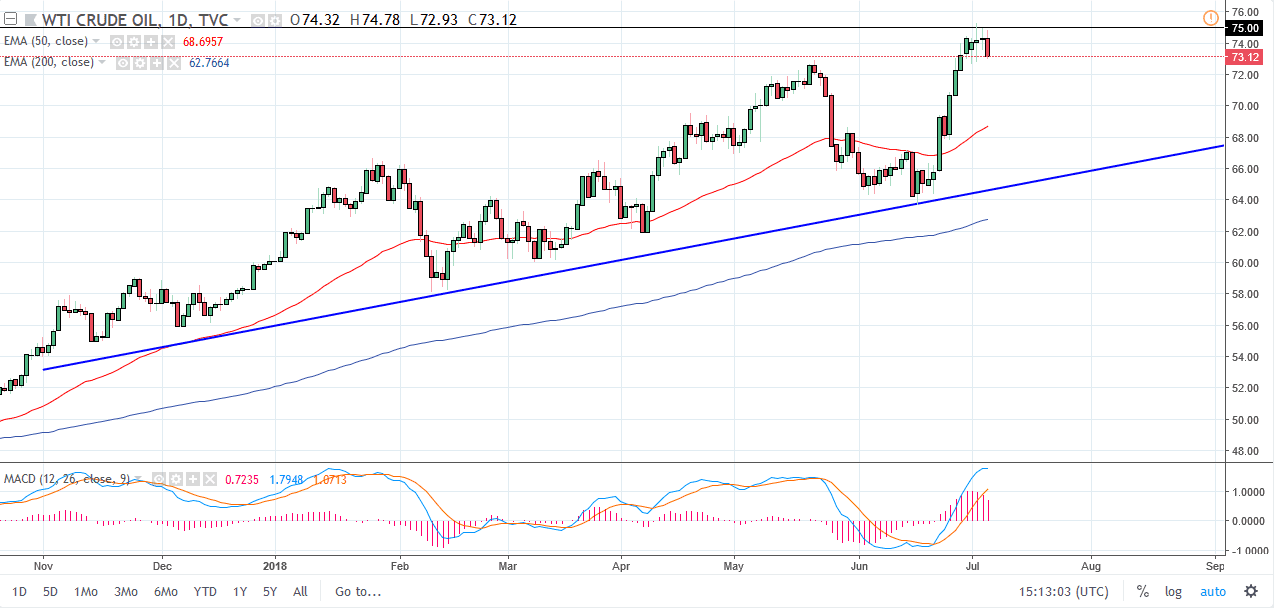

WTI Crude Oil

The WTI Crude Oil market has been very noisy in general, initially trying to break the $75 level above which of course is psychologically important. Overall, I think that the market is essentially waiting for the jobs number to make a significant move though, so it makes sense that we would continue to be cautious at this point. A pullback from that level could offer a nice buying opportunity, and I certainly think that the $72.50 level, the $70 level, in the 50 EMA, pictured in red on the chart, all offer potential buying opportunities. The alternate scenario of course is that we simply turn around to break through the $75 level, which would also have me buying this market. I think we are a bit overbought at this point, but it certainly wouldn’t be a seller.

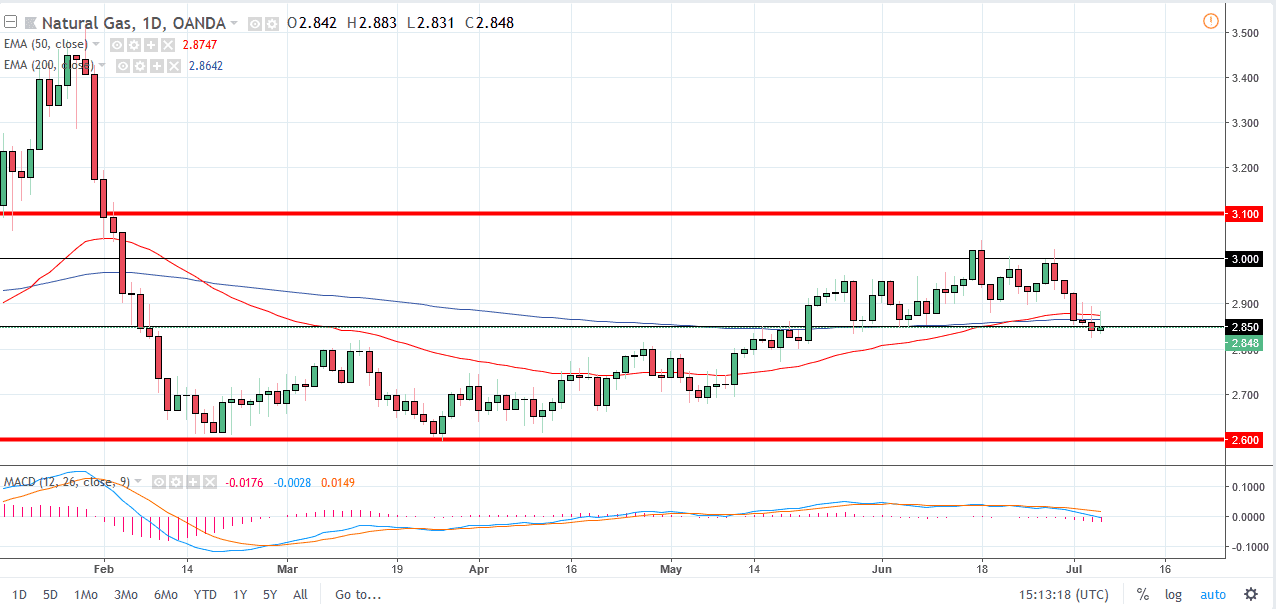

Natural Gas

Natural gas markets try to rally during the day but found enough resistance at the 50 day EMA to turn things around of form yet another shooting star. The market looks like it is trying to break down from here, and I think that once we cleared the immediate area we will go to the $2.80 level, the $2.70 level, and then possibly even the $2.60 level. The alternate scenario is that we turn around to break above the $2.90 level which would be a significant show strength and could possibly send this market looking for the $3.00 level above, which would of course be a very bullish sign. At this point though, I think cooling temperatures in the United States will continue to drive down demand, and of course a historically strong US dollar should continue to put bearish pressure on commodities in general.