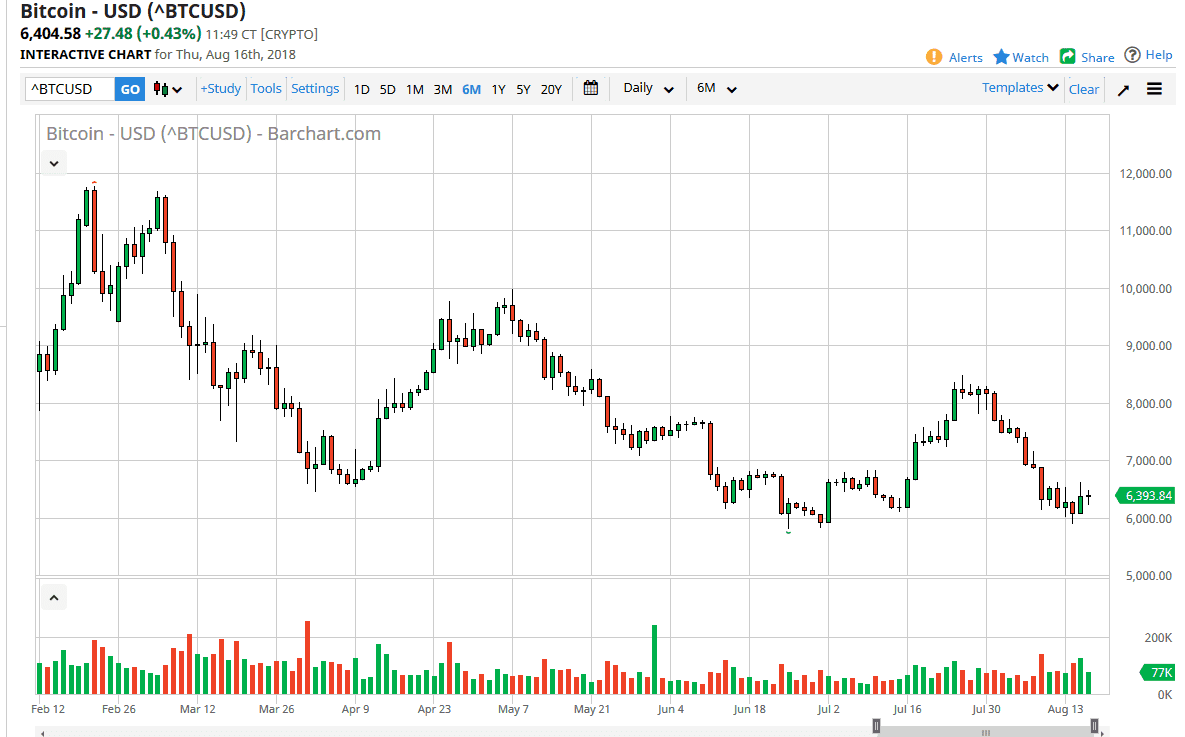

BTC/USD

Bitcoin was relatively quiet during the trading session on Thursday, which isn’t much of a surprise considering that the markets had been so noisy over the last couple of days. I think everybody needed to reset and take a breath. Looking at this chart, it still looks bearish to me, but we could get a little bit of continuation to the upside. For the short term trader, we need to break above the $6500 level to continue going higher. The natural target from there would be $7000, followed by a $7500. At this point, I believe that the $6000 level is going to continue to offer a major support barrier, and that may keep the market somewhat afloat. With that in mind, I recognize that the level could be played from the short-term charts for slight bounces, but what I fear is that playing that game is becoming more dangerous as we keep testing that area. Sooner or later, something will have to give.

For the longer-term trader, you’re going to have issues in this market unless you can buy bitcoin and simply ignore it. Most people don’t have that type of mentality, so you may find this a bit difficult. In general, I believe that we will continue to see a lot of choppy trading as people try to figure out what exactly Bitcoin is. It’s been a store of value, it’s been gold 2.0, it’s been currency, and it’s also a blockchain play. The problem is we are so early in the development that nobody truly knows how this turns out. This is pure speculation, as many who bought at $19,000 can tell you. If we were to break above the $8000 level, I might be convinced that we go screaming to the upside, probably testing the $10,000 level.