BTC/USD

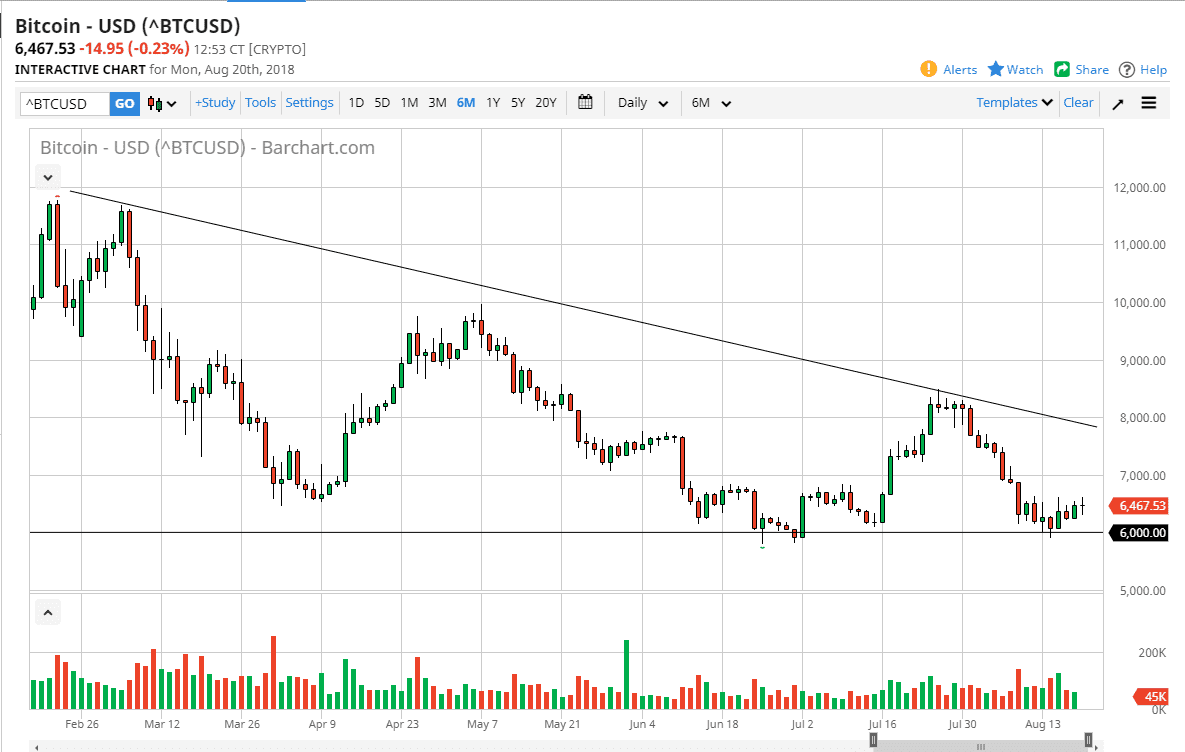

Bitcoin markets were very choppy during the trading session on Monday as traders came back to work from a quiet weekend. Bitcoin continues to struggle to find direction, although I suppose the one thing that you can say about this chart is that the $6000 level very obviously attracts a lot of attention. It is because of this that I believe we will probably see a continued demand for Bitcoin in the short term close to the $6000 handle. If we break down below there significantly, I think that the market breaks down to the $5000 level. I believe at this point the analysis is still going to be the same: sellers will continue to return to this market when we rally from here, as there are several resistance areas just above at the $6500 level, the $7000 level, the $7500 level, and of course the downtrend line that I have marked on the daily chart.

Volumes are relatively thin, and I think at this point the market is just waiting for some type of catalyst to make the next move. I do not think that there’s any rush to get involved in this market, as we will continue to weigh their options. Bitcoin is down well over 60% from the highs, and I think at this point most retail traders are starting to give up on their positions as many of them will have gotten in somewhere near $15,000 or so.

The question now is what’s the next big thing in this sector? As we continue to see a general malaise in the market, I cannot help but think that the attitude of the market isn’t changing anytime soon.