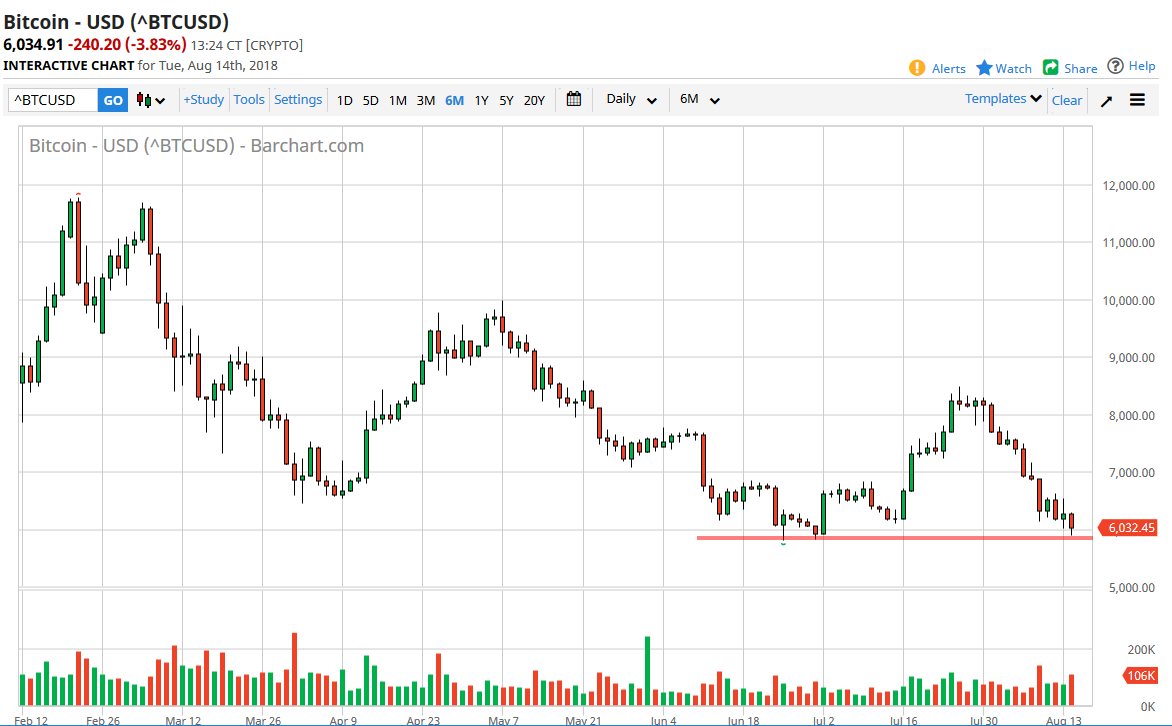

BTC/USD

Bitcoin markets broke down again during trading on Tuesday, piercing the $6000 level but finding a little bit of support in that area on the short-term charts. The market has been bearish for quite some time, and I have reiterated almost daily that you should be selling, not buying. I still maintain that the $6000 level is crucial, and if and when we break down below it from a daily close, I suspect that the $5000 level would be the next target. There is a long-term downtrend line that is now well below the $8000 level, so I think at this point it’s likely that rallies will continue to find plenty of selling pressure.

Beyond that, the US dollar has been strong for some time now, as several different currencies have fallen against them. This is mainly due to a slowdown in the global economy, and beyond that we have several geopolitical issues. There are serious problems with debt in China, and unlike the last run up in the Bitcoin market, the Chinese are not using Bitcoin to send money out of the country now.

Ultimately, the market looks likely to offer plenty of selling opportunities, and quite frankly one of the biggest arguments I’m starting here again is that Bitcoin can’t go much lower, because of the cost of mining. Those who trade Ethereum know better than that, as its price is well below the viable cost of mining coins now. Ultimately, the Bitcoin market continues to crumble and I don’t think that there is a catalyst coming to turn things around. If we break down below the $5000 level, then the market probably goes much lower. In general, it’s not until we break the $8000 level that I could envision buying this market, or we would need some type of longer-term supportive candle on something like the monthly chart.