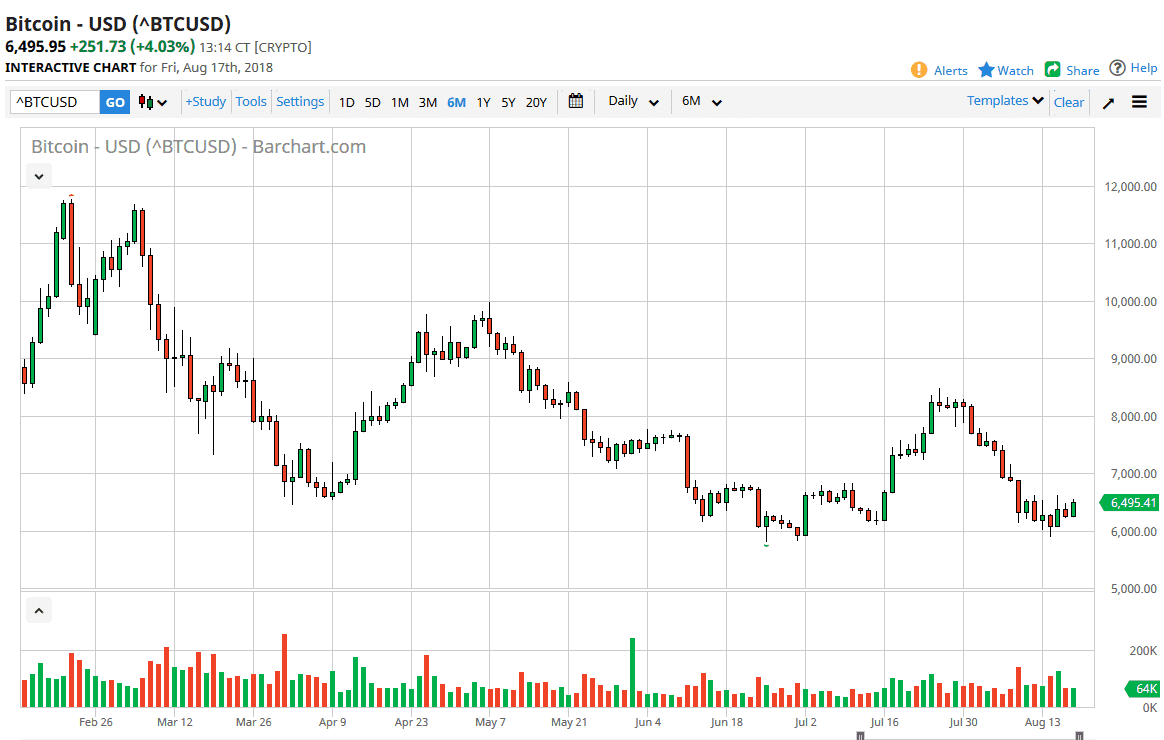

BTC/USD

The Bitcoin market rallied again during the trading session on Friday, to complete a bit of a rounding pattern for the week. However, we are still at very extreme lows, and at this point I think that rallies are still to be sold. The nice thing about the Bitcoin market is that it is so technical. What I mean by this is that round numbers matter, such as the $6000 level underneath offering massive support. If we break down below the $6000 level significantly, we could continue to go lower, perhaps reaching towards the $5000 level. However, if we rally from here I think that $7000 will probably offer a lot of selling pressure. While we have had a nice week of stability, we are still at very low levels.

There is a downtrend that extends and slices through the $8000 level, so we need to close above there before we can begin to think about changing the trend. I believe that the Bitcoin market will continue to suffer at the hands of speculators as we simply don’t have the momentum to continue to go higher. Most of the public the got so excited about Bitcoin last year is deep in the hole, so they certainly are not looking to come in and add to a position that is in such bad shape. Quite frankly, it’s difficult to imagine a scenario where a lot of confidence comes into the market. This is because we continue to hear reasons why Bitcoin is going to go back to the $20,000 level, yet none of them seem to last. Recently, it’s been talks about the ETF world coming to save Bitcoin, but quite frankly that goes counter to what Bitcoin was supposed to be in the first place.