BTC/USD

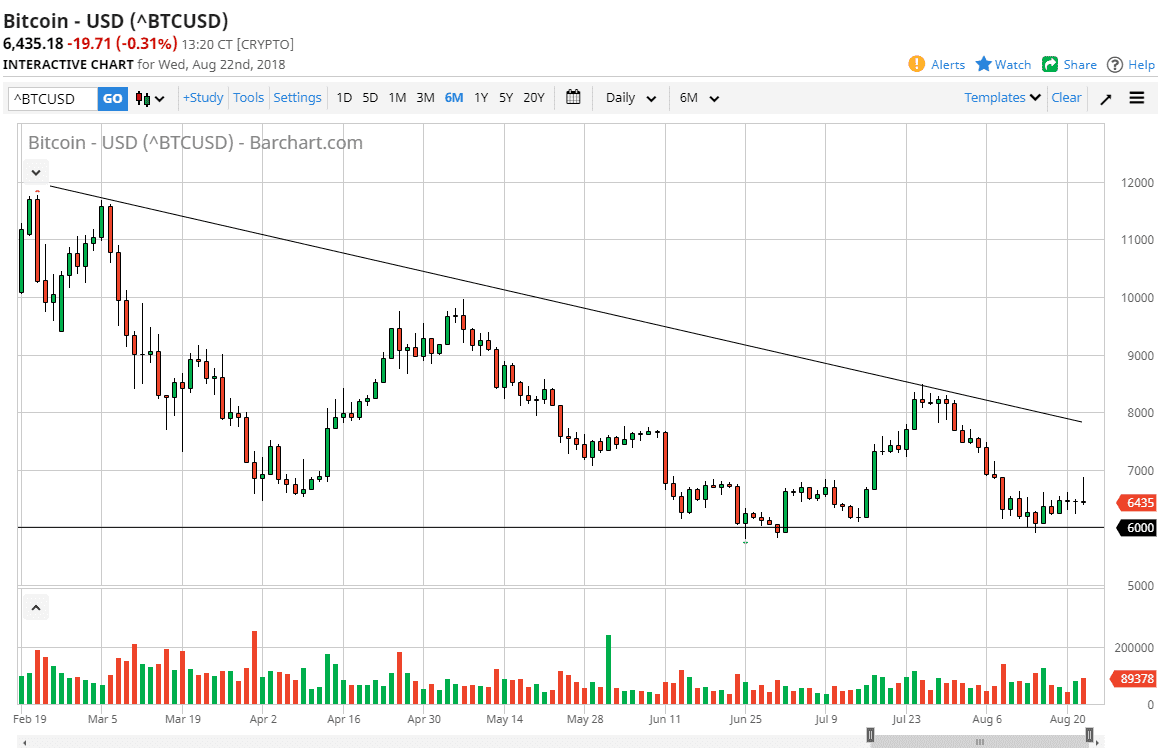

Bitcoin markets initially tried to rally during the trading session on Wednesday but gave back most of the gains as we reached the $7000 level. This is an area that I have been talking about for a minute now, and it has offered the exact resistance that I thought it would. Because of this, it looks like Bitcoin just isn’t ready to go anywhere and we are going to continue to bounce around just above the $6000 level. At this point, the market desperately need some type of catalyst to move. Right now we simply just don’t have it and I think we are going to continue to see short term back and forth type of trading.

If we do break above the $7000 level, I also see a lot of resistance at $7500 and then again at the $8000 level. At this point, I think that the market will continue to find sellers jumping in, based upon the fact that bitcoin just simply has lost all momentum. Beyond that, central banks are developing their own cryptos, and it’s not hard to imagine that the general public will trust the Federal Reserve over the decentralized network of computers. (This isn’t my debate, just an observation in the reality.)

As a technical analyst, is very easy to see that $6000 is massive support. However, it’s just as easy to see that each high that we make continues to be lower and has been for the entirety of 2018. This market once lost 90% of its value, and at this point it wouldn’t surprise me if it did it again. At this point, we’ve already lost about 66%, so that’s not a stretch of the imagination by any means. I am not a buyer of Bitcoin until we break above the $8000 level.