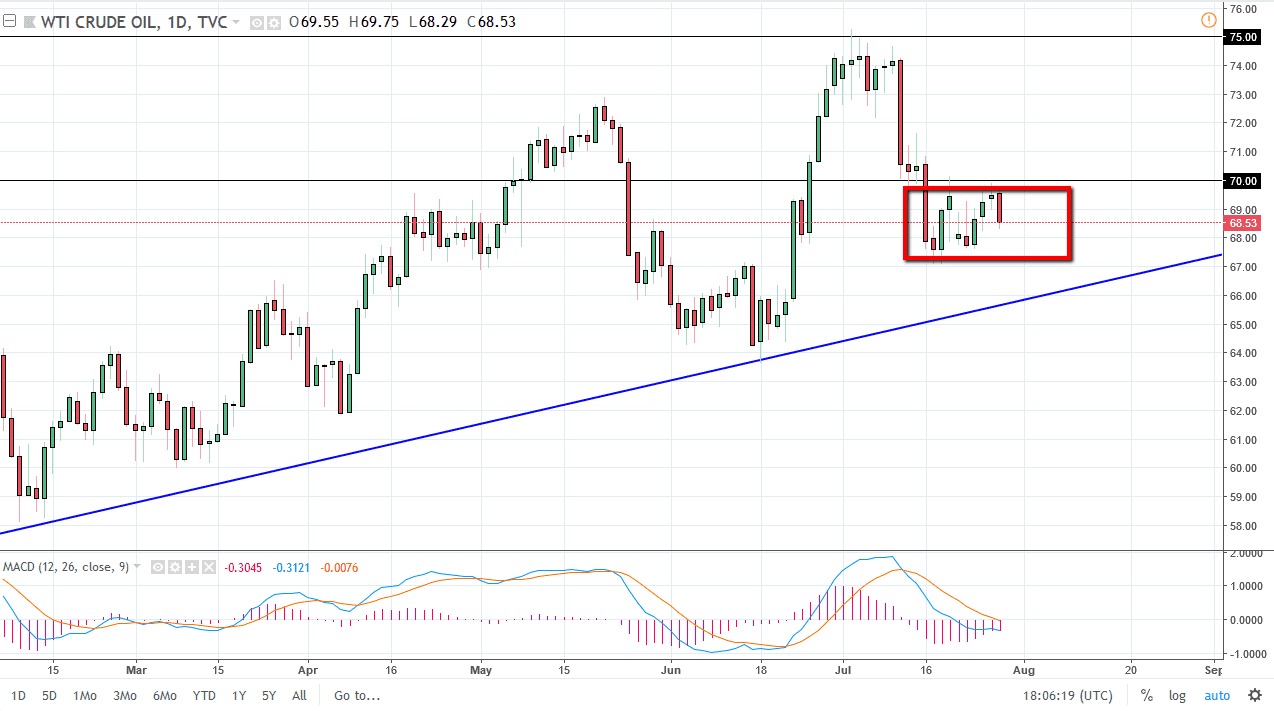

The WTI Crude Oil market fell a bit during the trading session on Friday, as we continue to grind back and forth in a relatively tight consolidating rectangle. The $70 level above continues offer resistance, and as I had suggested previously, the sellers reappeared near the $70 handle. Looking at this chart, there is obviously a significant amount of supply just above the $70 level. I do see some support underneath, especially at the uptrend line. At this point though, I think the support is going to prove to be very stringent, because of geopolitical issues with Iran, and of course I believe that the US dollar may soften based upon longer-term charts against such currencies as the Euro, the Australian dollar, and the British pound. That being said, I believe it’s going to be very noisy, so short-term traders will more than likely love this market.

Natural Gas

Natural gas markets shot higher during the trading session on Friday, mainly because of the strong GDP coming out of the United States from what I can tell. I believe that the market is continuing the overall consolidation that we had seen with the $2.70 level underneath being the “floor” in the market while the $3.00 level above is the “ceiling.” By breaking the top of the shooting star from the previous session, Freddie shows that the buyers are back. I think this market continues to bounce around between these two major areas, so I think there is probably more danger to the upside then down now that we have cleared the $2.80 level. That being said, I think this is a short-term opportunity, perhaps over the next couple of weeks.